Cutting applicant referrals by 25%

Cutting applicant referrals by 25%

Cutting applicant referrals by 25%

Problem

30% of applicants are referred to customer support via email during sign-up over email, leading to delays and wait times of weeks. This led to bad publicity, customer abandonment, and hiring support staff to cope.

Solution

I used support ticket analysis to create in-app journeys, reducing applicant referrals by 25%. This means fewer support agents needed and faster customer response times throughout the app.

30% of applicants referred

Many applicants were redirected to customer support before they could sign up primarily due to issues with checks:

30% of applicants referred

Many applicants were redirected to customer support before they could sign up primarily due to issues with checks:

30% of applicants referred

Many applicants were redirected to customer support before they could sign up primarily due to issues with checks:

Addresses provided do not match those in the database.

Documents or images for ID verification have poor quality.

Names given do not match the ID.

Applicants are appearing on a watchlist.

An inefficient review process

An inefficient review process

To tackle the issues, a support agent contacts applicants through in-app messages and emails, leading to back-and-forth communication and prolonged delays.

To tackle the issues, a support agent contacts applicants through in-app messages and emails, leading to back-and-forth communication and prolonged delays.

Wait times lasted weeks

When demand peaked, the wait times became excessively long. As a result, customers grew frustrated, leading to negative publicity and some customers abandoning the service.

Wait times lasted weeks

When demand peaked, the wait times became excessively long. As a result, customers grew frustrated, leading to negative publicity and some customers abandoning the service.

Wait times lasted weeks

When demand peaked, the wait times became excessively long. As a result, customers grew frustrated, leading to negative publicity and some customers abandoning the service.

Hiring support = £££

To speed up wait times, Kroo brought on board many support agents, each costing the company £27.5k/year. This hefty expense underscored the pressing need for a more efficient way to handle referrals.

Hiring support = £££

To speed up wait times, Kroo brought on board many support agents, each costing the company £27.5k/year. This hefty expense underscored the pressing need for a more efficient way to handle referrals.

Hiring support = £££

To speed up wait times, Kroo brought on board many support agents, each costing the company £27.5k/year. This hefty expense underscored the pressing need for a more efficient way to handle referrals.

Analysing support chats

I began by reviewing support chats to gather insights for designing a smoother in-app experience. From this analysis, two core themes emerged:

Analysing support chats

I began by reviewing support chats to gather insights for designing a smoother in-app experience. From this analysis, two core themes emerged:

Analysing support chats

I began by reviewing support chats to gather insights for designing a smoother in-app experience. From this analysis, two core themes emerged:

🙈

Requirements ignored

Applicants missed important requirements, leading to the need for additional clarification and assistance.

🙈

Requirements ignored

Applicants missed important requirements, leading to the need for additional clarification and assistance.

🙈

Requirements ignored

Applicants missed important requirements, leading to the need for additional clarification and assistance.

🫤

Confusion over requests

Applicants had trouble understanding some concepts, resulting in the need for education and extended communication.

🫤

Confusion over requests

Applicants had trouble understanding some concepts, resulting in the need for education and extended communication.

🫤

Confusion over requests

Applicants had trouble understanding some concepts, resulting in the need for education and extended communication.

How might we streamline referrals?

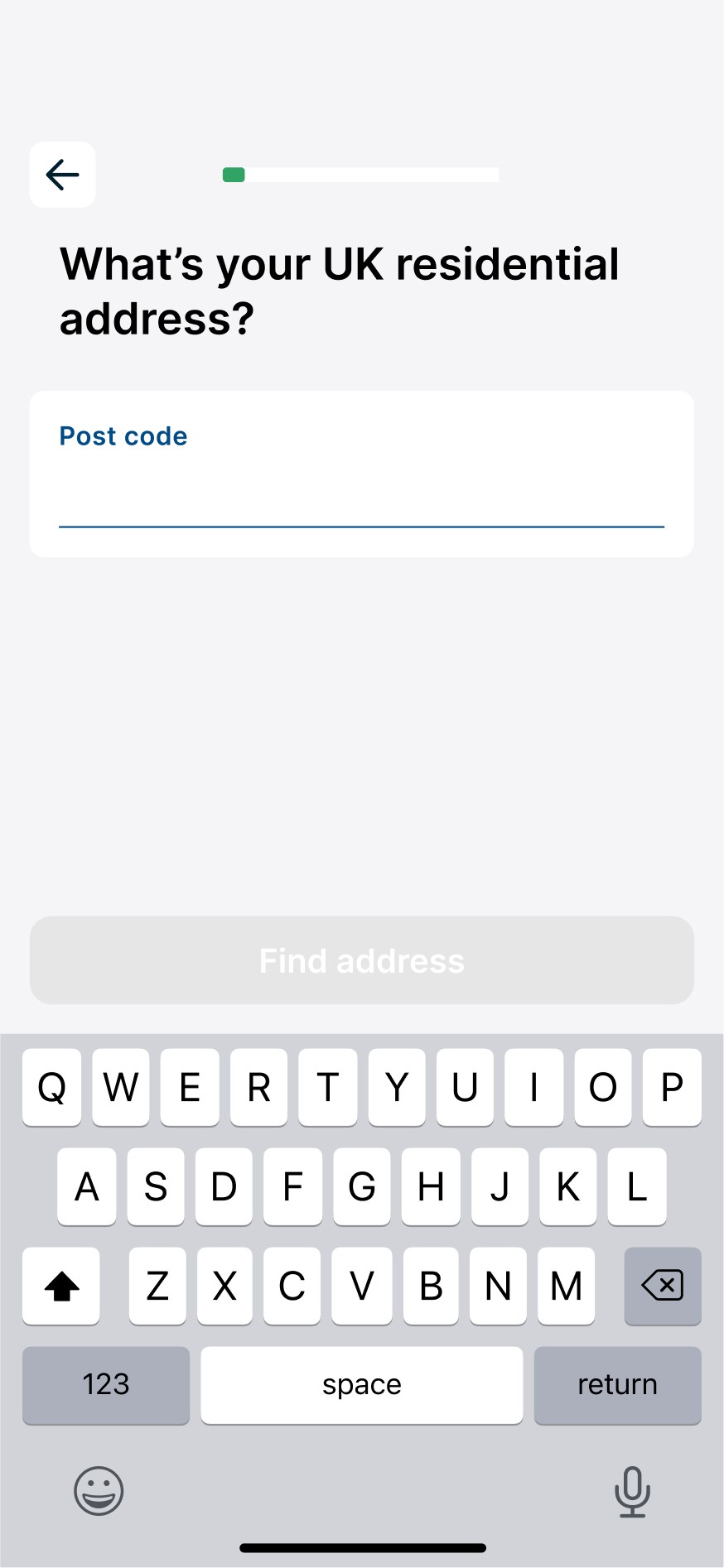

Addressing addresses

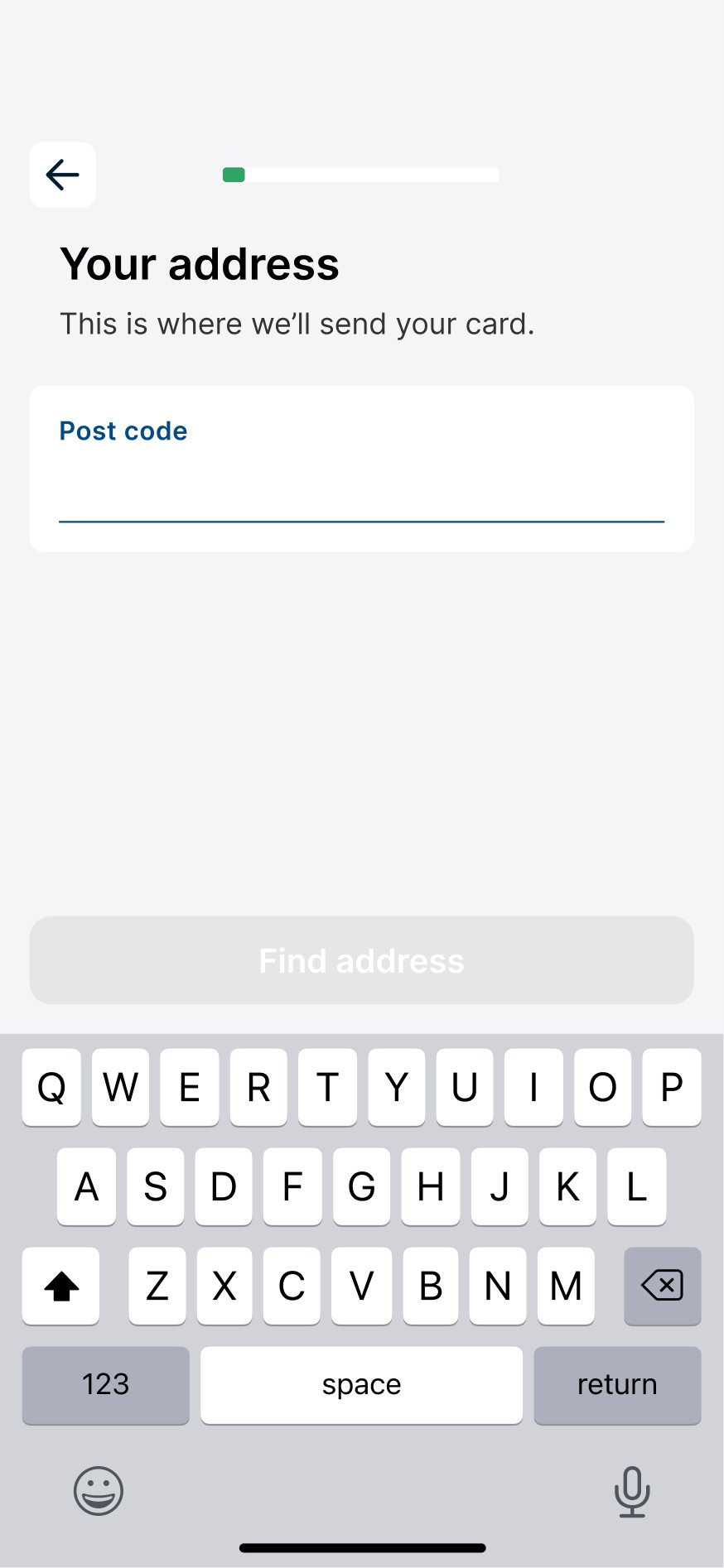

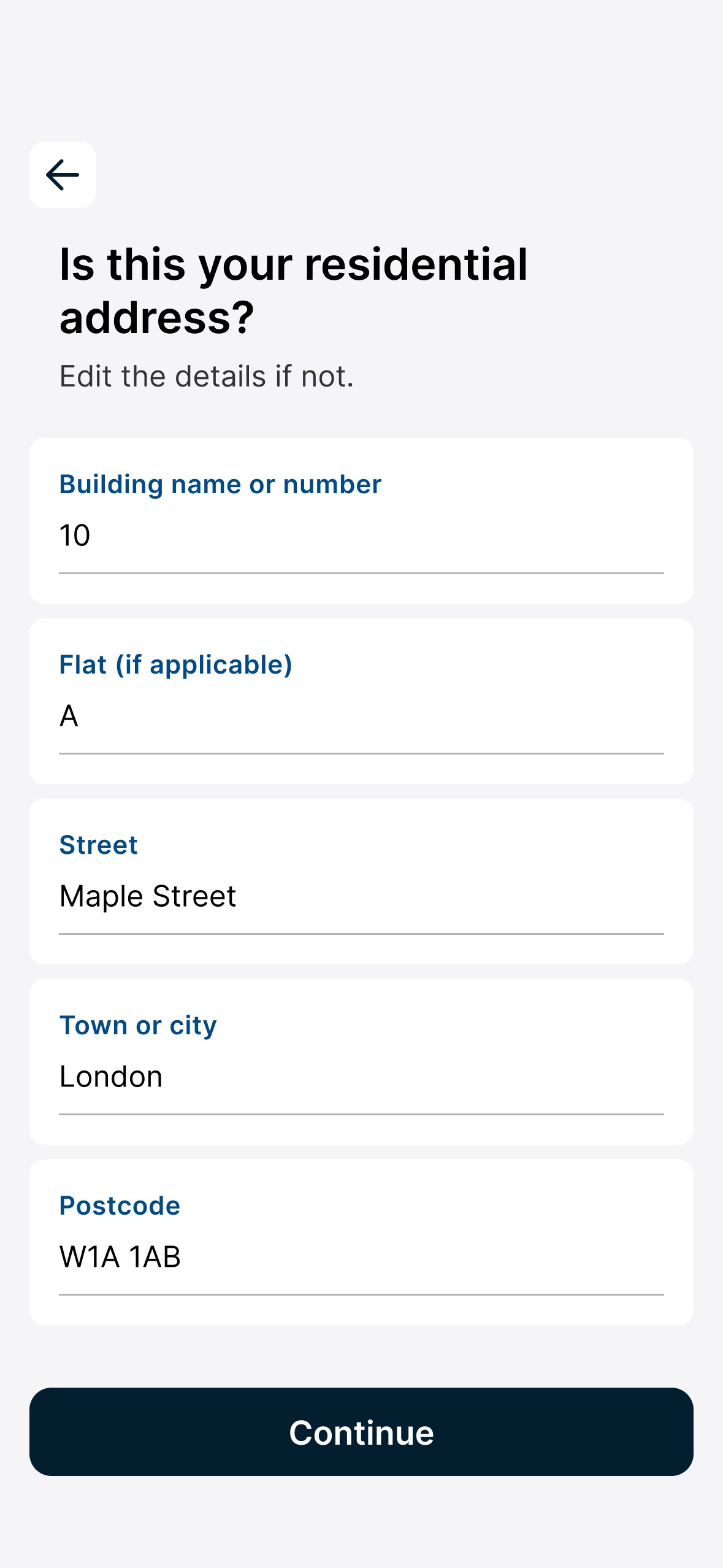

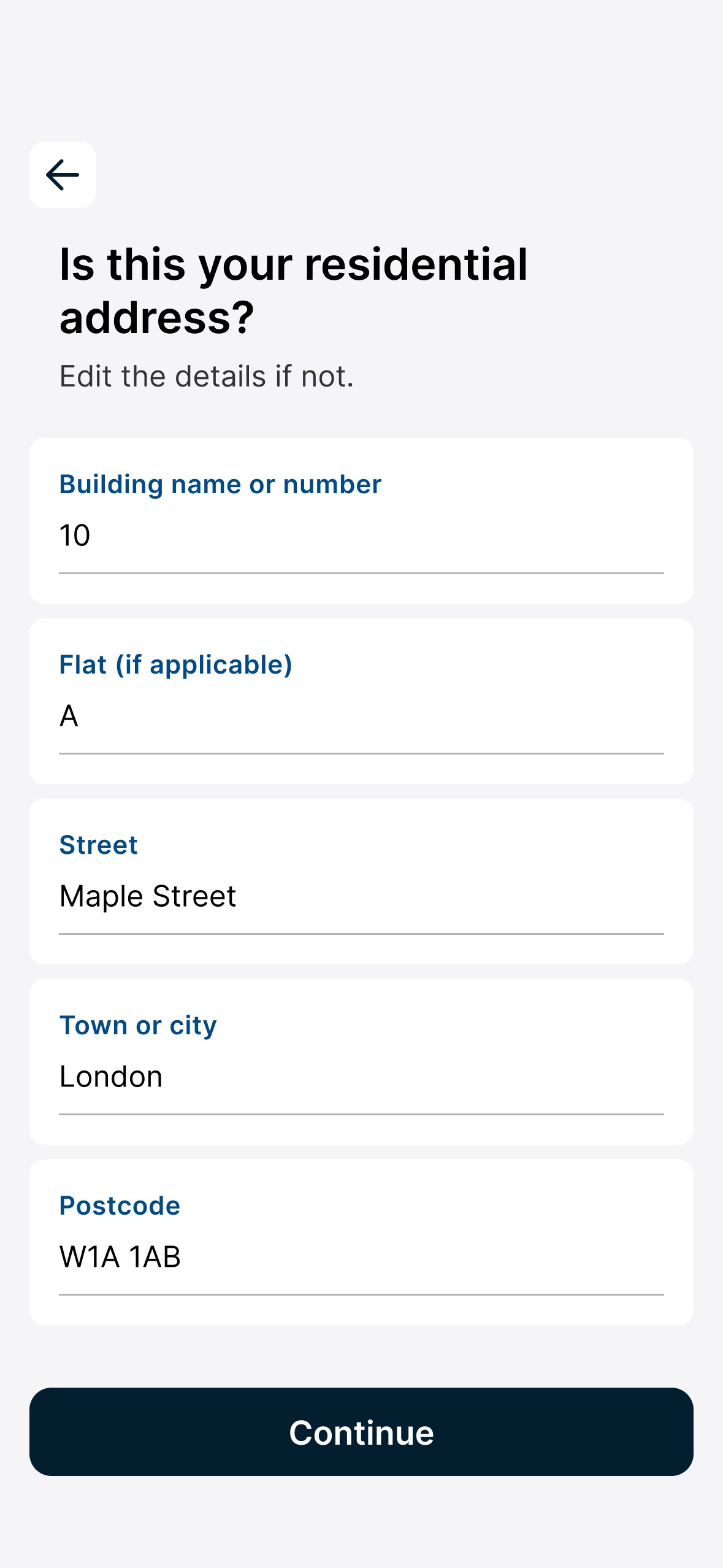

During sign-up, users enter their address, which is then cross-referenced with TransUnion's database. If there's no match, users need to provide proof of address to open an account.

Addressing addresses

During sign-up, users enter their address, which is then cross-referenced with TransUnion's database. If there's no match, users need to provide proof of address to open an account.

Addressing addresses

During sign-up, users enter their address, which is then cross-referenced with TransUnion's database. If there's no match, users need to provide proof of address to open an account.

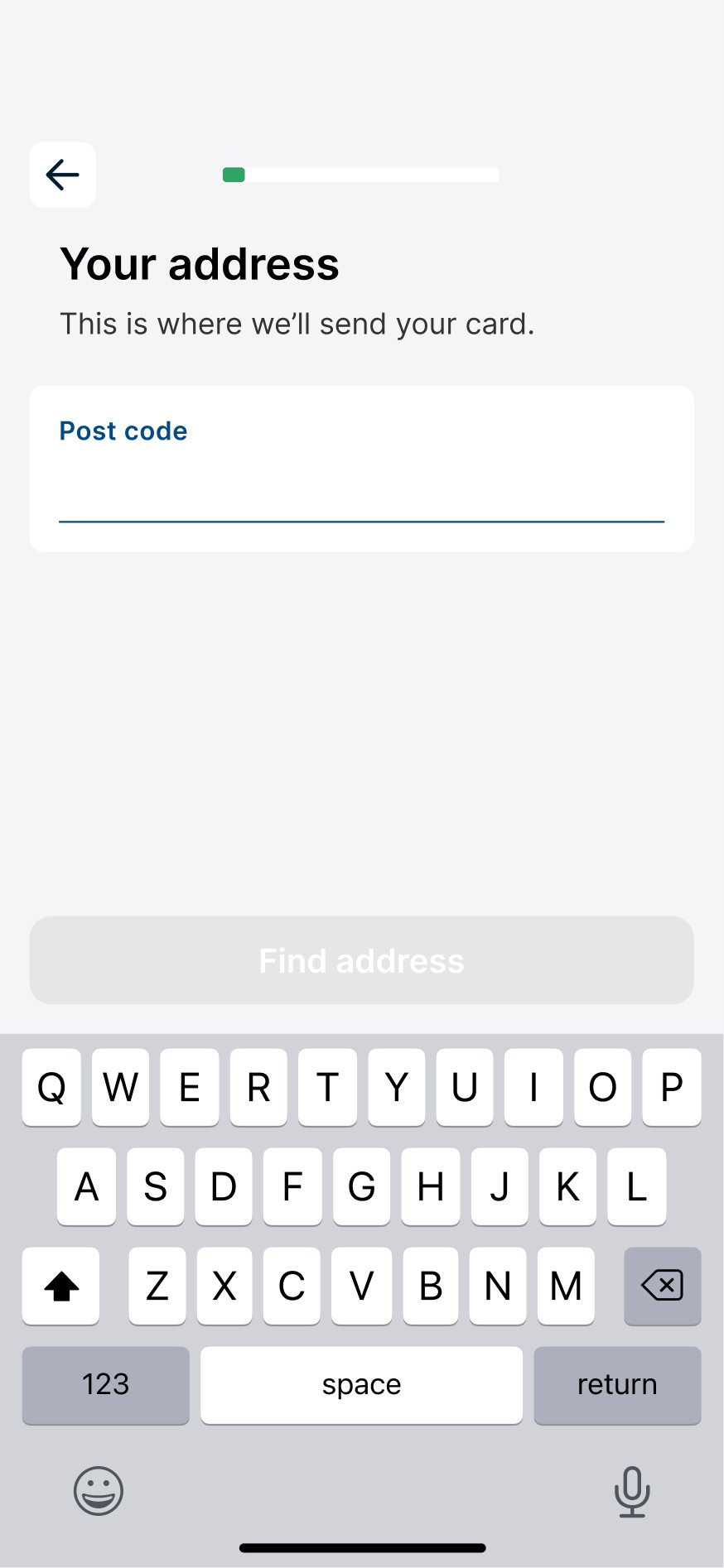

Before

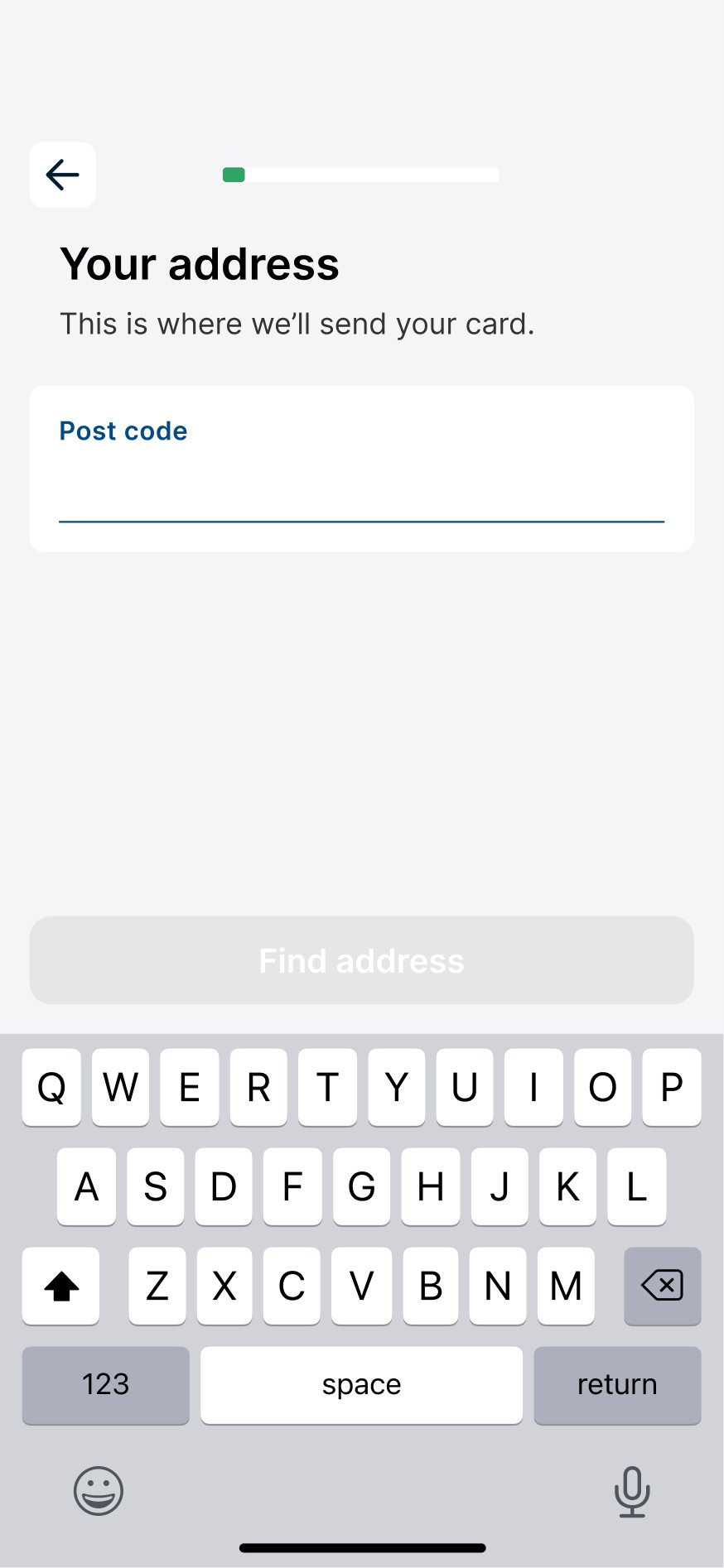

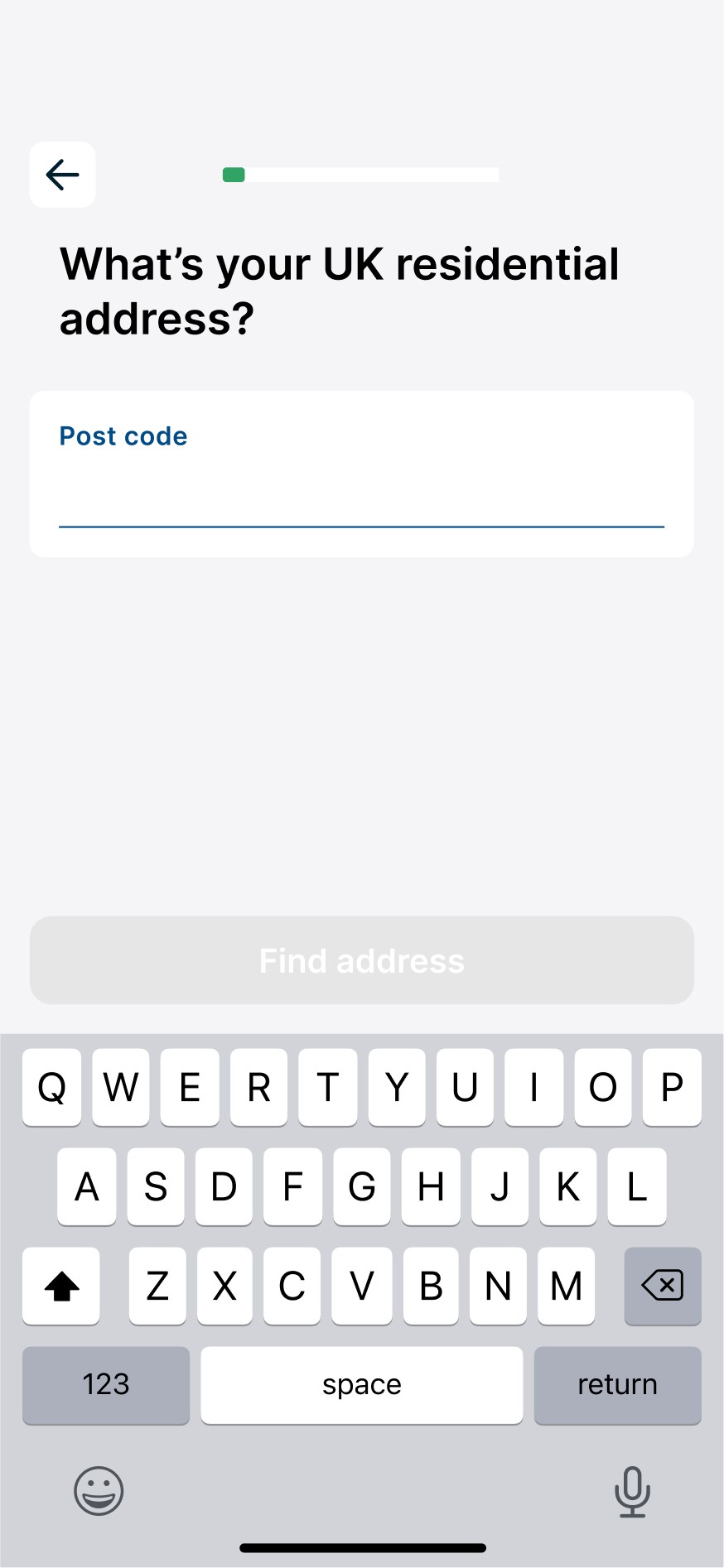

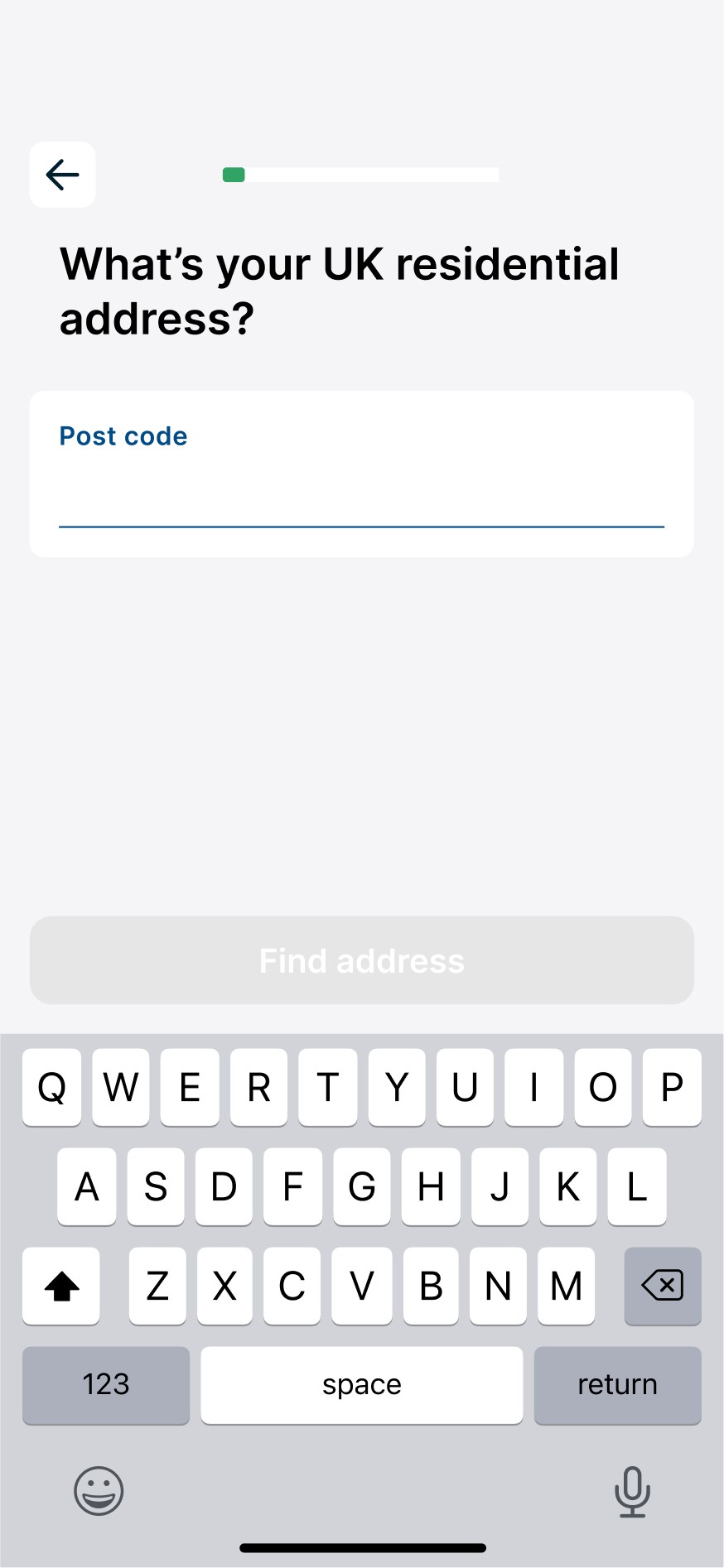

After

Preventative copy

The copy. 'This is where we'll send your card.' caused some applicants to give a preferred postal location instead of their UK residential address. To fix this, I made the question clearer.

Preventative copy

The copy. 'This is where we'll send your card.' caused some applicants to give a preferred postal location instead of their UK residential address. To fix this, I made the question clearer.

Preventative copy

The copy. 'This is where we'll send your card.' caused some applicants to give a preferred postal location instead of their UK residential address. To fix this, I made the question clearer.

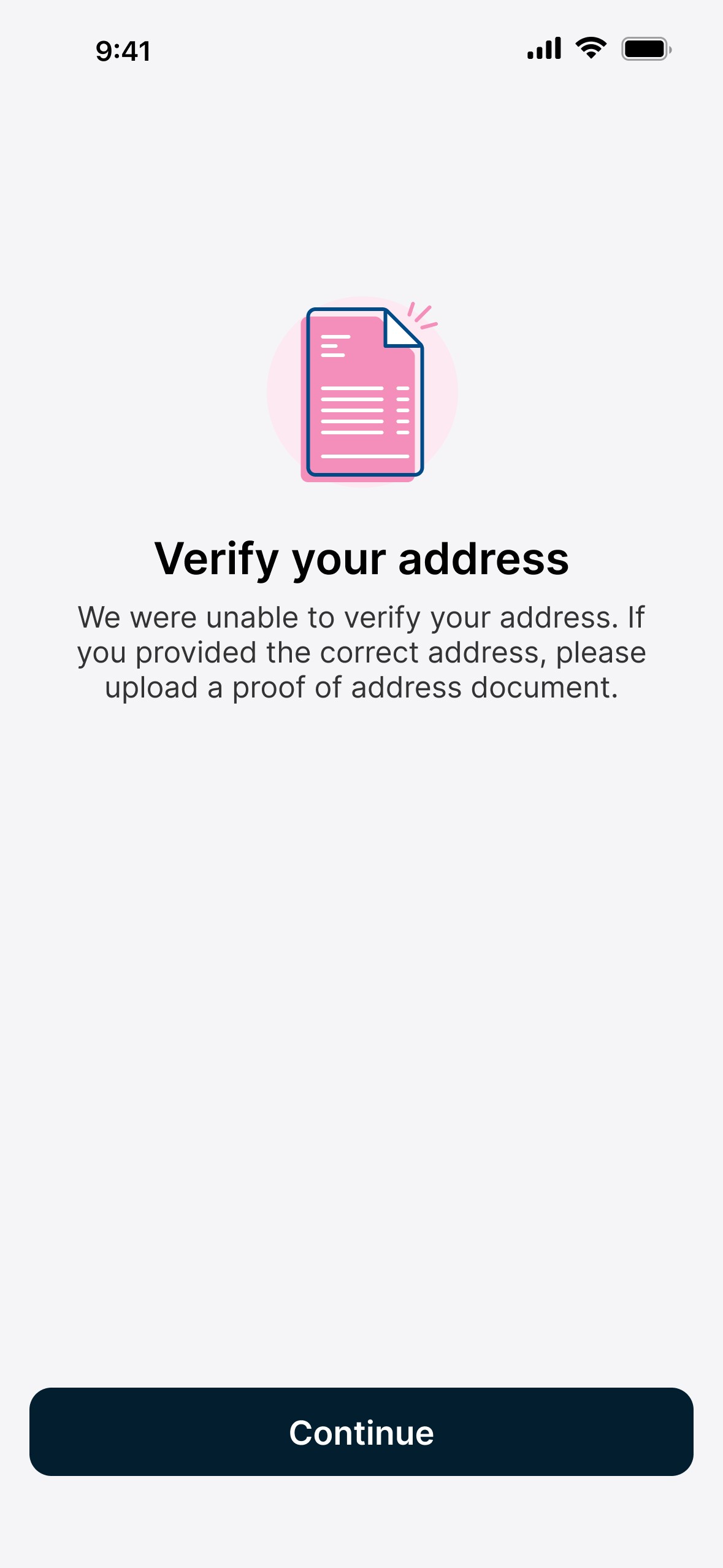

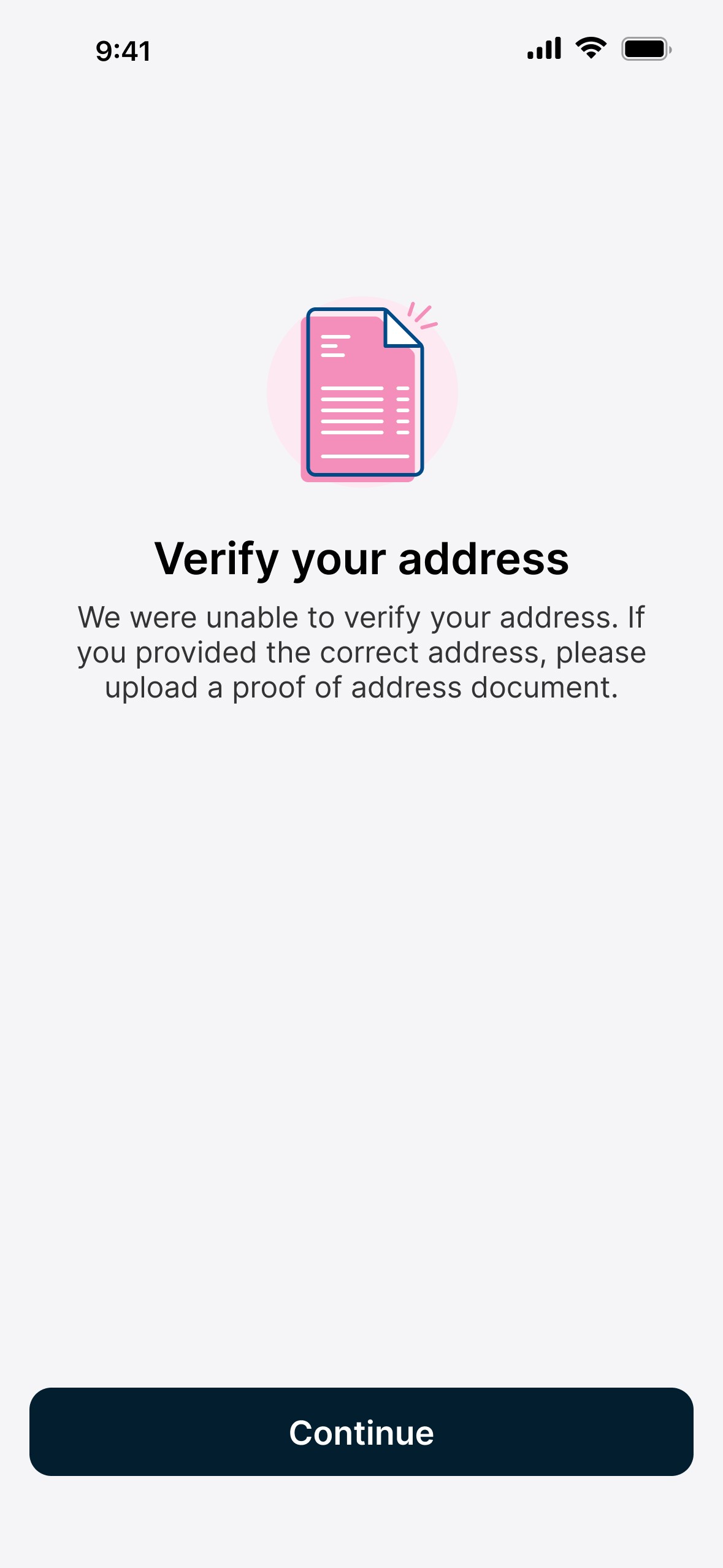

Providing proof

Proof of address submission is now facilitated within the app, powered by Onfido's document verification services on the backend for real-time automated decision-making.

Providing proof

Proof of address submission is now facilitated within the app, powered by Onfido's document verification services on the backend for real-time automated decision-making.

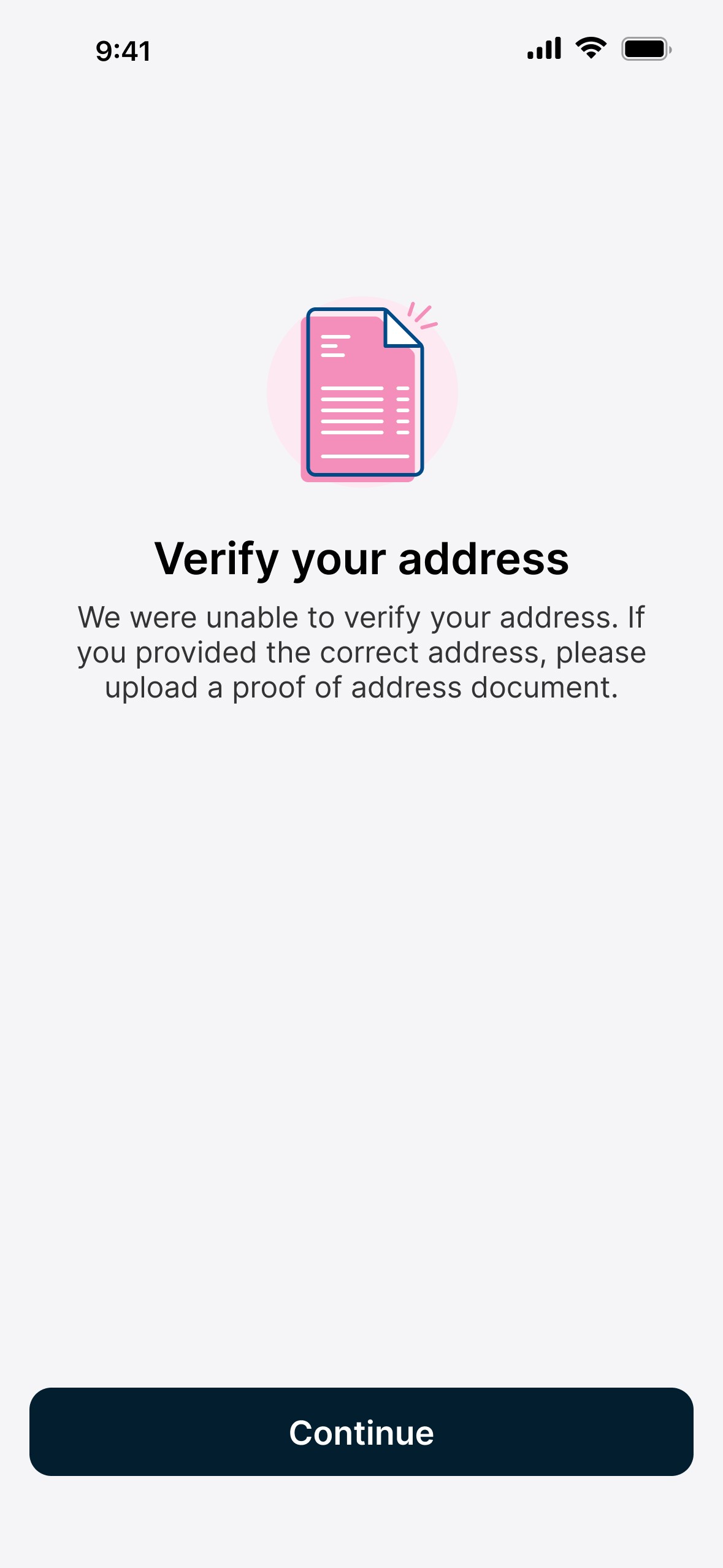

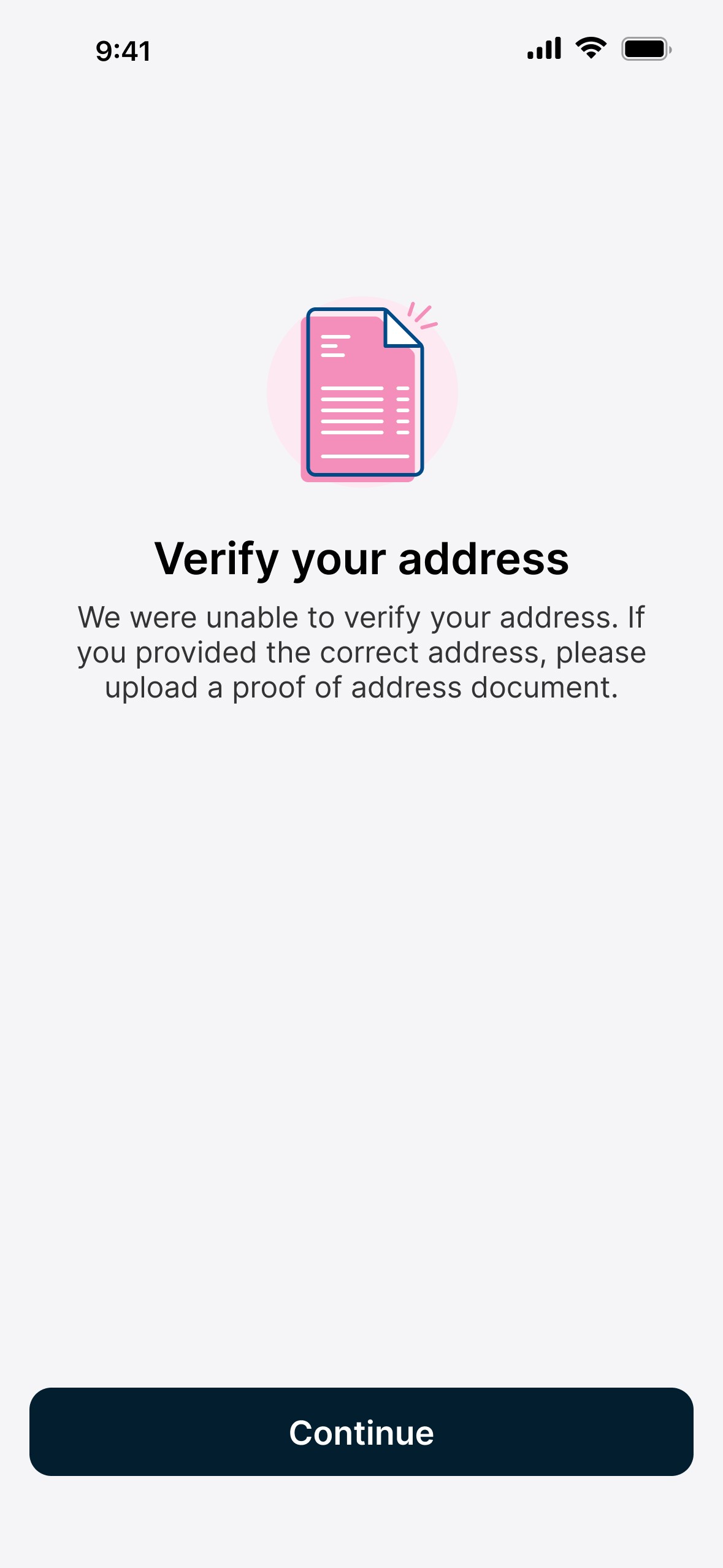

Notification

If the address check fails, we send a notification to prompt the user to verify their address.

Notification

If the address check fails, we send a notification to prompt the user to verify their address.

Interstitial screen

The screen informs returning applicants about what went wrong and provides guidance on how to proceed.

Interstitial screen

The screen informs returning applicants about what went wrong and provides guidance on how to proceed.

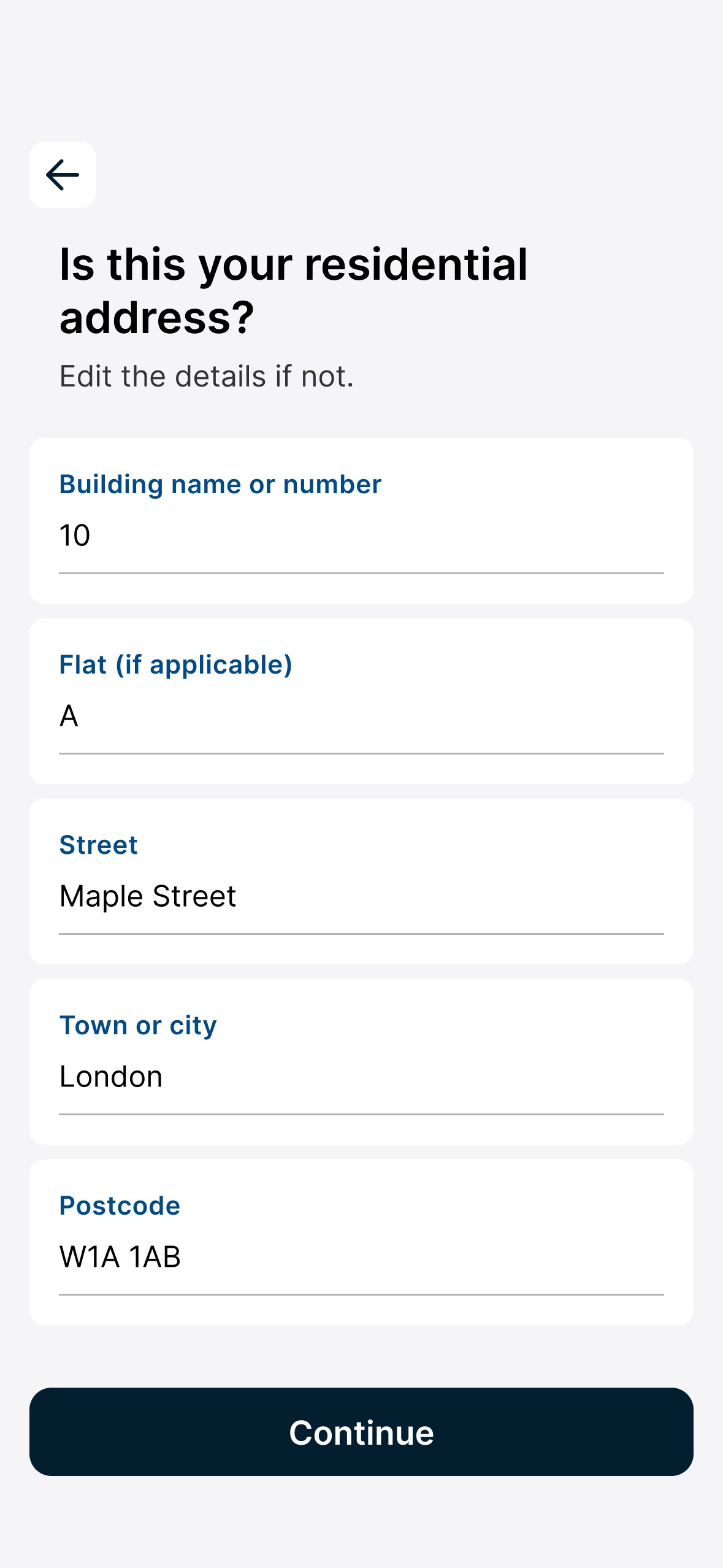

Edit address

If there was a mistake causing the mismatch, the user can update to the correct address without needing to submit proof.

Edit address

If there was a mistake causing the mismatch, the user can update to the correct address without needing to submit proof.

Type of proof

If the address doesn't match the data base, the applicant needs to provide a specific type of proof, like a utility bill.

Type of proof

If the address doesn't match the data base, the applicant needs to provide a specific type of proof, like a utility bill.

Clear requirements

A common issue was applicants submitting invalid proofs, so the document criteria has been personalised.

Clear requirements

A common issue was applicants submitting invalid proofs, so the document criteria has been personalised.

Error handling

I added color-coded validation for intuitive error recovery.

Error handling

I added color-coded validation for intuitive error recovery.

Decline

If fraud is detected, the customer will automatically be declined to mitigate the risk.

Decline

If fraud is detected, the customer will automatically be declined to mitigate the risk.

Notification

If the address check fails, we send a notification to prompt the user to verify their address.

Interstitial screen

The screen informs returning applicants about what went wrong and provides guidance on how to proceed.

Edit address

If there was a mistake causing the mismatch, the user can update to the correct address without needing to submit proof.

Notification

If the address check fails, we send a notification to prompt the user to verify their address.

Interstitial screen

The screen informs returning applicants about what went wrong and provides guidance on how to proceed.

Repeat ID verification

With over 1,000 referrals due to failed identity verification, I devised a user journey for reattempting verification. It kicks off with a notification and interstitial screen, similar to the proof of address process.

If they fail verification three times, they will be declined to protect the integrity of our customer base.

Repeat ID verification

With over 1,000 referrals due to failed identity verification, I devised a user journey for reattempting verification. It kicks off with a notification and interstitial screen, similar to the proof of address process.

If they fail verification three times, they will be declined to protect the integrity of our customer base.

Repeat ID verification

With over 1,000 referrals due to failed identity verification, I devised a user journey for reattempting verification. It kicks off with a notification and interstitial screen, similar to the proof of address process.

If they fail verification three times, they will be declined to protect the integrity of our customer base.

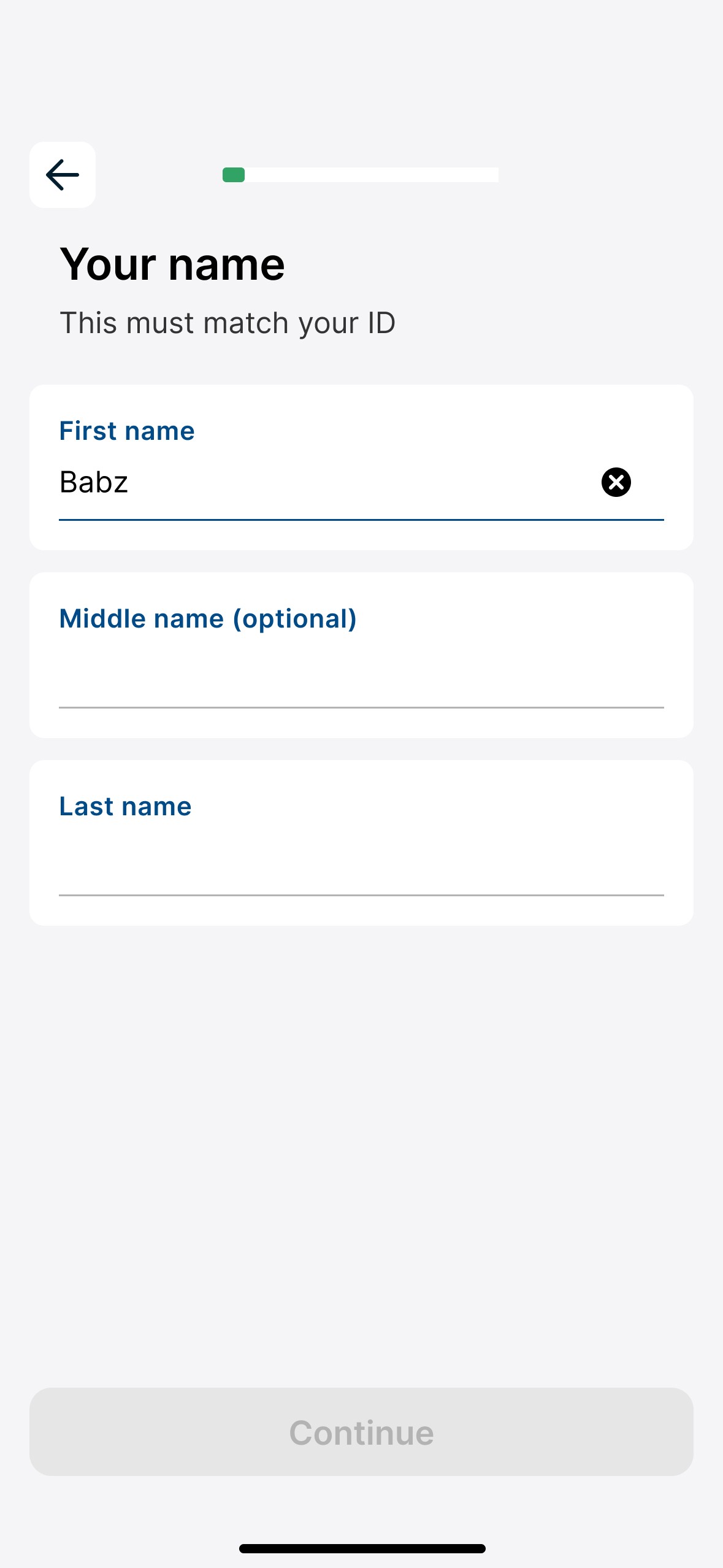

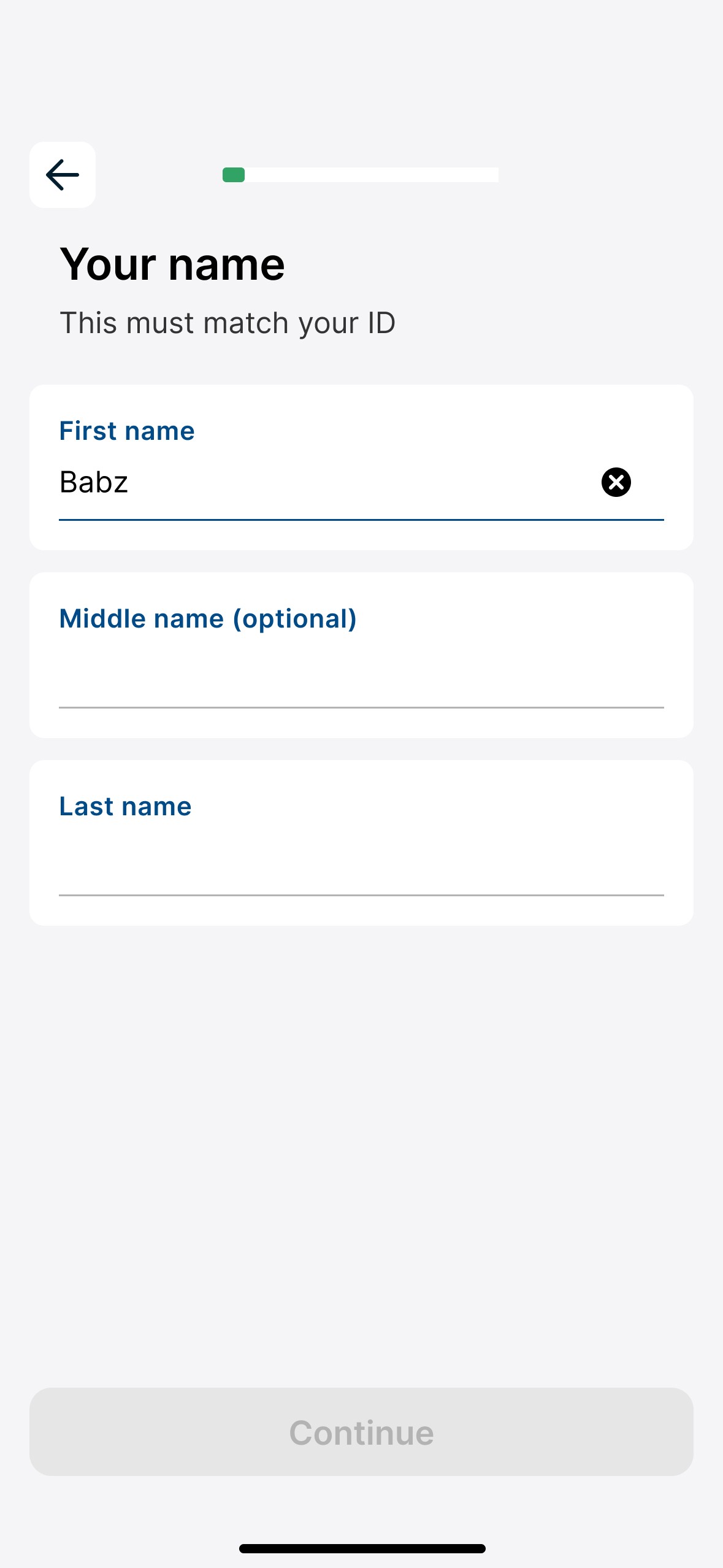

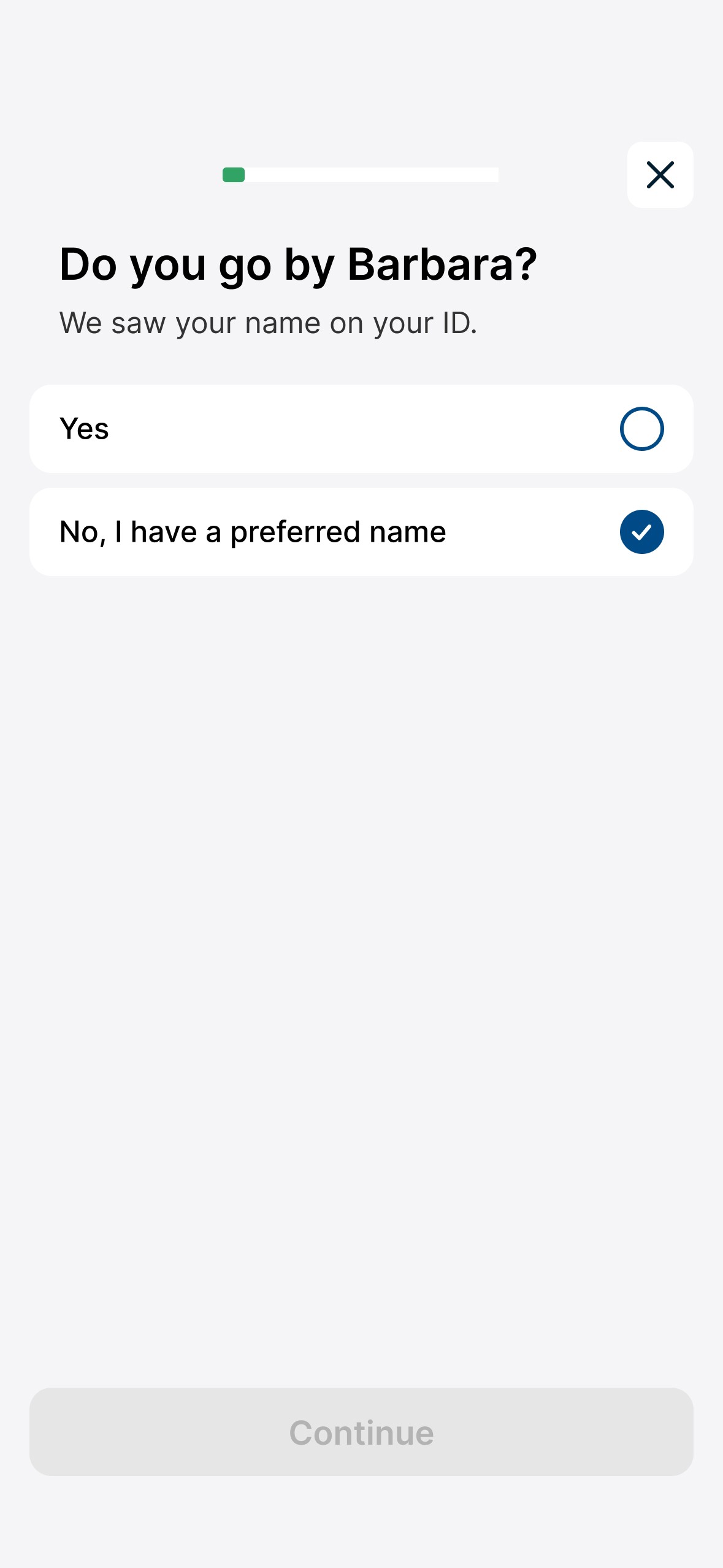

No more name mismatches

Typos and preferred names caused hundreds of support tickets, despite the screen's clear instruction: "This must match your ID." Barbara, aka Babz, was one example.

No more name mismatches

Typos and preferred names caused hundreds of support tickets, despite the screen's clear instruction: "This must match your ID." Barbara, aka Babz, was one example.

No more name mismatches

Typos and preferred names caused hundreds of support tickets, despite the screen's clear instruction: "This must match your ID." Barbara, aka Babz, was one example.

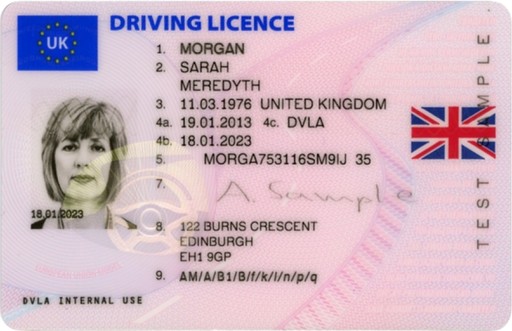

Autofill form fields

To prevent name mismatches and manual entry, I introduced an autocapture feature. It extracts the name and date of birth from the ID scan to fill out the form automatically.

Autofill form fields

To prevent name mismatches and manual entry, I introduced an autocapture feature. It extracts the name and date of birth from the ID scan to fill out the form automatically.

Autofill form fields

To prevent name mismatches and manual entry, I introduced an autocapture feature. It extracts the name and date of birth from the ID scan to fill out the form automatically.

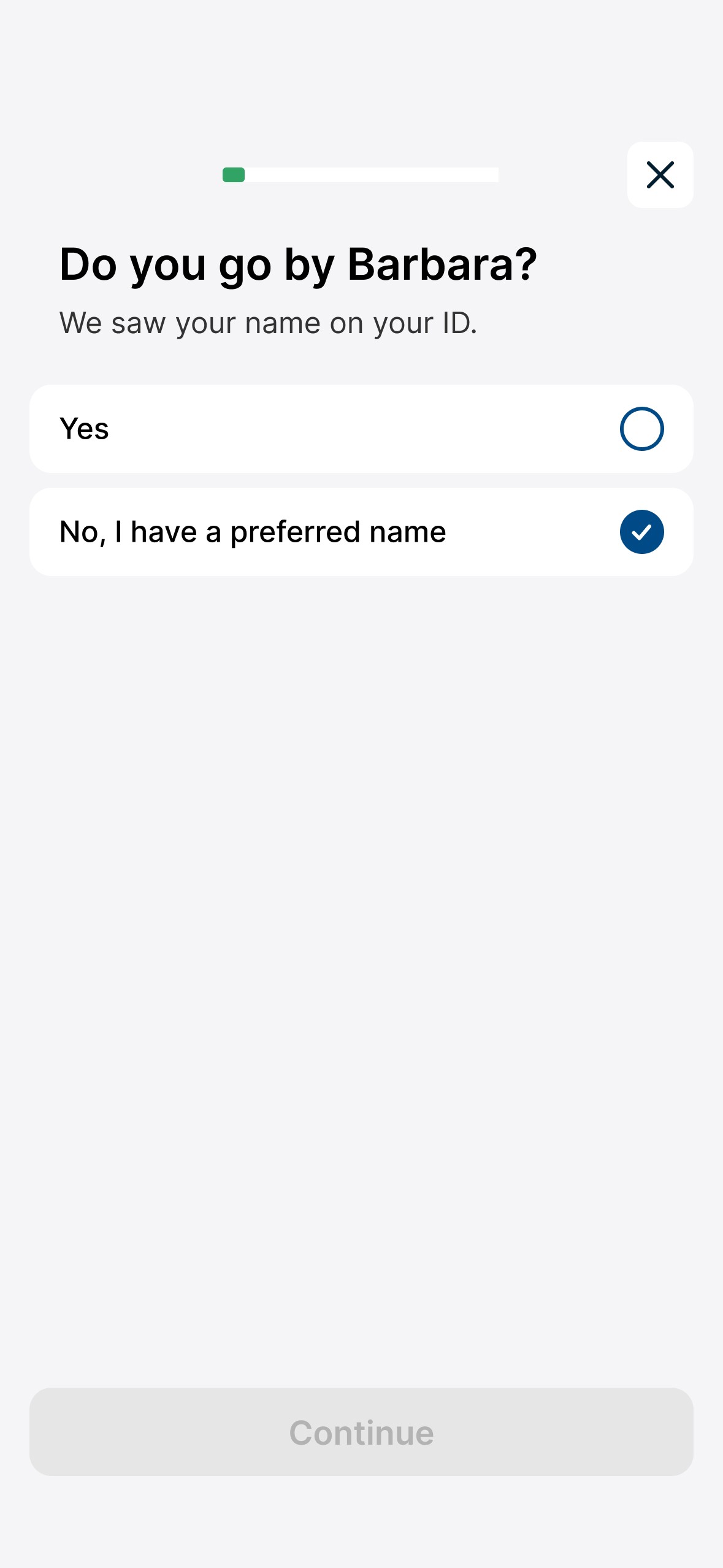

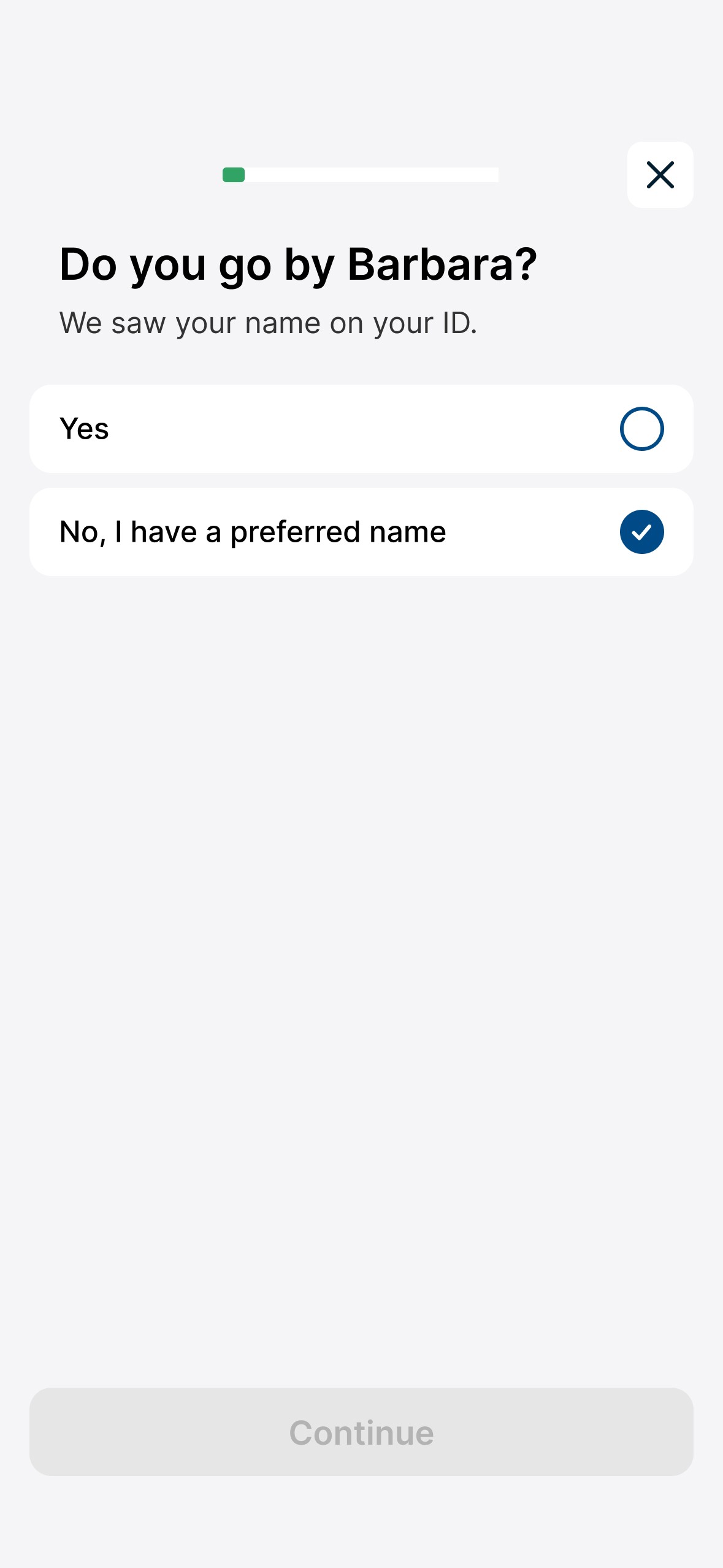

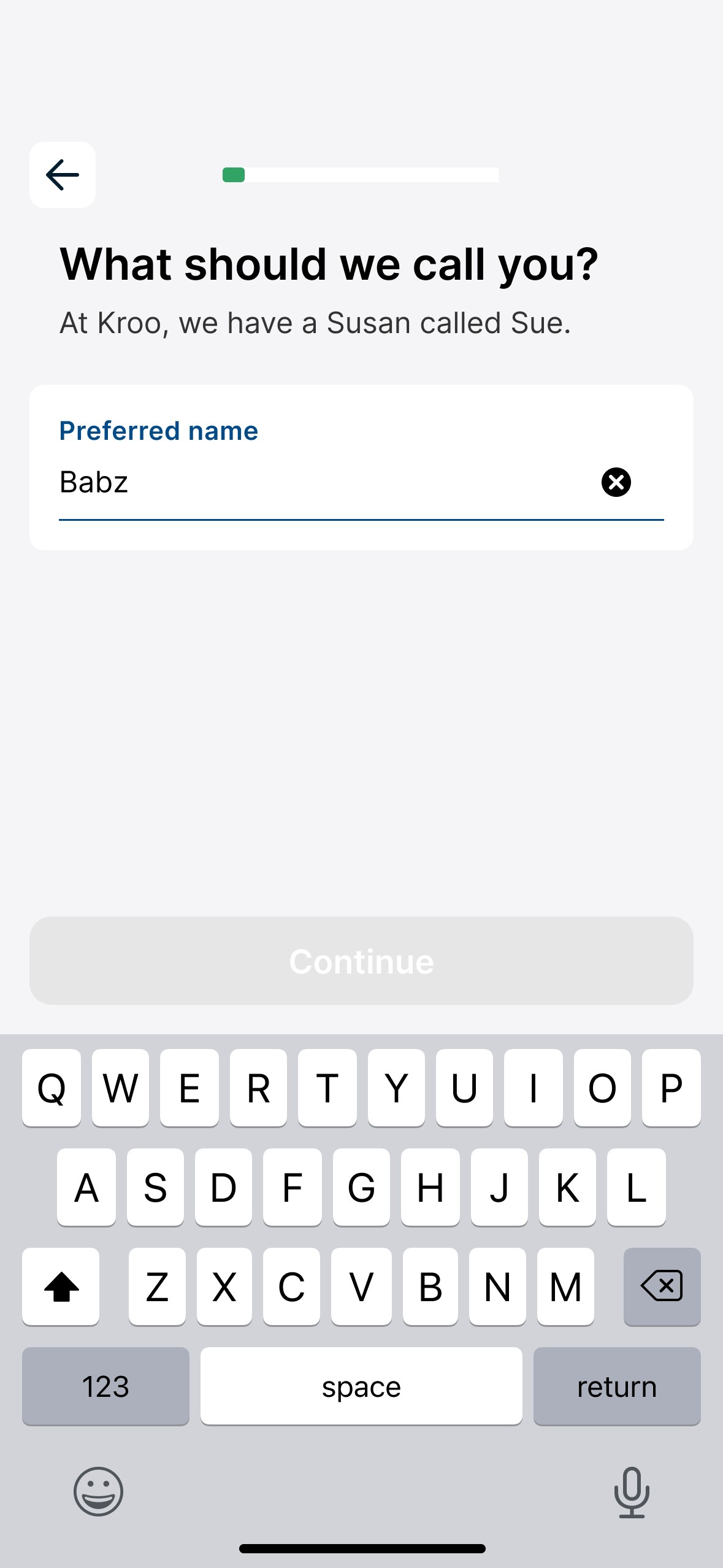

Asking for preferred names

The prevalence of name mismatches shows that many users prefer not to use their legal name. So, after the ID scan, they're given the option to provide a preferred name. If they do, then there's an anchor, 'Sue from Kroo', to aid in selecting something appropriate.

Asking for preferred names

The prevalence of name mismatches shows that many users prefer not to use their legal name. So, after the ID scan, they're given the option to provide a preferred name. If they do, then there's an anchor, 'Sue from Kroo', to aid in selecting something appropriate.

Preferred name

The prevalence of name mismatches shows that many users prefer not to use their legal name. So, after the ID scan, they're given the option to provide a preferred name. If they do, then there's an anchor, 'Sue from Kroo', to aid in selecting something appropriate.

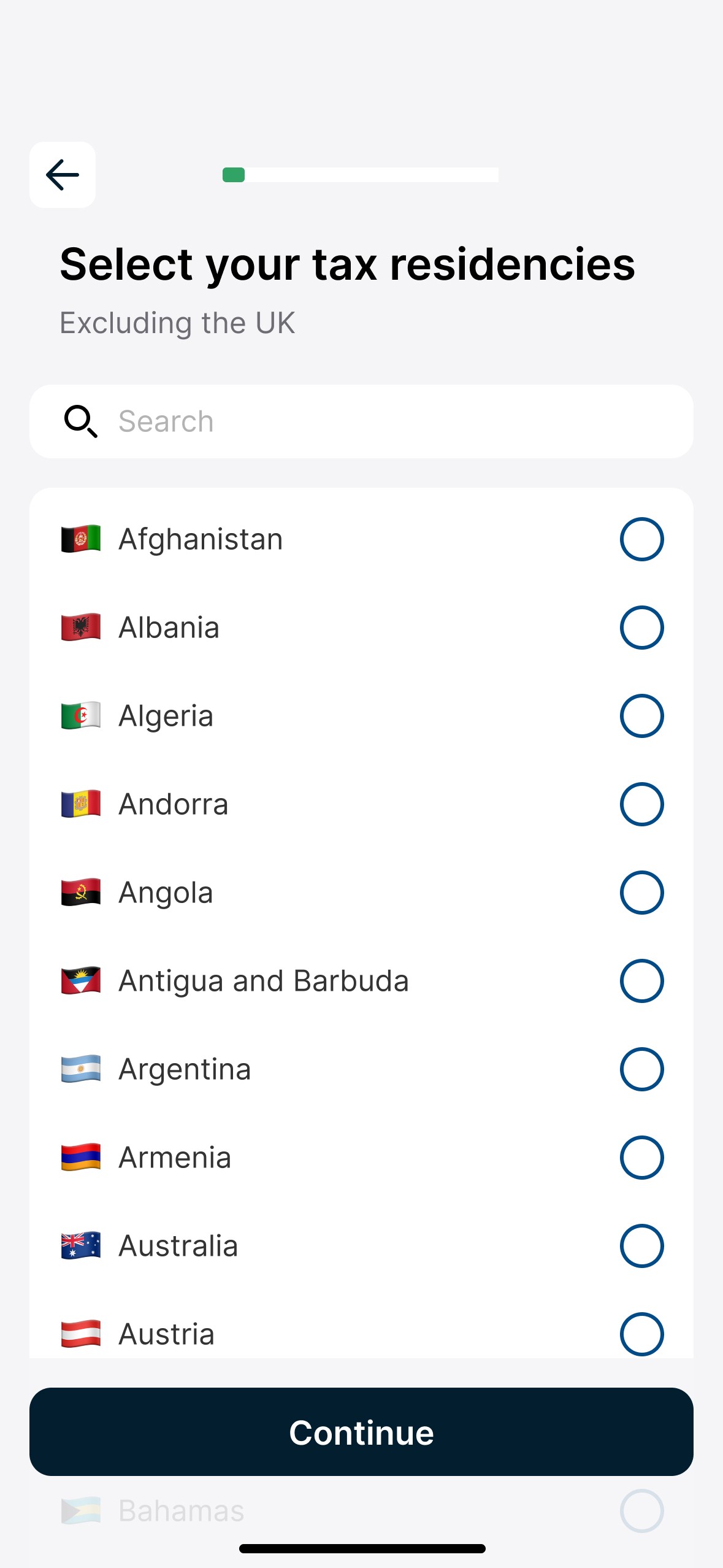

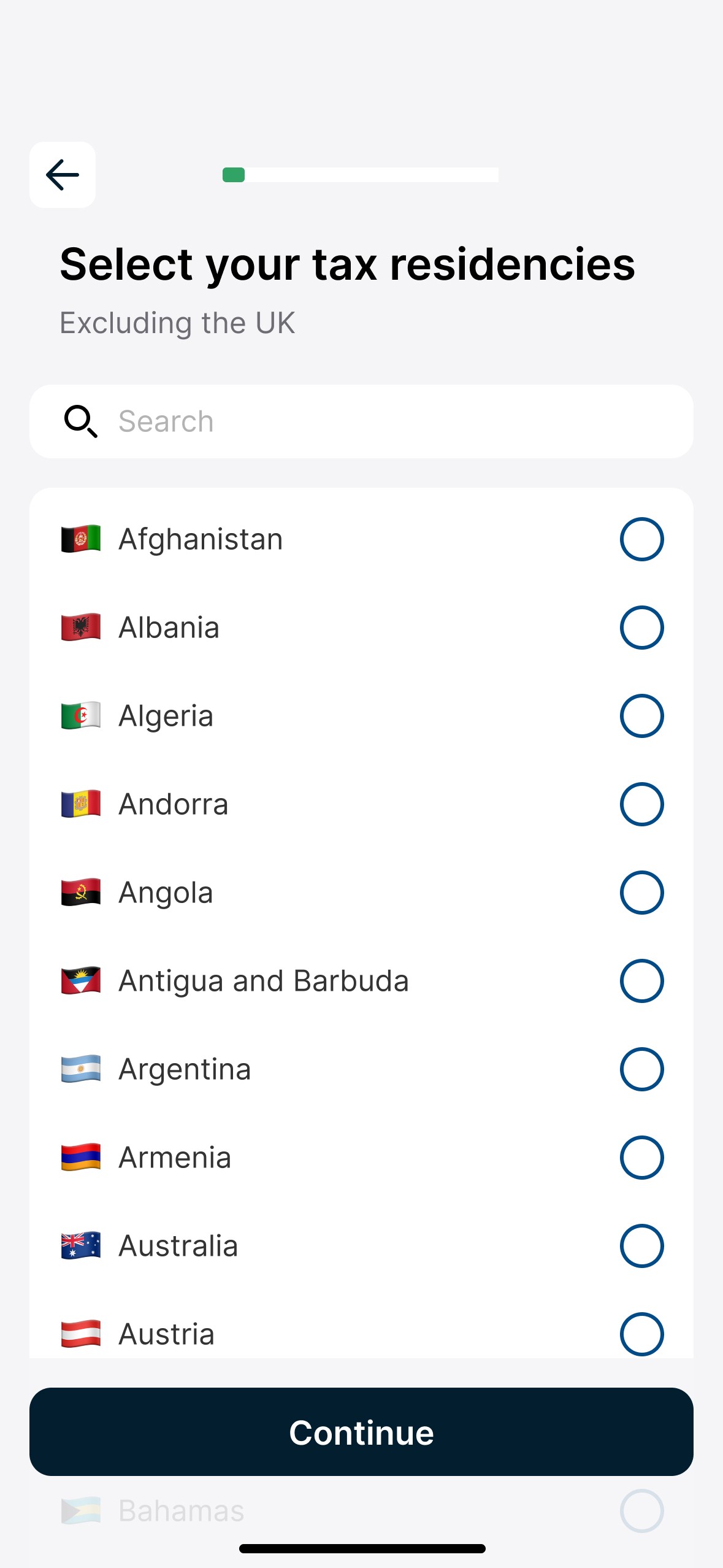

Collecting Tax Identification Numbers

While customers with tax residency outside the UK could open accounts without providing a relevant Tax Identification Numbers (TINs), our support team had to follow up which reduced capacity and affected wait times. This also demanded an in-app journey.

Collecting Tax Identification Numbers

While customers with tax residency outside the UK could open accounts without providing a relevant Tax Identification Numbers (TINs), our support team had to follow up which reduced capacity and affected wait times. This also demanded an in-app journey.

Collecting Tax Identification Numbers

While customers with tax residency outside the UK could open accounts without providing a relevant Tax Identification Numbers (TINs), our support team had to follow up which reduced capacity and affected wait times. This also demanded an in-app journey.

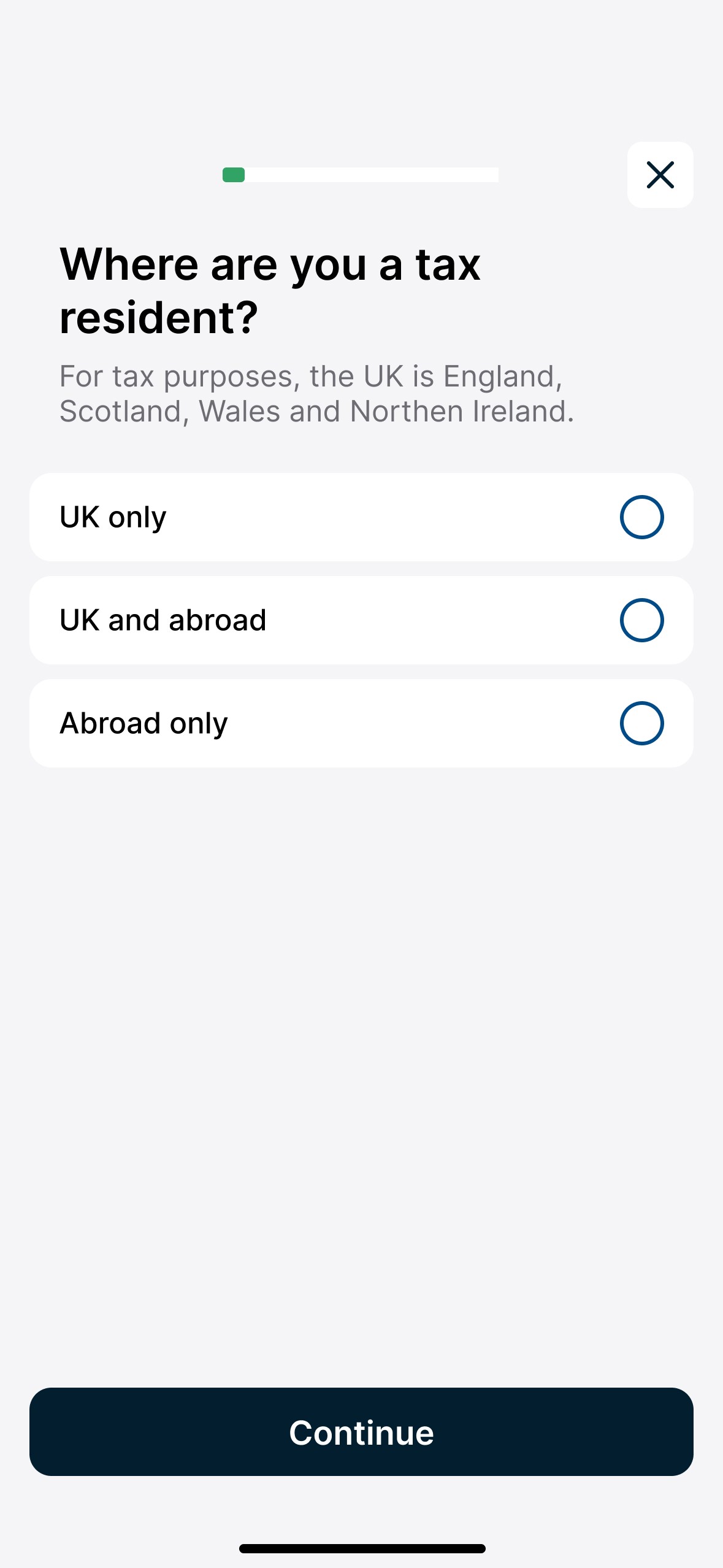

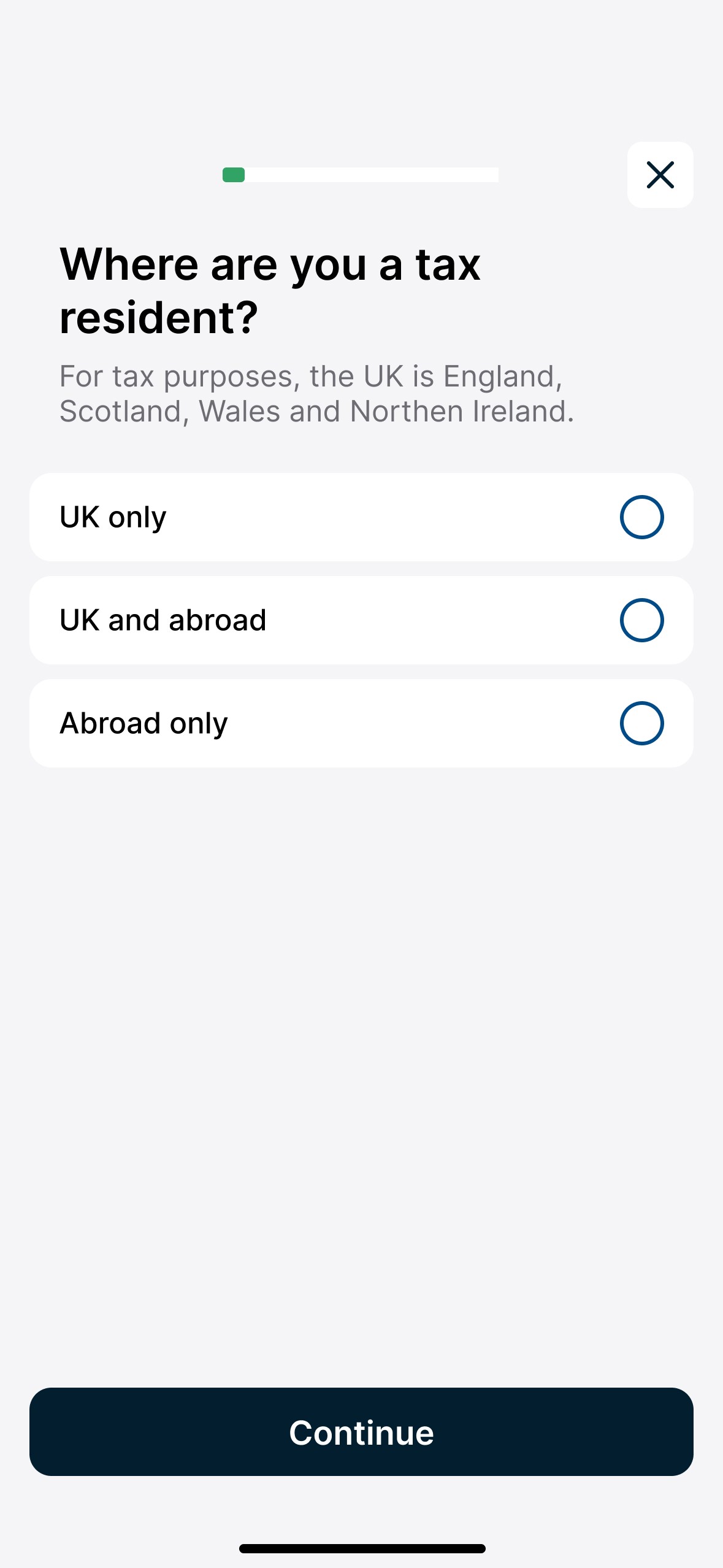

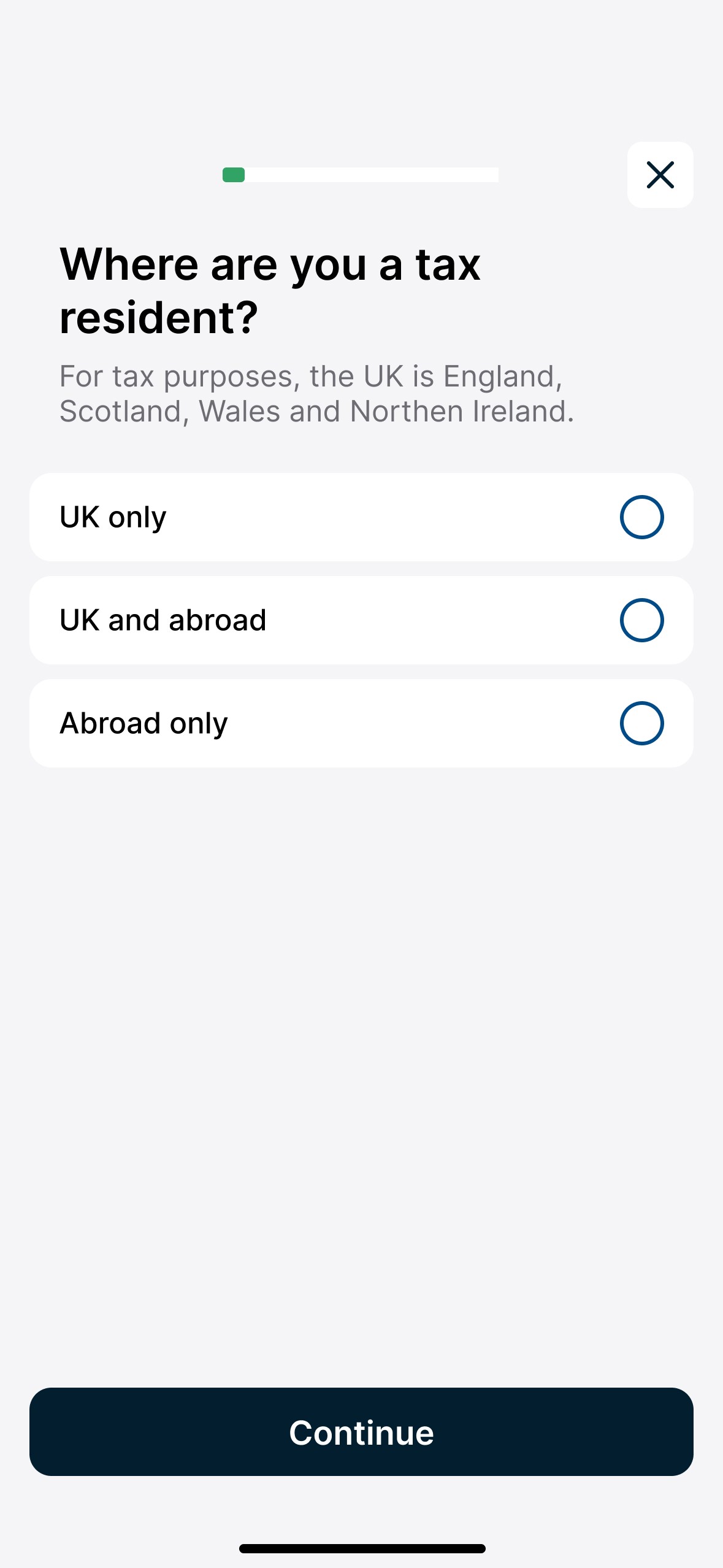

Declare tax residency

Applicants can declare their tax residency status during the onboarding journey.

Declare tax residency

Applicants can declare their tax residency status during the onboarding journey.

Declare tax residency

Applicants can declare their tax residency status during the onboarding journey.

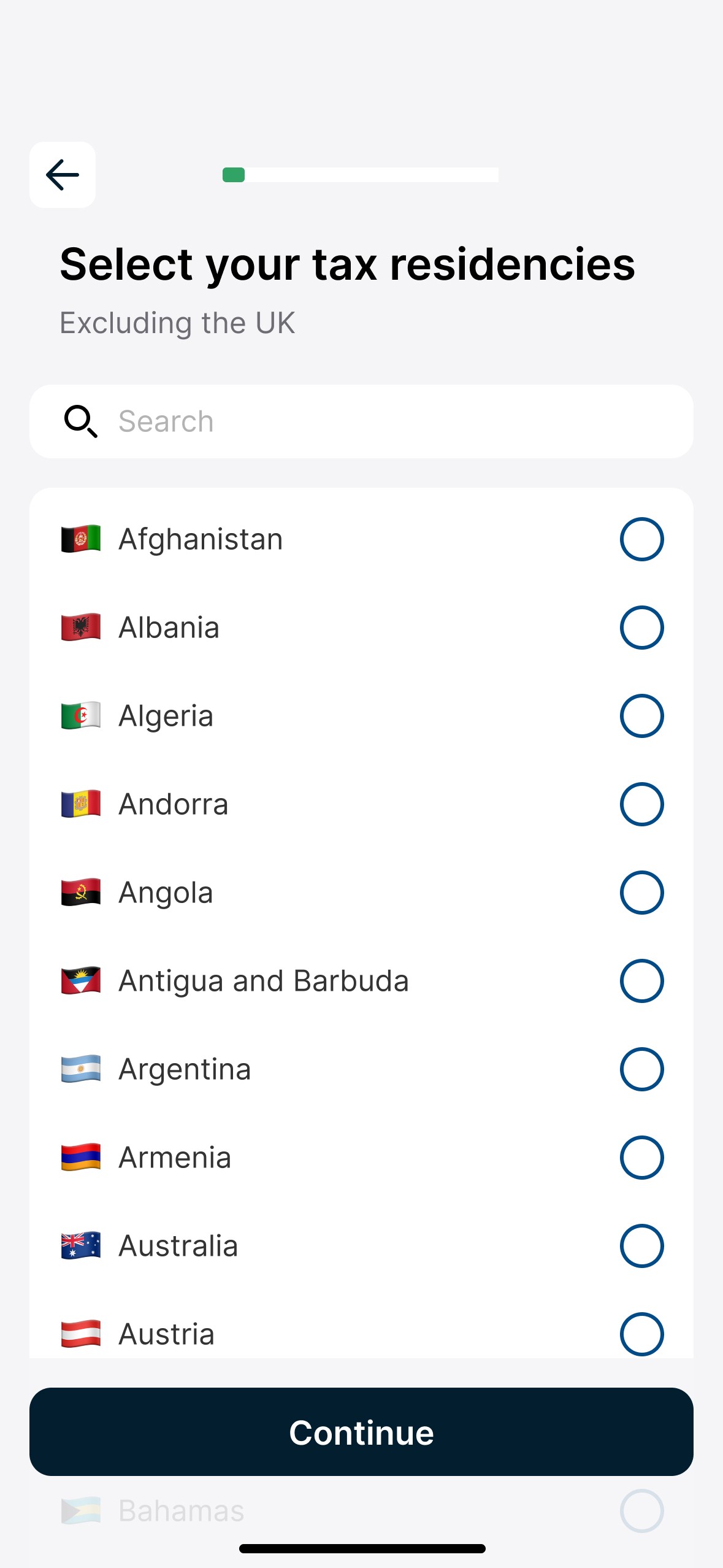

Search or scroll

I added search and flags as visual cues to simplify selecting tax residency from around 200 options.

Search or scroll

I added search and flags as visual cues to simplify selecting tax residency from around 200 options.

Search or scroll

I added search and flags as visual cues to simplify selecting tax residency from around 200 options.

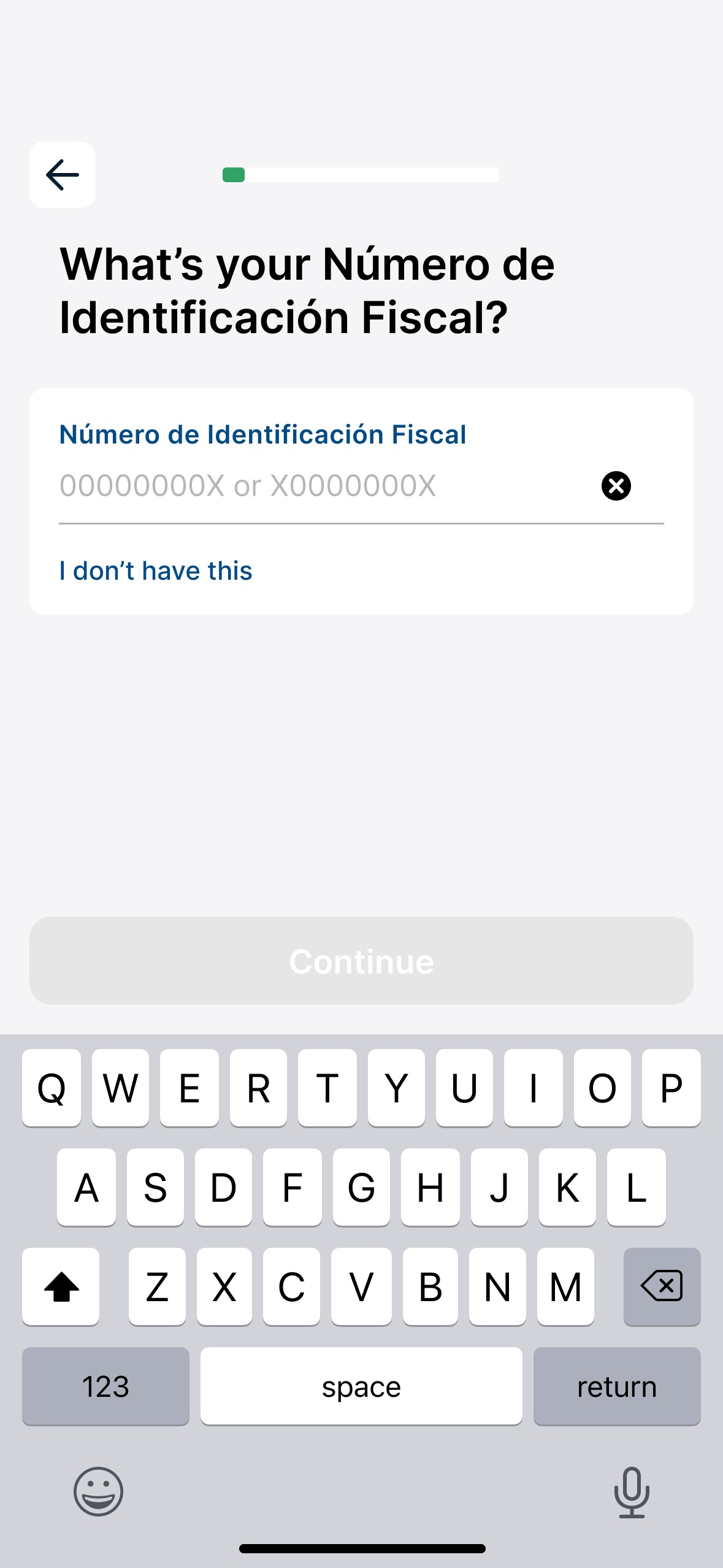

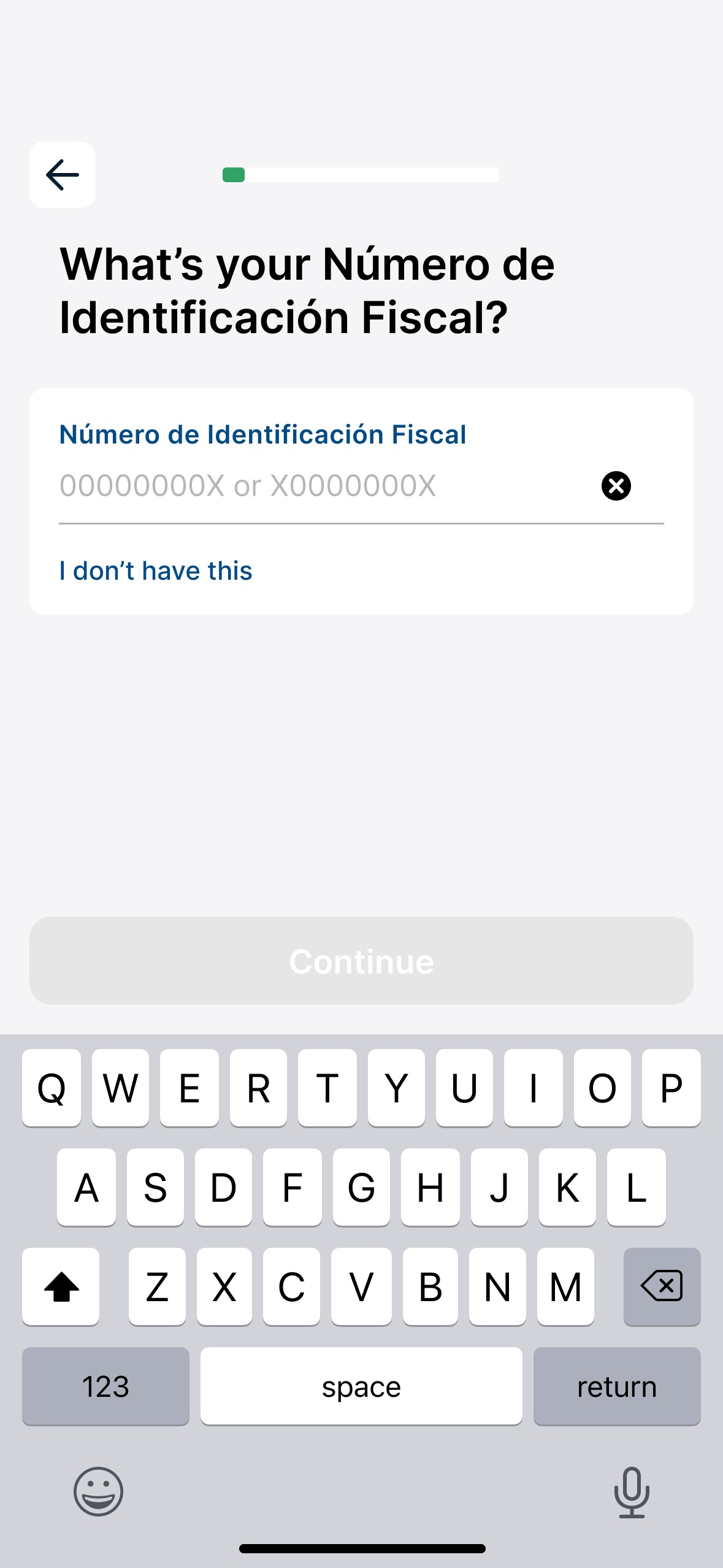

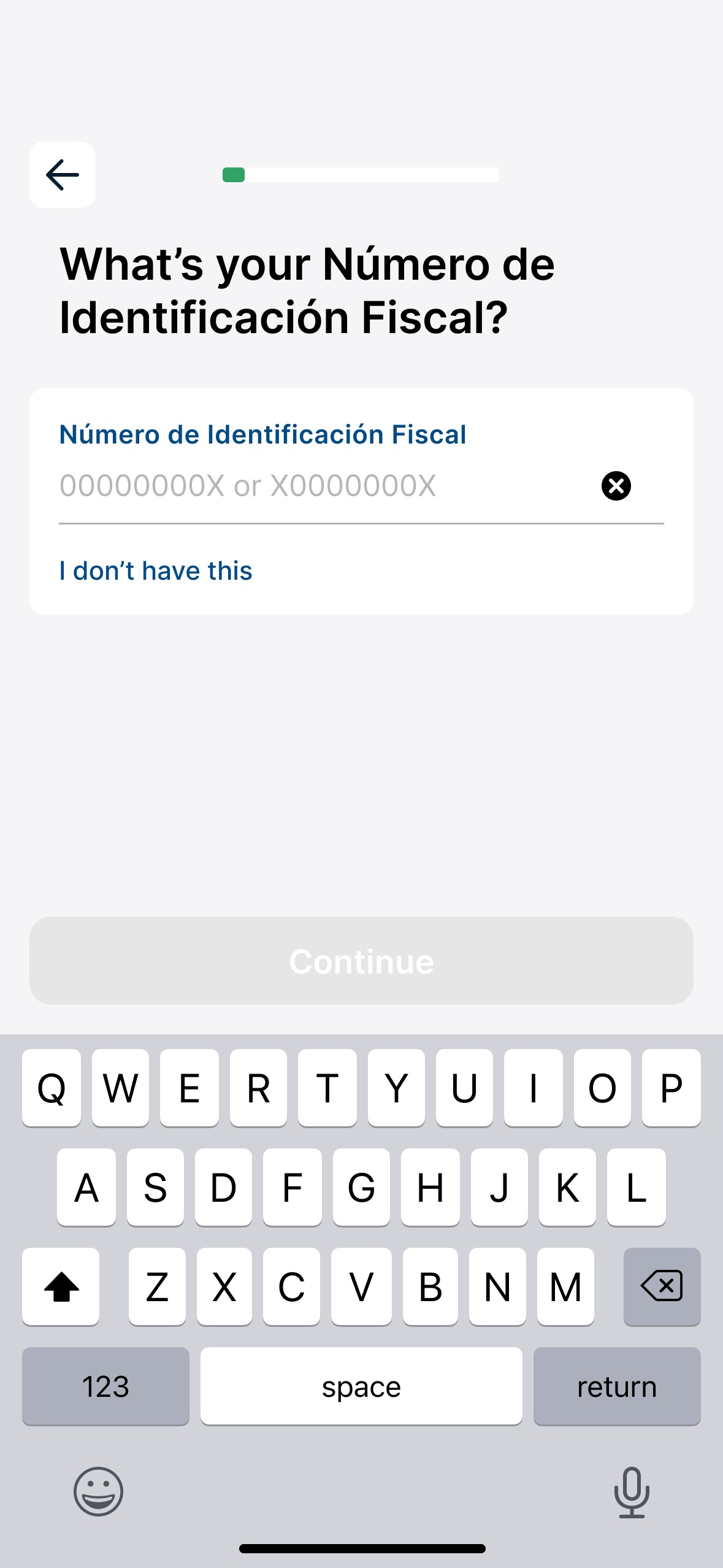

Localised format

Testing showed that many users were unfamiliar with the term "TIN," so I included the localised name and format.

Localised format

Testing showed that many users were unfamiliar with the term "TIN," so I included the localised name and format.

Localised format

Testing showed that many users were unfamiliar with the term "TIN," so I included the localised name and format.

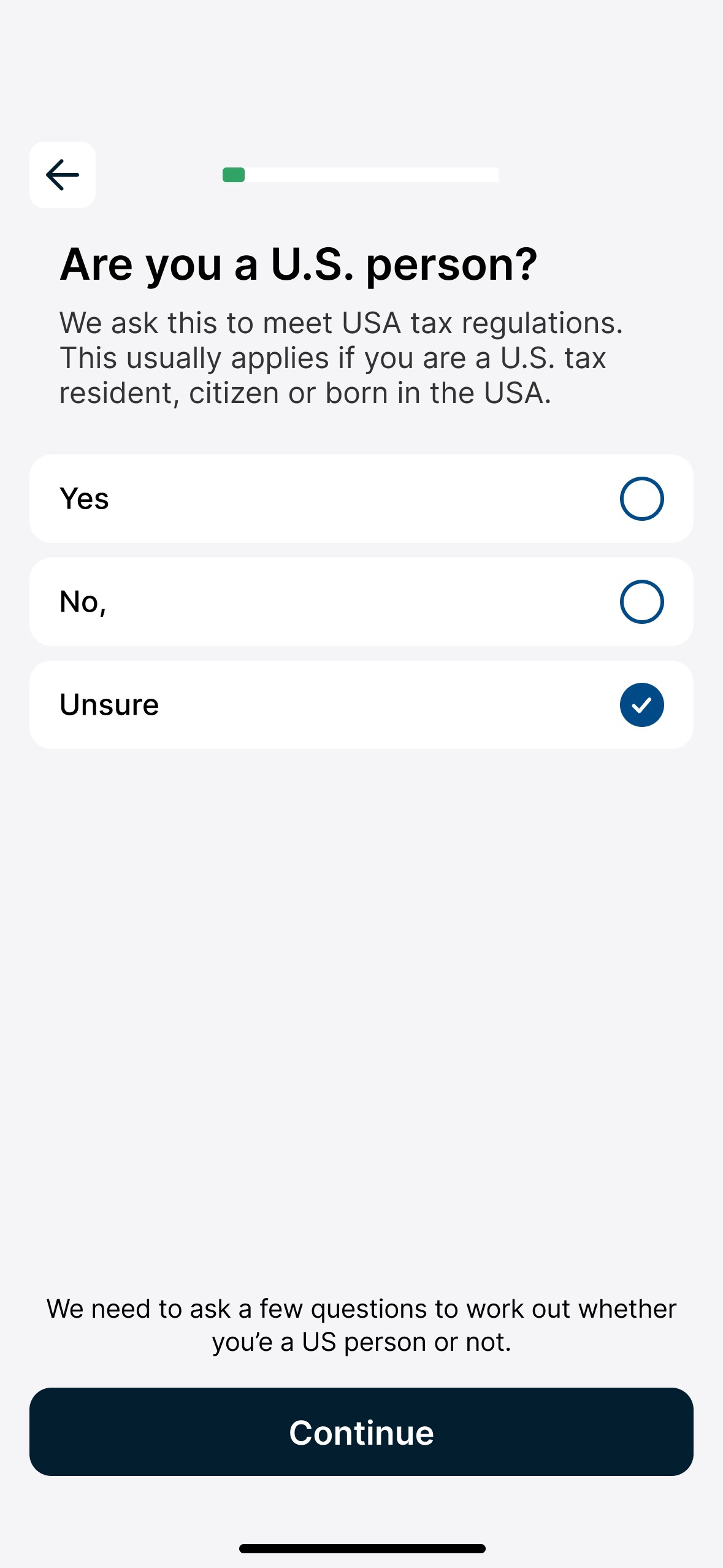

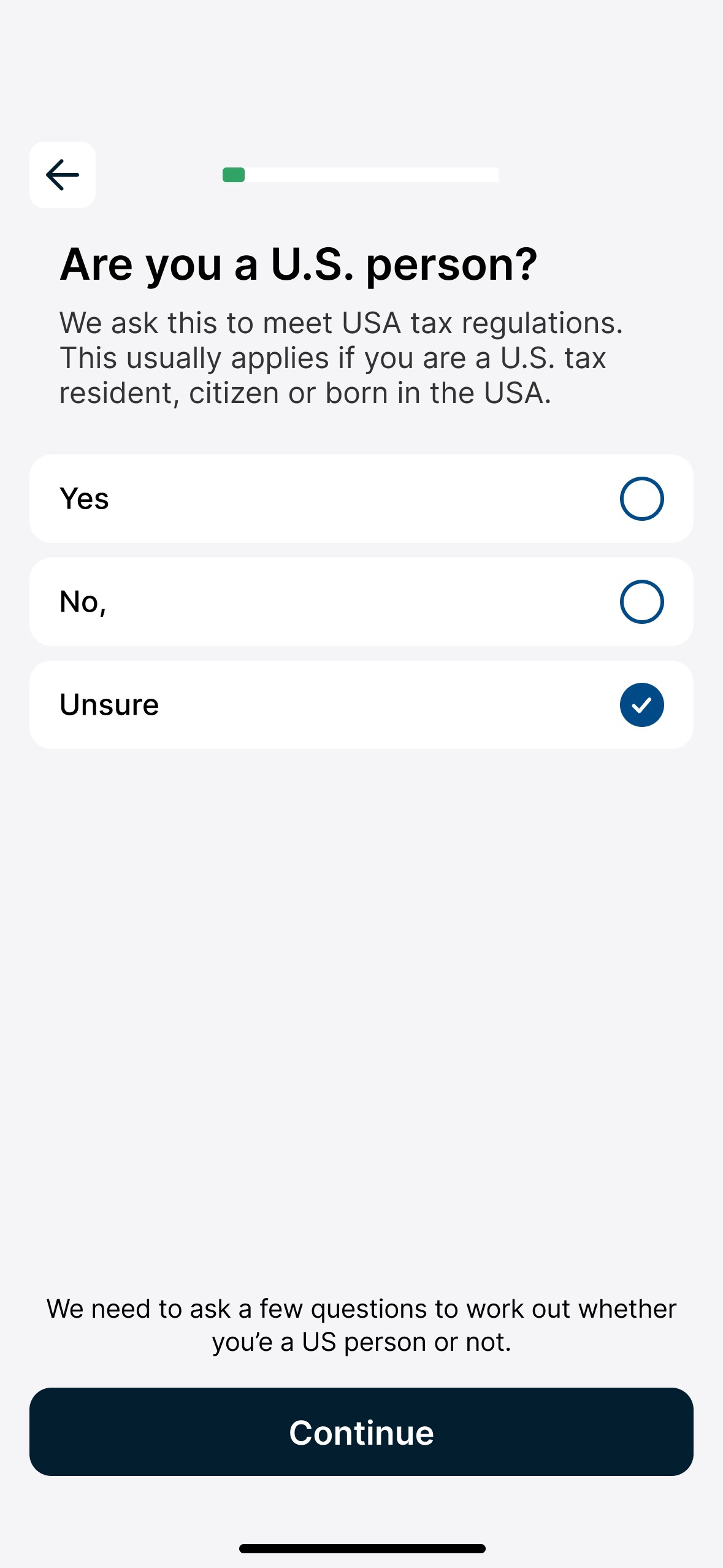

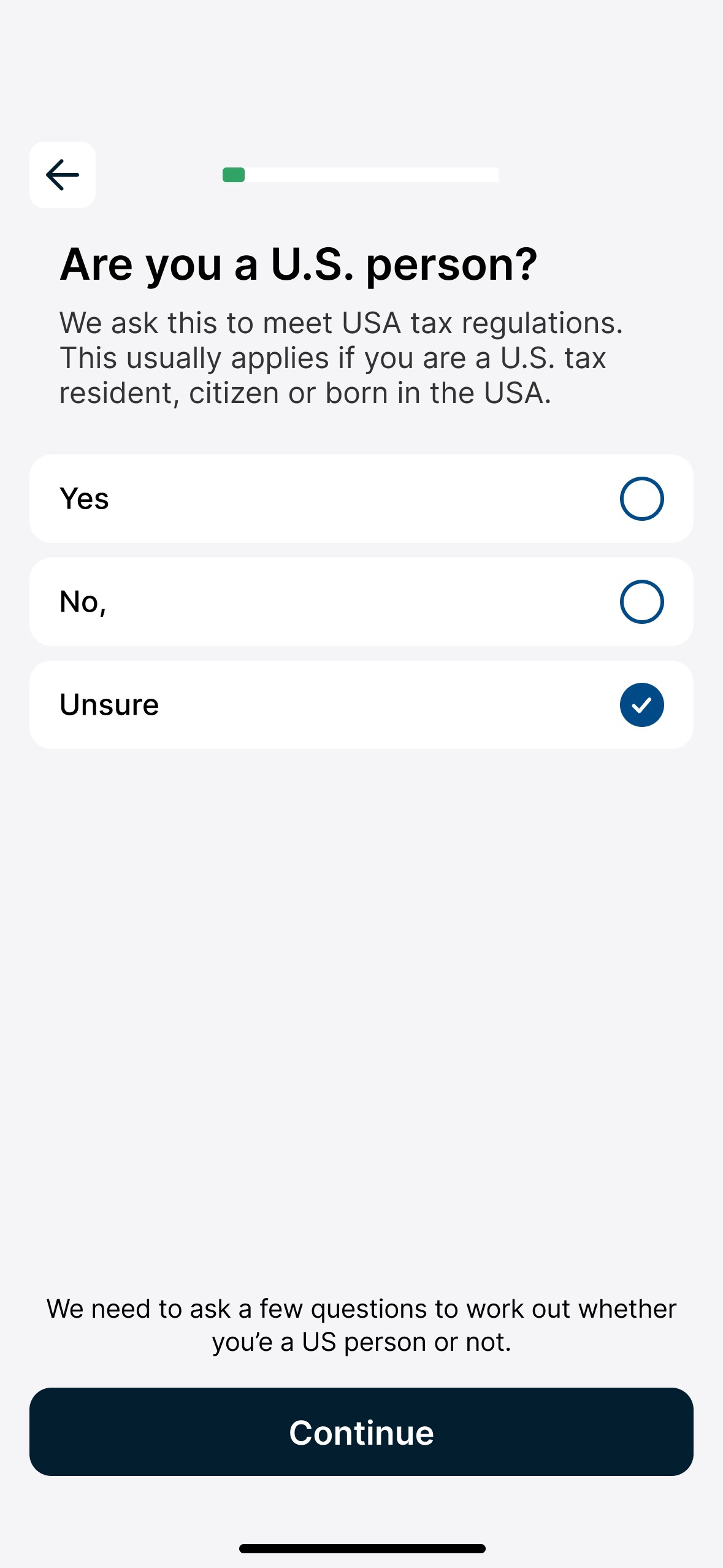

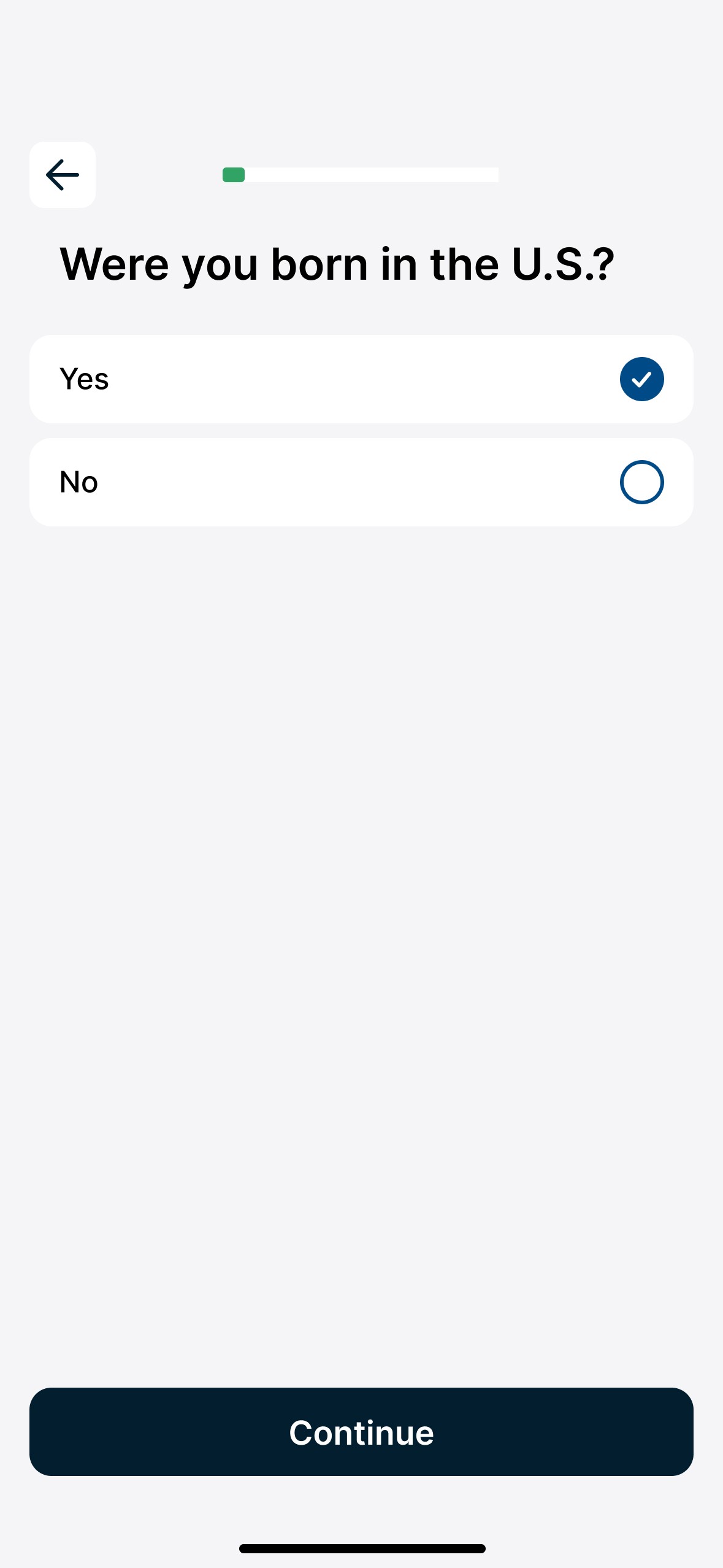

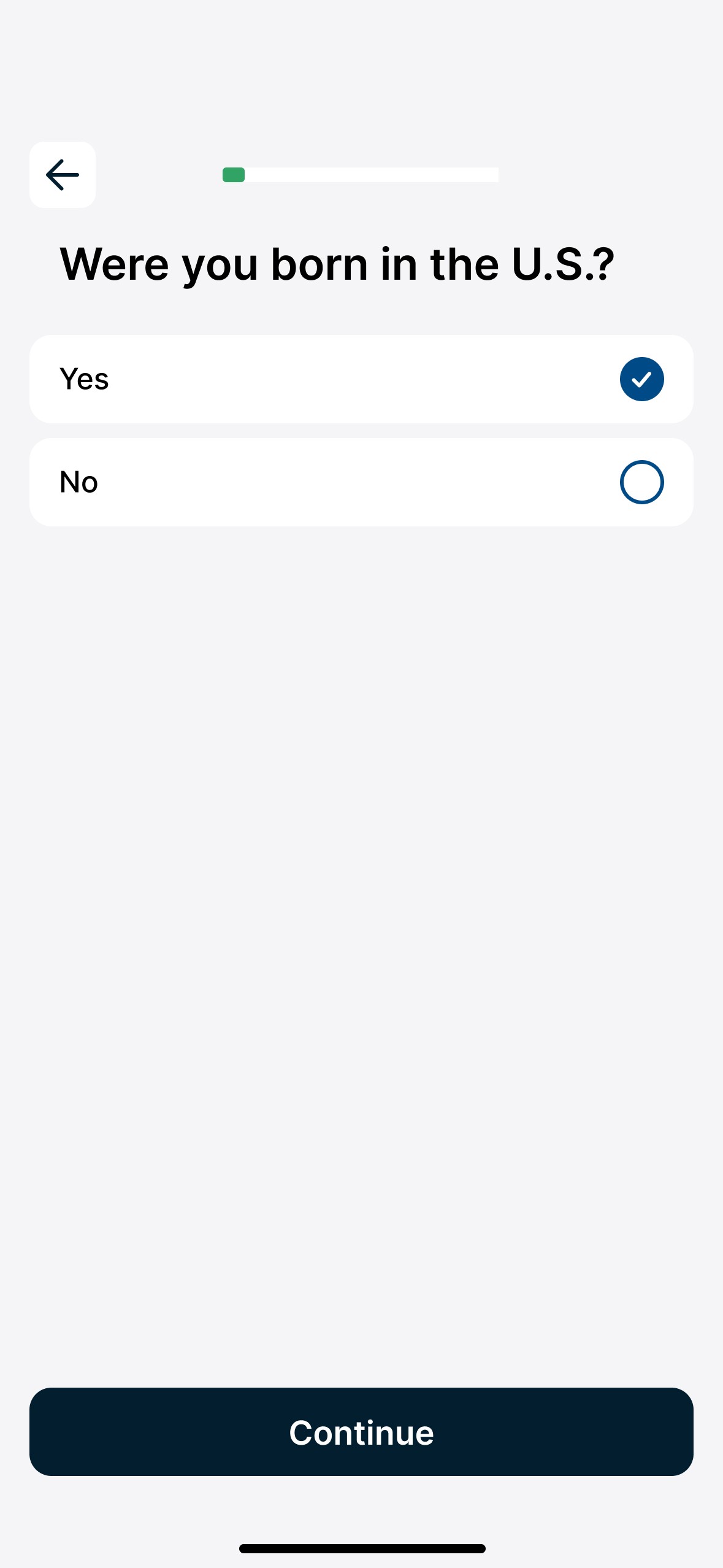

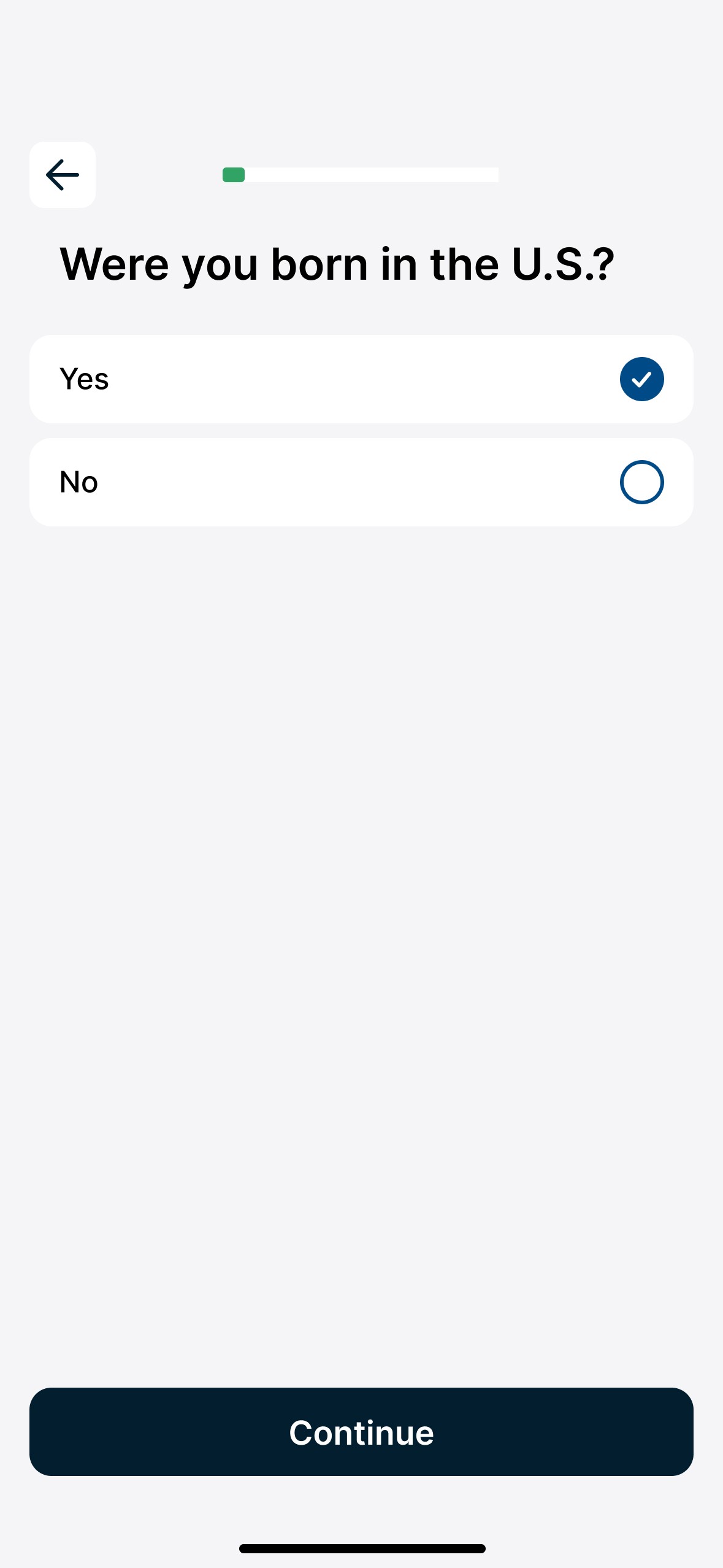

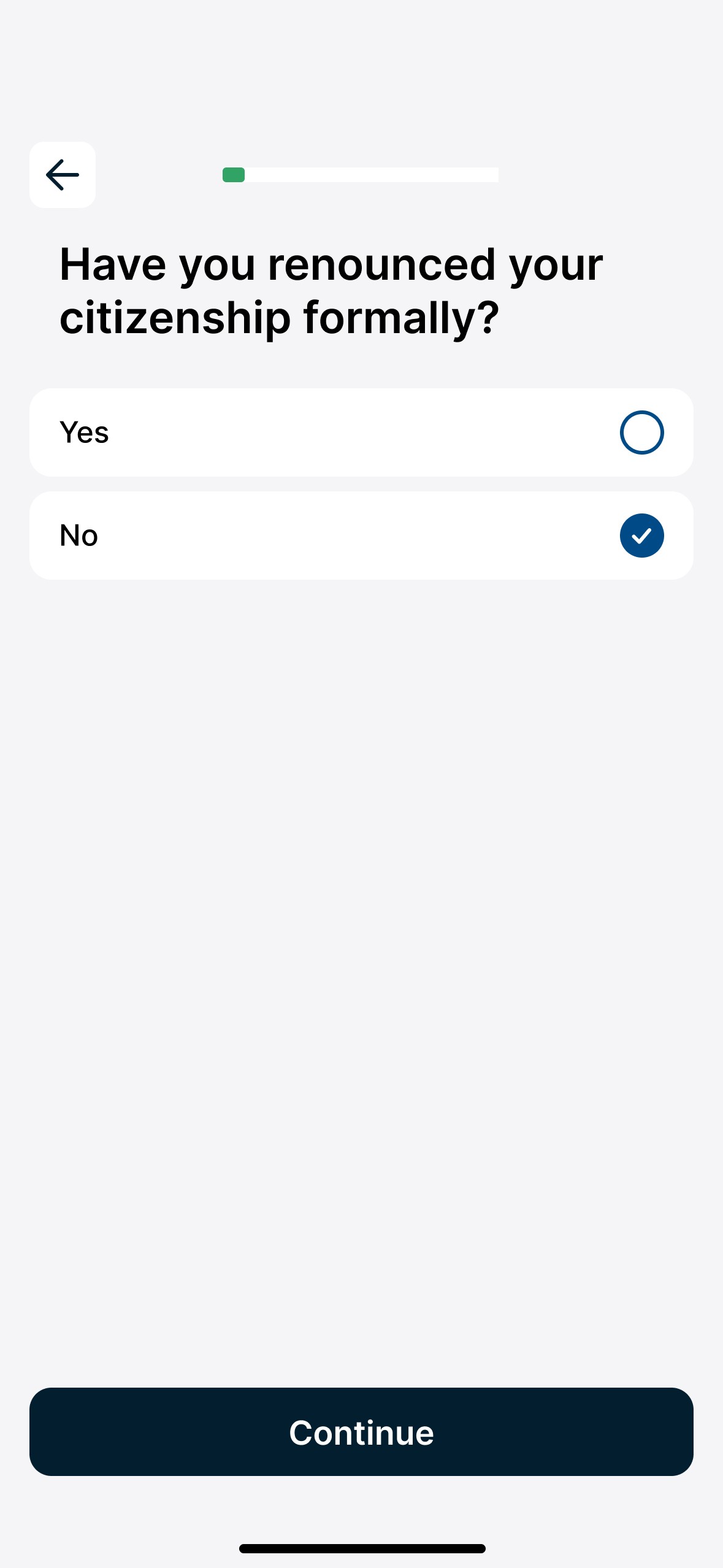

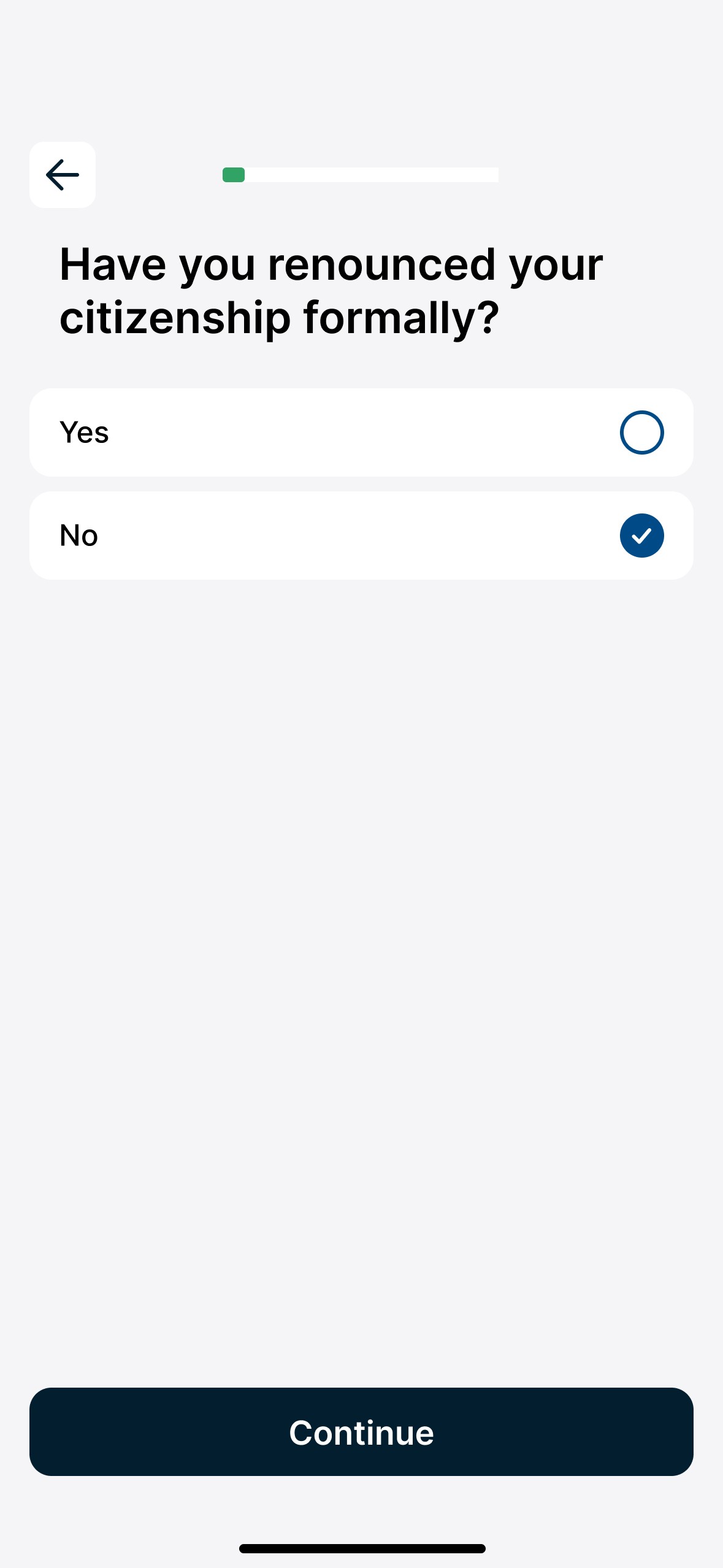

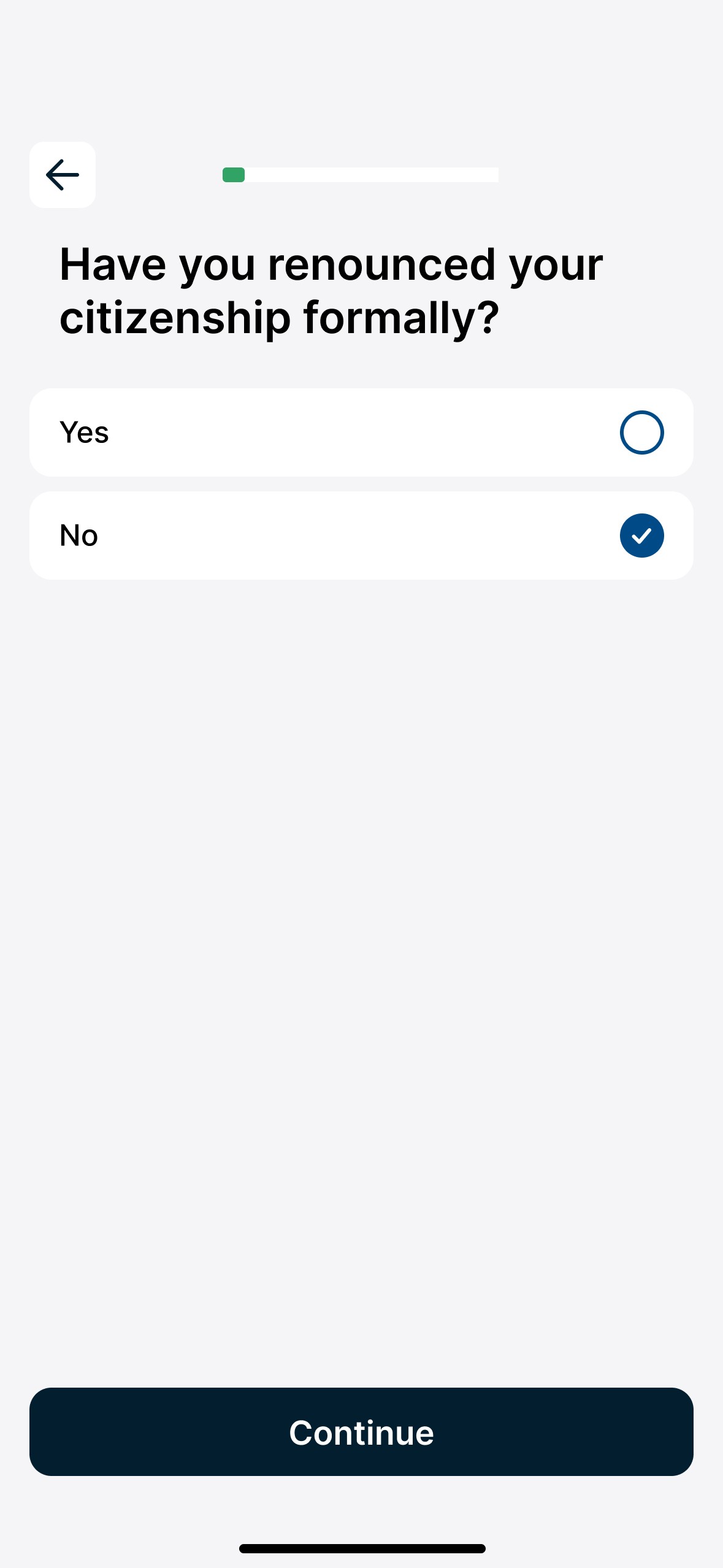

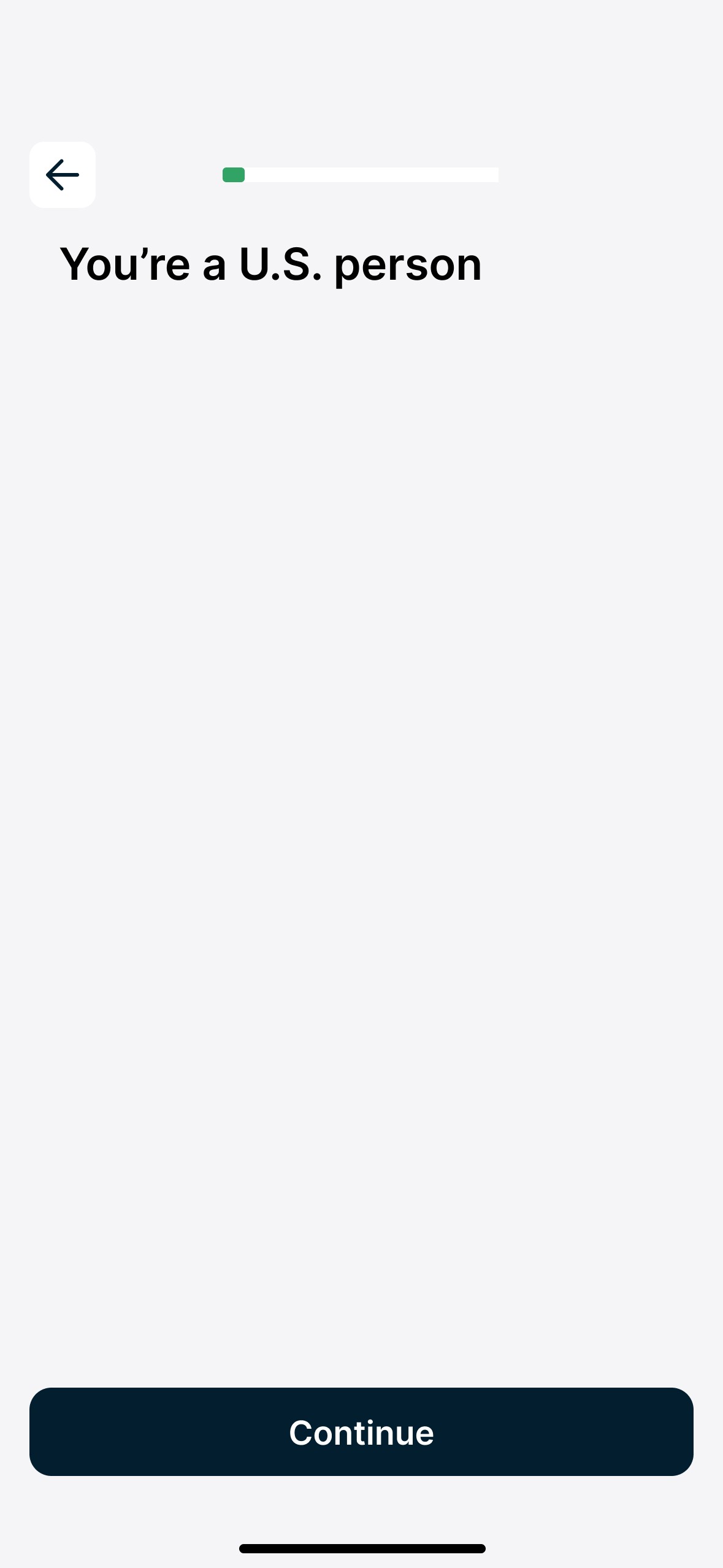

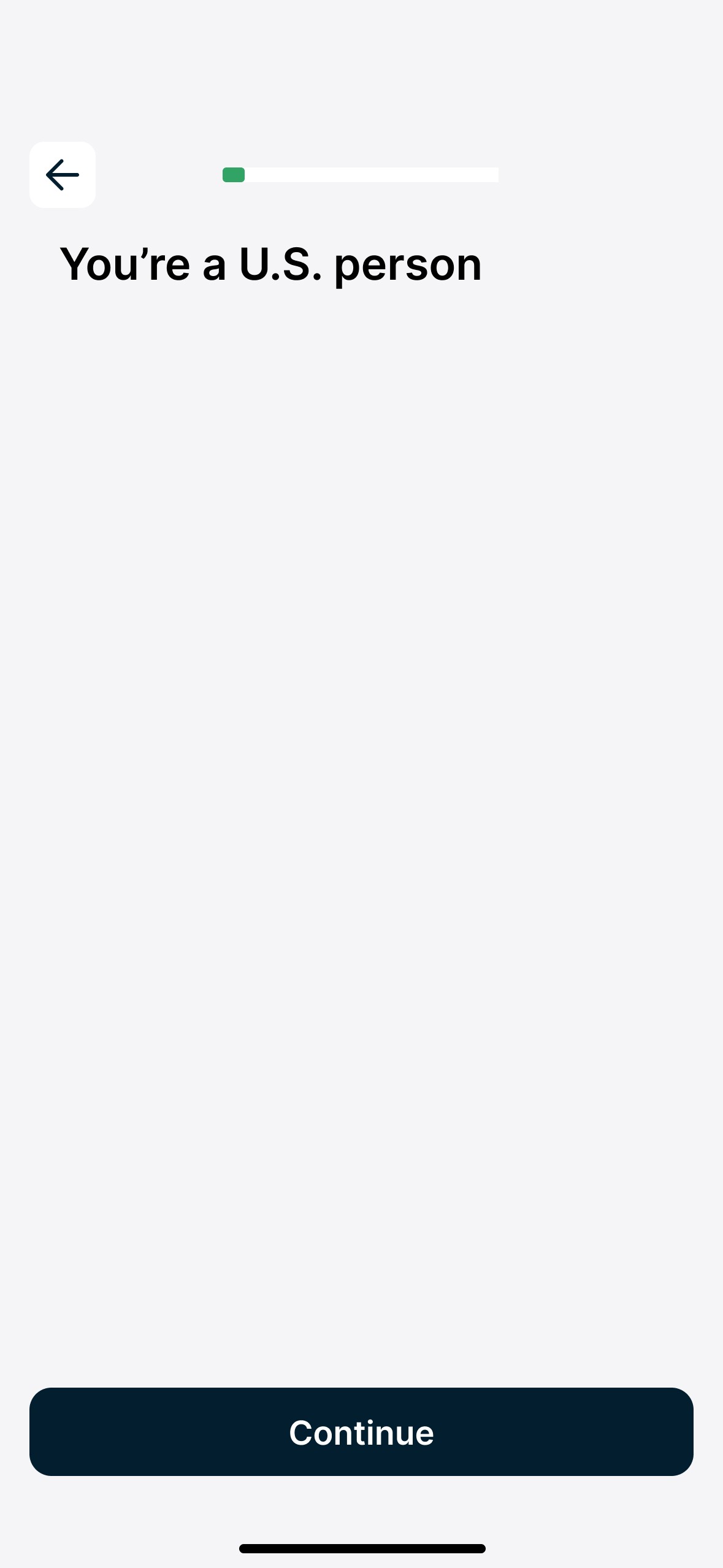

Determining U.S. persons

You don't need to be a tax resident of the U.S. to be a U.S. person. But, U.S. tax law requires U.S. persons to provide their Social Security Number. Instead of support intervening, it can be collected in-app.

Defining a U.S. person is challenging due to intricate criteria in tax laws. Previously, this led to lengthy support chats and staff training. Now, users can work out their status via a short survey.

Takeaways

Almost all applicants can now open an account in minutes, where in-app journeys decreased referrals from 30% to 5%.

Analysing support tickets was crucial in overcoming pain points and blockers in the in-app experience.

Automation can have a huge business impact: fewer support agents needed, and response times improve across the whole of support.