Saving Pots

Leveraging latecomer advantage to design a savings experience that outshines industry giants, like Monzo, Starling and Revolut.

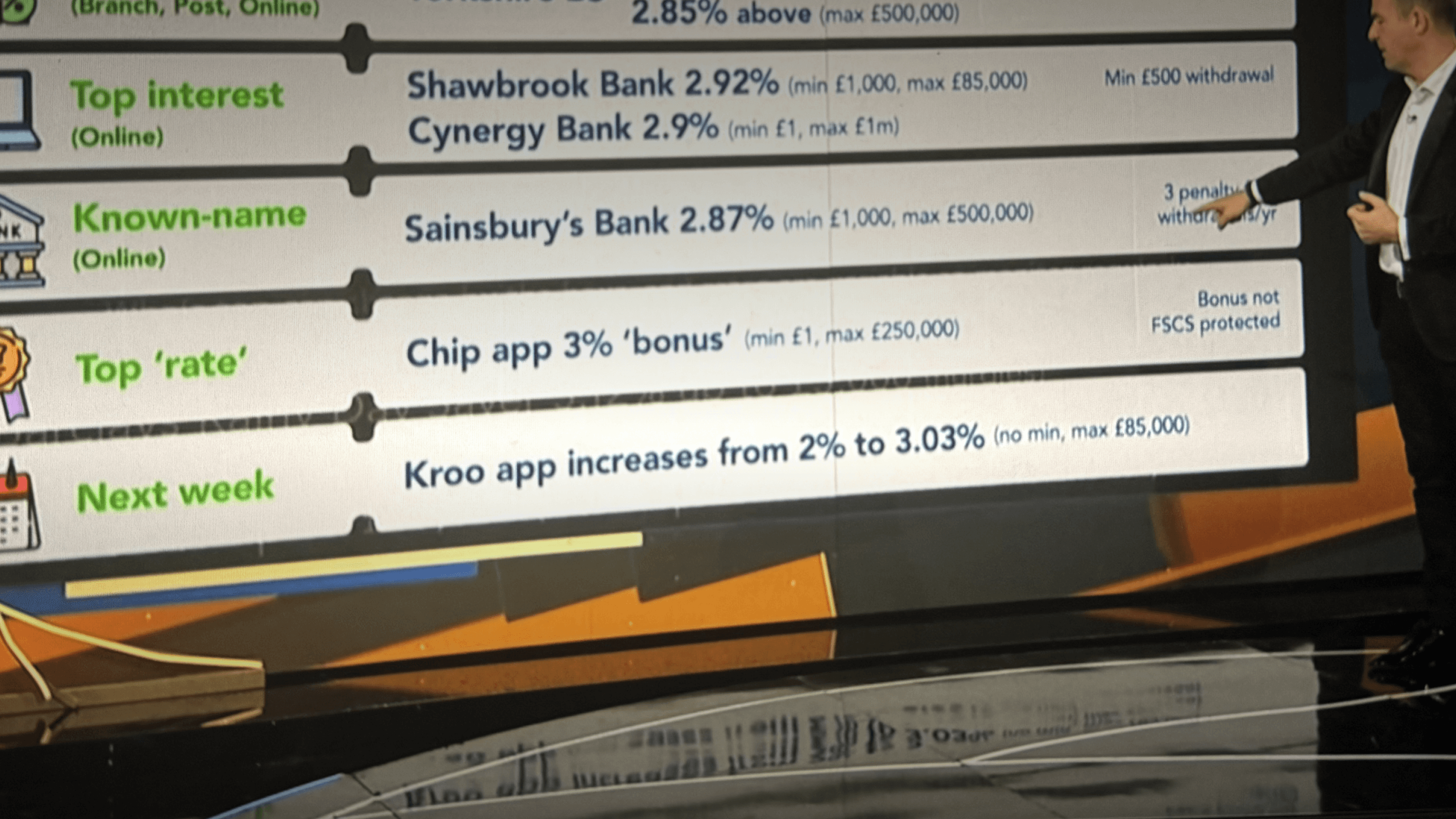

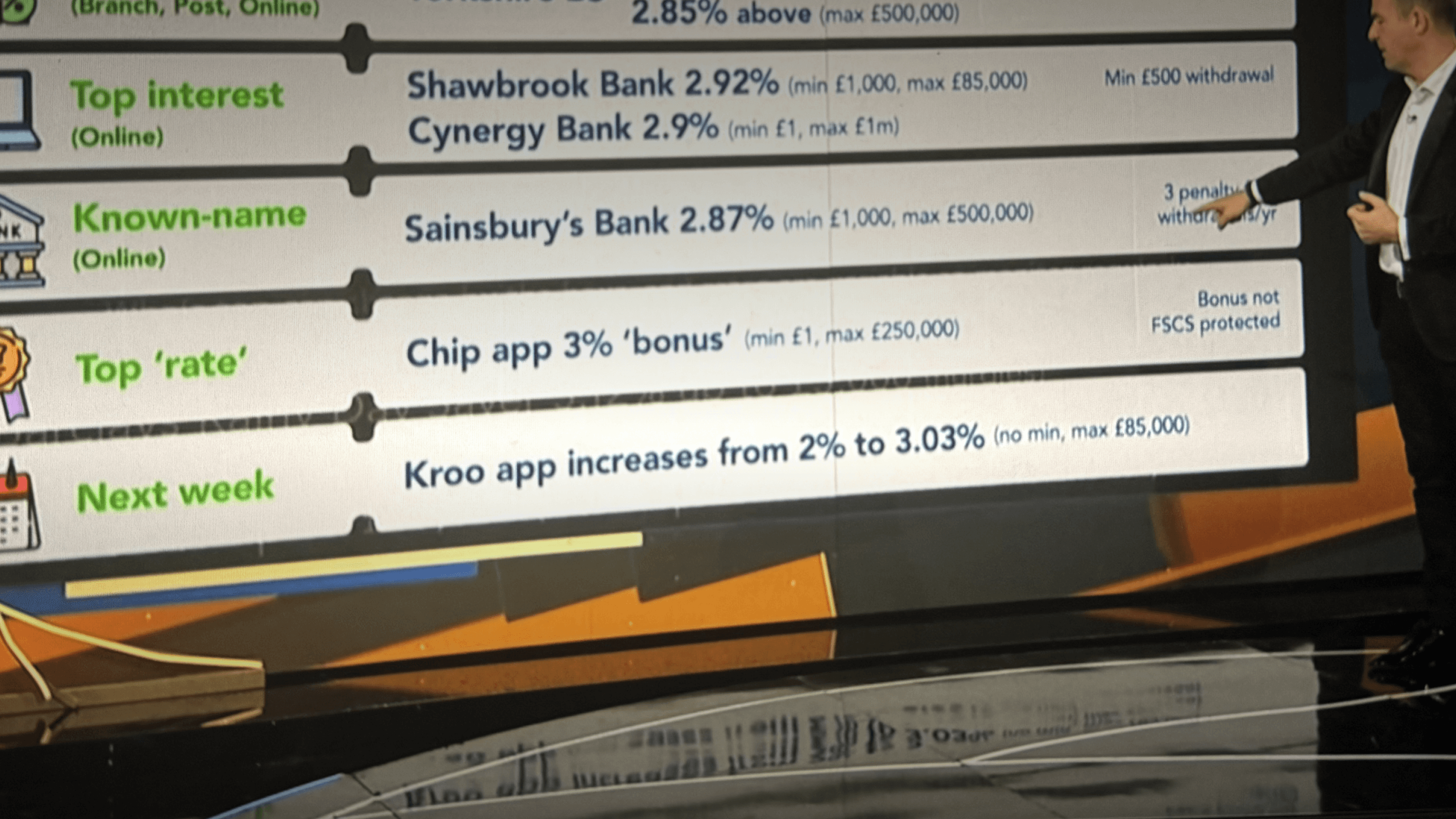

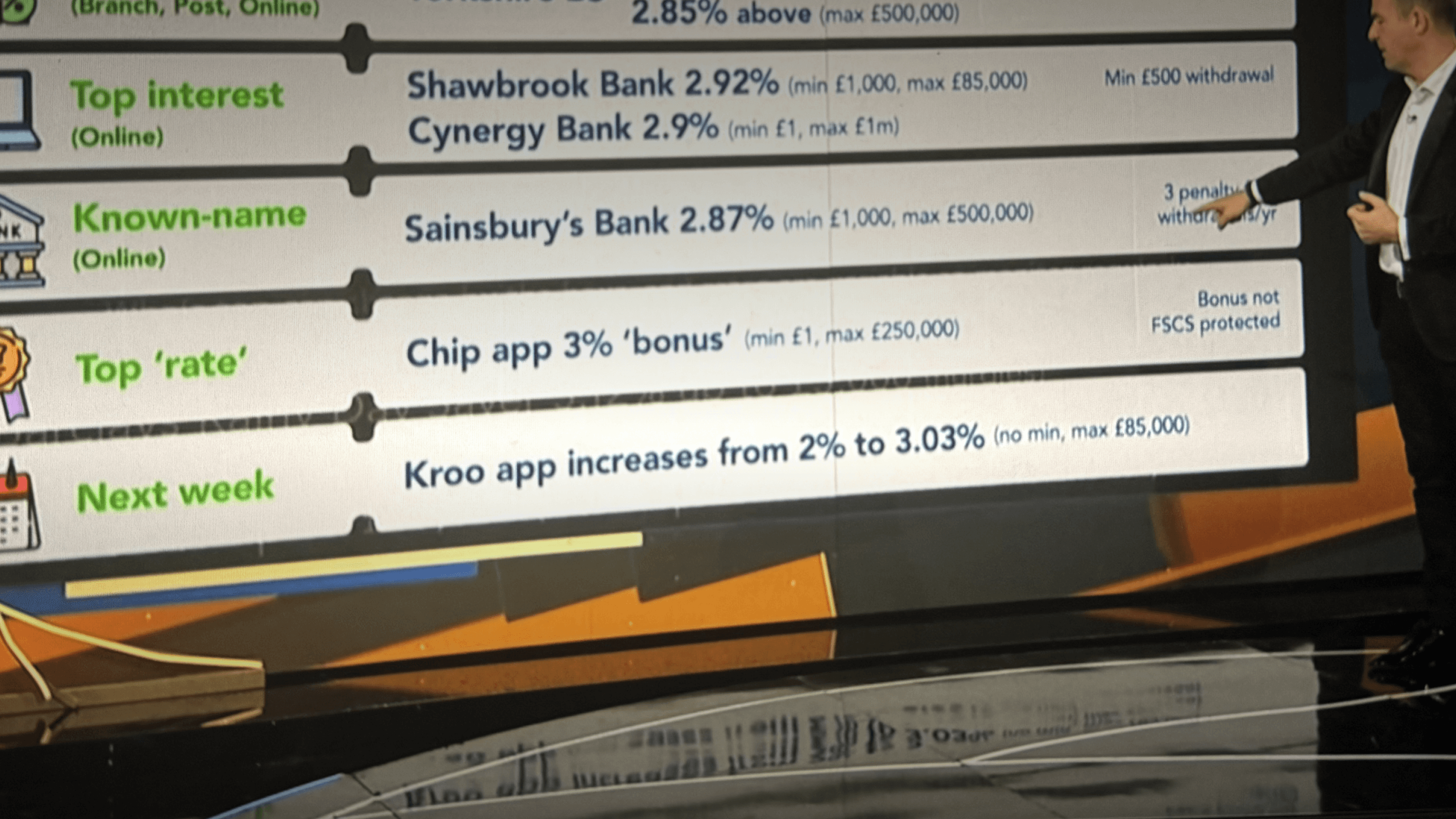

The rise of Kroo

At the height of the cost of living crisis, Kroo acquired 150,000+ customers. This growth sparked when Martin Lewis, on his prime time money show, dubbed the Kroo current account as:

The rise of Kroo

At the height of the cost of living crisis, Kroo acquired 150,000+ customers. This growth sparked when Martin Lewis, on his prime time money show, dubbed the Kroo current account as:

The rise of Kroo

At the height of the cost of living crisis, Kroo acquired 150,000+ customers. This growth sparked when Martin Lewis, on his prime time money show, dubbed the Kroo current account as:

The best open to-all easy access savings with unlimited withdrawals seen since 2012.

The best open to-all easy access savings with unlimited withdrawals seen since 2012.

The best open to-all easy access savings with unlimited withdrawals seen since 2012.

Problem

Kroo’s huge 4.35% interest rate was a top hit with savers. However a big obstacle hindered customers from making it their primary current account: the inability to separate savings from spending. Interviews revealed insights:

Problem

Kroo’s huge 4.35% interest rate was a top hit with savers. However a big obstacle hindered customers from making it their primary current account: the inability to separate savings from spending. Interviews revealed insights:

Problem

Kroo’s huge 4.35% interest rate was a top hit with savers. However a big obstacle hindered customers from making it their primary current account: the inability to separate savings from spending. Interviews revealed insights:

😵💫

Hard to track

Merging savings and regular expenses and spending makes it hard to differentiate between the two.

😵💫

Hard to track

Merging savings and regular expenses and spending makes it hard to differentiate between the two.

😵💫

Hard to track

Merging savings and regular expenses and spending makes it hard to differentiate between the two.

😈

Temptation

A big balance might give a false sense of security, potentially encouraging overspending.

😈

Temptation

A big balance might give a false sense of security, potentially encouraging overspending.

😈

Temptation

A big balance might give a false sense of security, potentially encouraging overspending.

😳

Security risks

Customers worry about keeping all their money in one place, especially in case of card theft or fraud.

😳

Security risks

Customers worry about keeping all their money in one place, especially in case of card theft or fraud.

😳

Security risks

Customers worry about keeping all their money in one place, especially in case of card theft or fraud.

🙄

Needs met

Other banks offer better functionalities, such as savings pots, to meet various spending needs.

🙄

Needs met

Other banks offer better functionalities, such as savings pots, to meet various spending needs.

🙄

Needs met

Other banks offer better functionalities, such as savings pots, to meet various spending needs.

Moving money aside

Only 6% of customers were primary users. This low engagement is a risk to profitability and customer loyalty. Feedback and insights showed a need for pots to set money aside for different purposes.

Moving money aside

Only 6% of customers were primary users. This low engagement is a risk to profitability and customer loyalty. Feedback and insights showed a need for pots to set money aside for different purposes.

Moving money aside

Only 6% of customers were primary users. This low engagement is a risk to profitability and customer loyalty. Feedback and insights showed a need for pots to set money aside for different purposes.

Needs savers pots

Something I miss is the ability to set money aside (i.e. pots).

Needs savers pots

Something I miss is the ability to set money aside (i.e. pots).

Needs savers pots

Something I miss is the ability to set money aside (i.e. pots).

Good in parts

Be nice to be able to create pots to budget and save.

Good in parts

Be nice to be able to create pots to budget and save.

Good in parts

Be nice to be able to create pots to budget and save.

Great service

Great service. But needs savings pots to make it perfect.

Great service

Great service. But needs savings pots to make it perfect.

Great service

Great service. But needs savings pots to make it perfect.

Current accounts with Pots ✅

Current accounts with Pots ✅

Pots’ success and effectiveness has been proven by other leading app-based banks. Extensive literature on saving psychology backs up that it’s a good way to manage your money.

Pots’ success and effectiveness has been proven by other leading app-based banks. Extensive literature on saving psychology backs up that it’s a good way to manage your money.

Chase

Monzo

Starling

TSB

Current accounts without Pots ❌

Current accounts without Pots ❌

Adding Pots not only would can engage Kroo users, but capture market share from traditional banks.

Adding Pots not only would can engage Kroo users, but capture market share from traditional banks.

AIB

AIB

Bank of Ireland

Bank of Ireland

Barclays

Barclays

Citi

Citi

Cooperative Bank

Cooperative Bank

Cynergy Bank

Cynergy Bank

Danske Bank

Danske Bank

First Direct

First Direct

Halifax

Halifax

HSBC

HSBC

ICICI

ICICI

Investec

Investec

LLoyds

LLoyds

Nationwide

Nationwide

NatWest

NatWest

Metro Bank

Metro Bank

PNBJI

PNBJI

Royal Bank of Scotland

Royal Bank of Scotland

Santander

Santander

Smile

Smile

Triodos bank

Triodos bank

UBL

UBL

Ulster bank

Ulster bank

Virgin Money

Virgin Money

From MVP to MLP

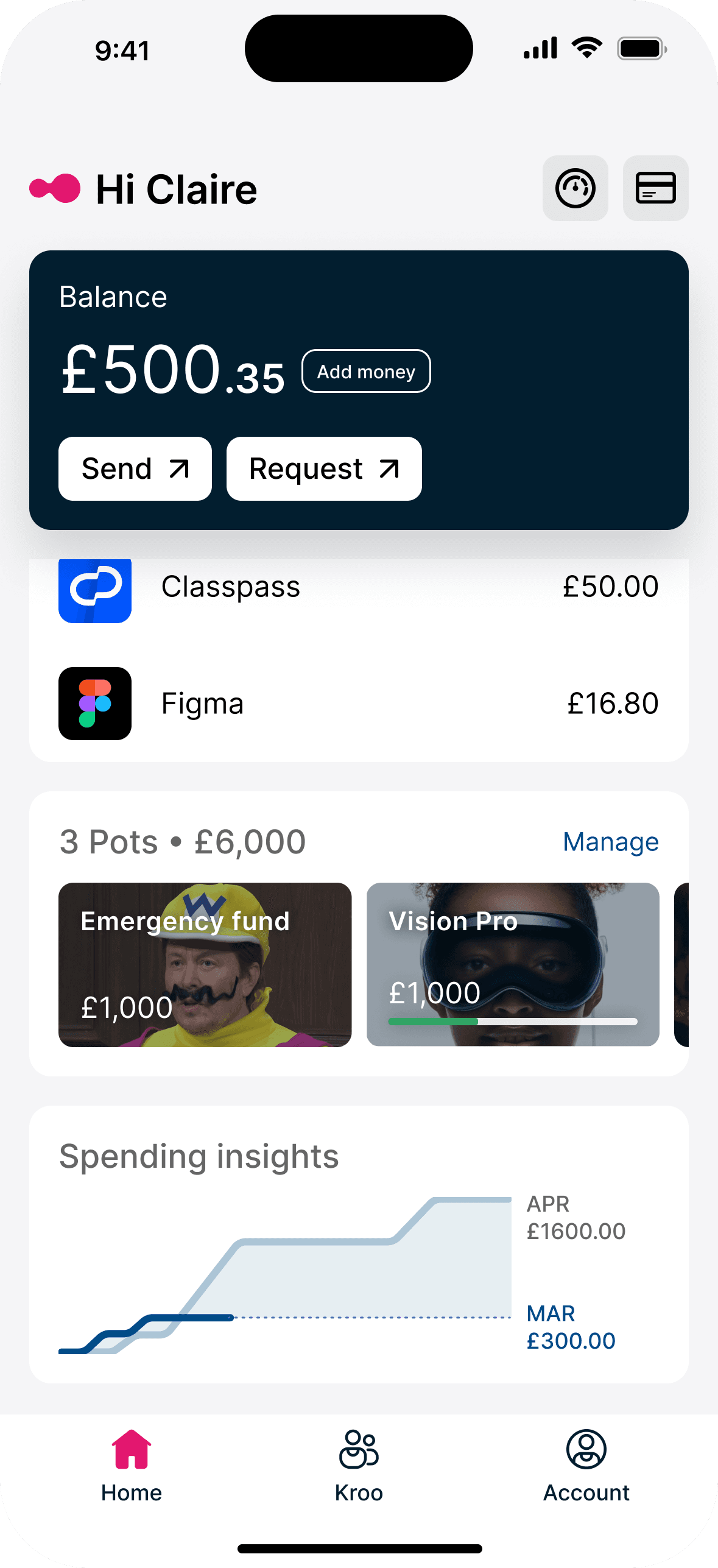

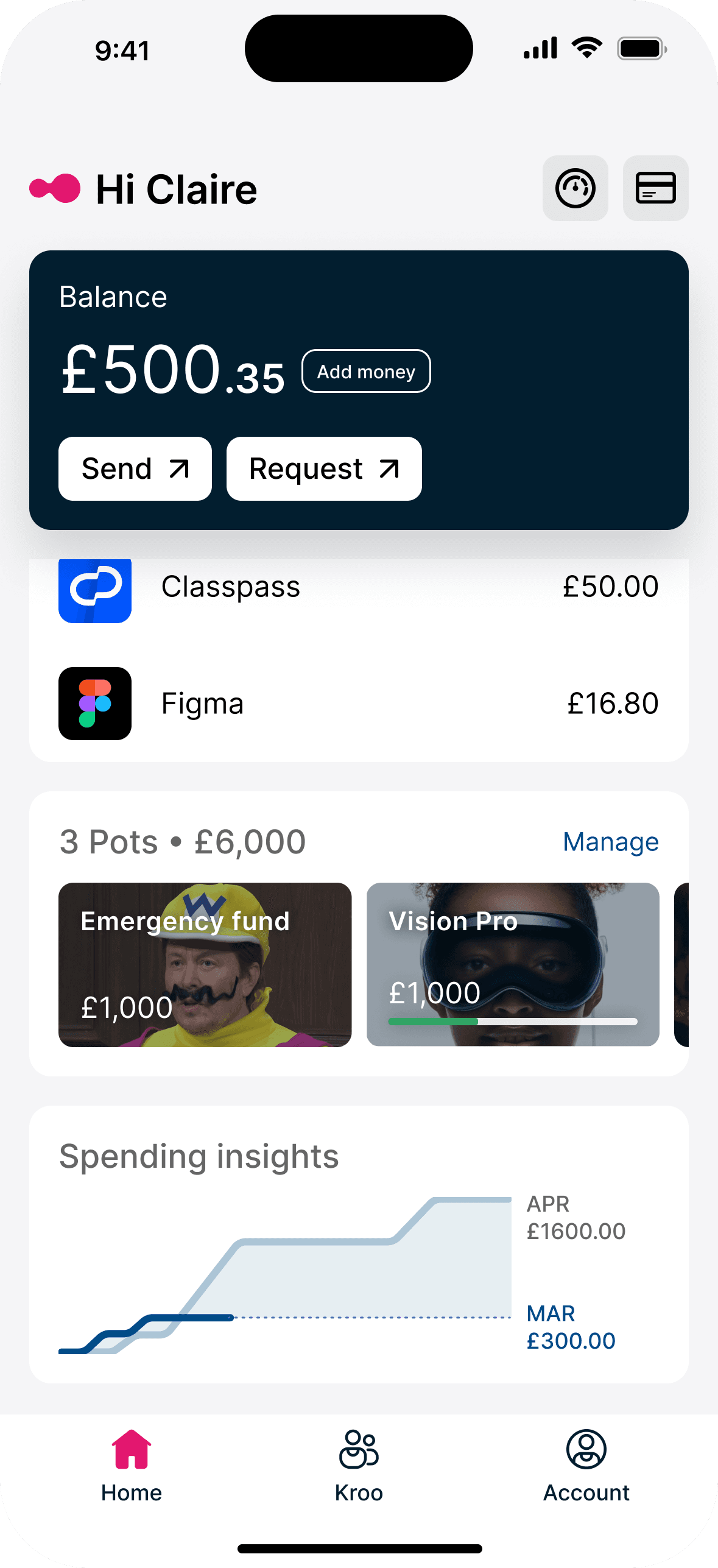

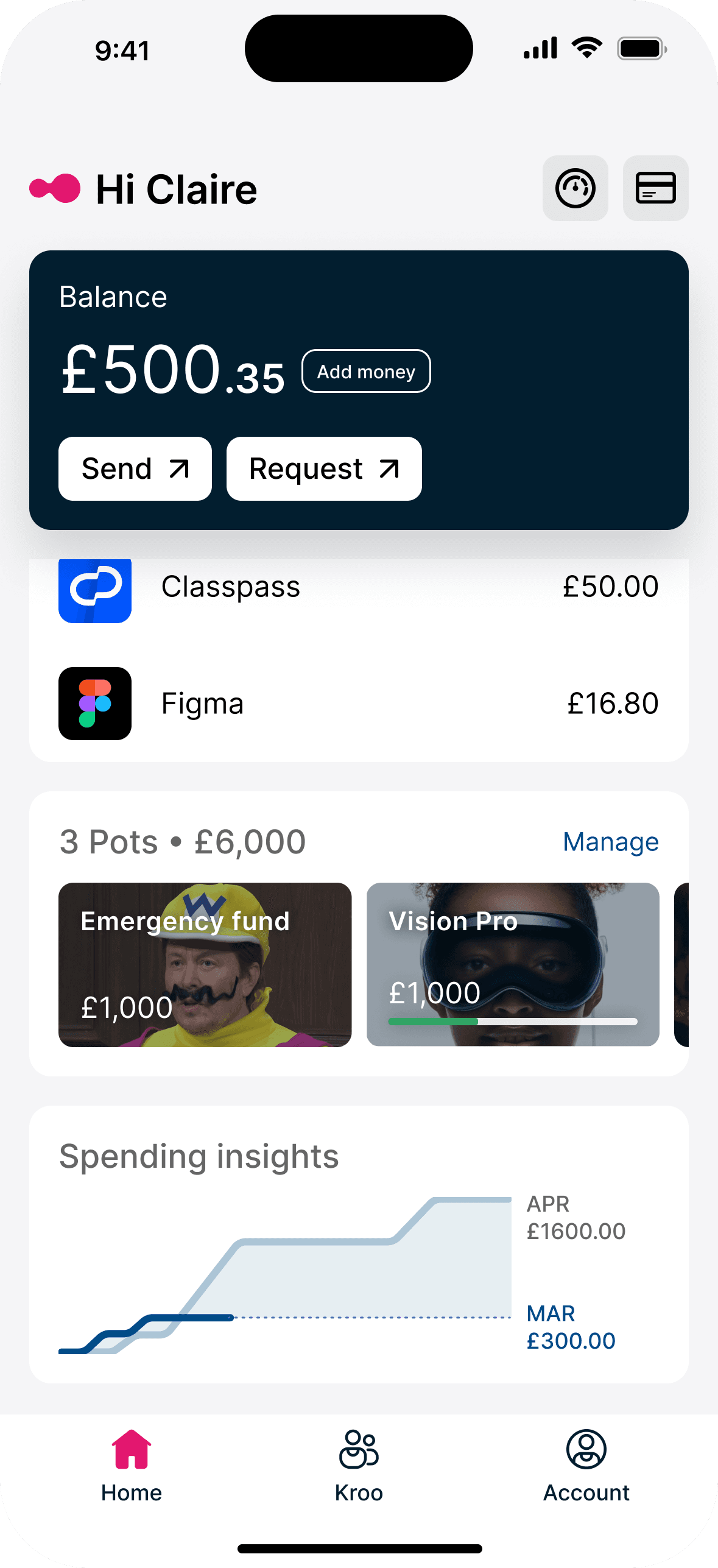

As the lead designer for Saving Pots, I inherited a basic minimum viable product (MVP) that allowed users to create pots with names, deposit and withdraw funds, and track activity.

I audited the MVP and ran user tests, also analysing competitors like Starling, Monzo, Revolut, and Chase. This helped identify areas to excel. My goal was clear: to make Pots a minimum lovable product (MLP).

I then created a roadmap and designed core features like adding images, automatic transfers, round-ups, better pot management, and sorting income.

I then created a roadmap and designed core features like adding images, automatic transfers, round-ups, better pot management, and sorting income.

Highlights

Set up

Setting up a pot is a simple, step-by-step process where savings features are introduced individually. This use of progressive disclosure increases engagement and understanding.

Once set up is done, little effort is needed going forward. With everything automated, they can sit back, while their savings grow effortlessly.

Set up

Setting up a pot is a simple, step-by-step process where savings features are introduced individually. This use of progressive disclosure increases engagement and understanding.

Once set up is done, little effort is needed going forward. With everything automated, they can sit back, while their savings grow effortlessly.

Set up

Setting up a pot is a simple, step-by-step process where savings features are introduced individually. This use of progressive disclosure increases engagement and understanding.

Once set up is done, little effort is needed going forward. With everything automated, they can sit back, while their savings grow effortlessly.

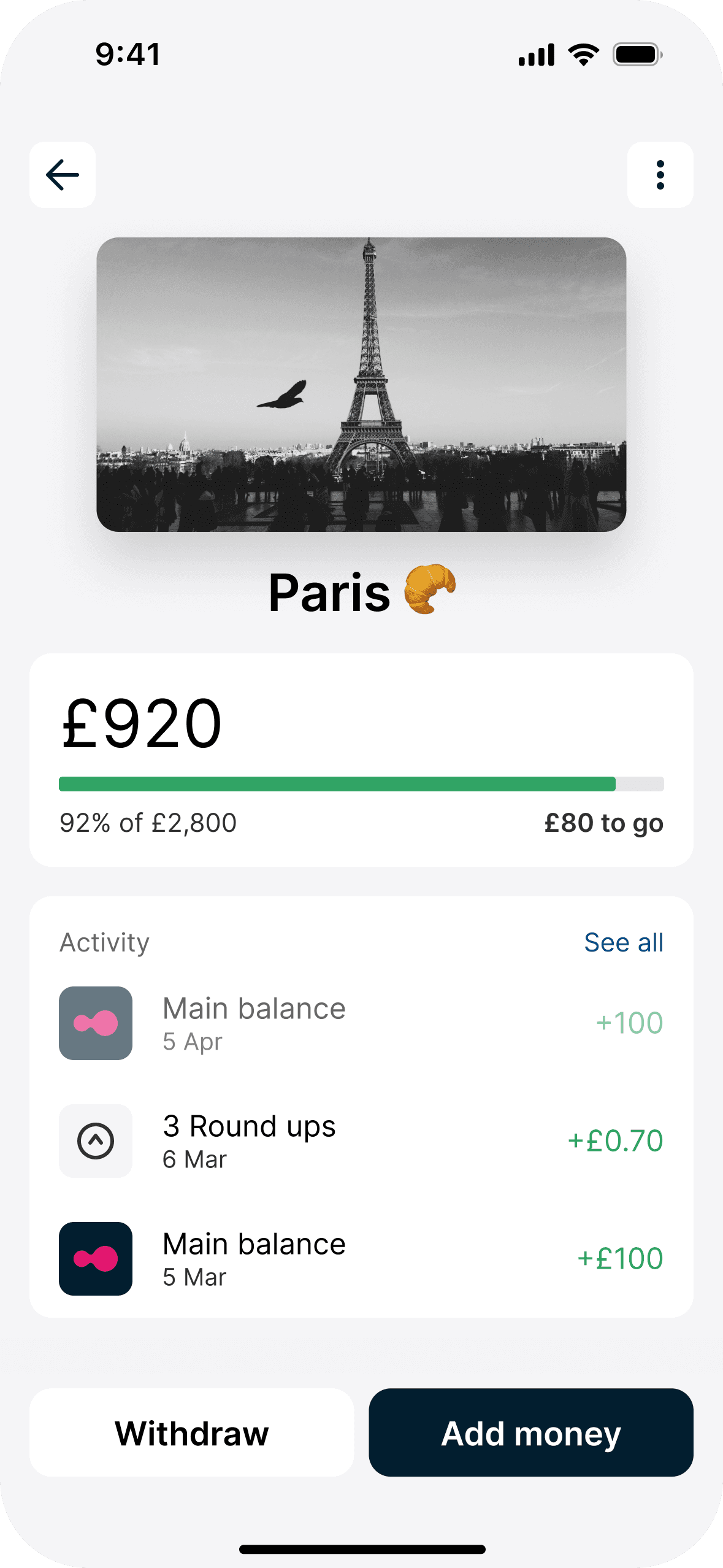

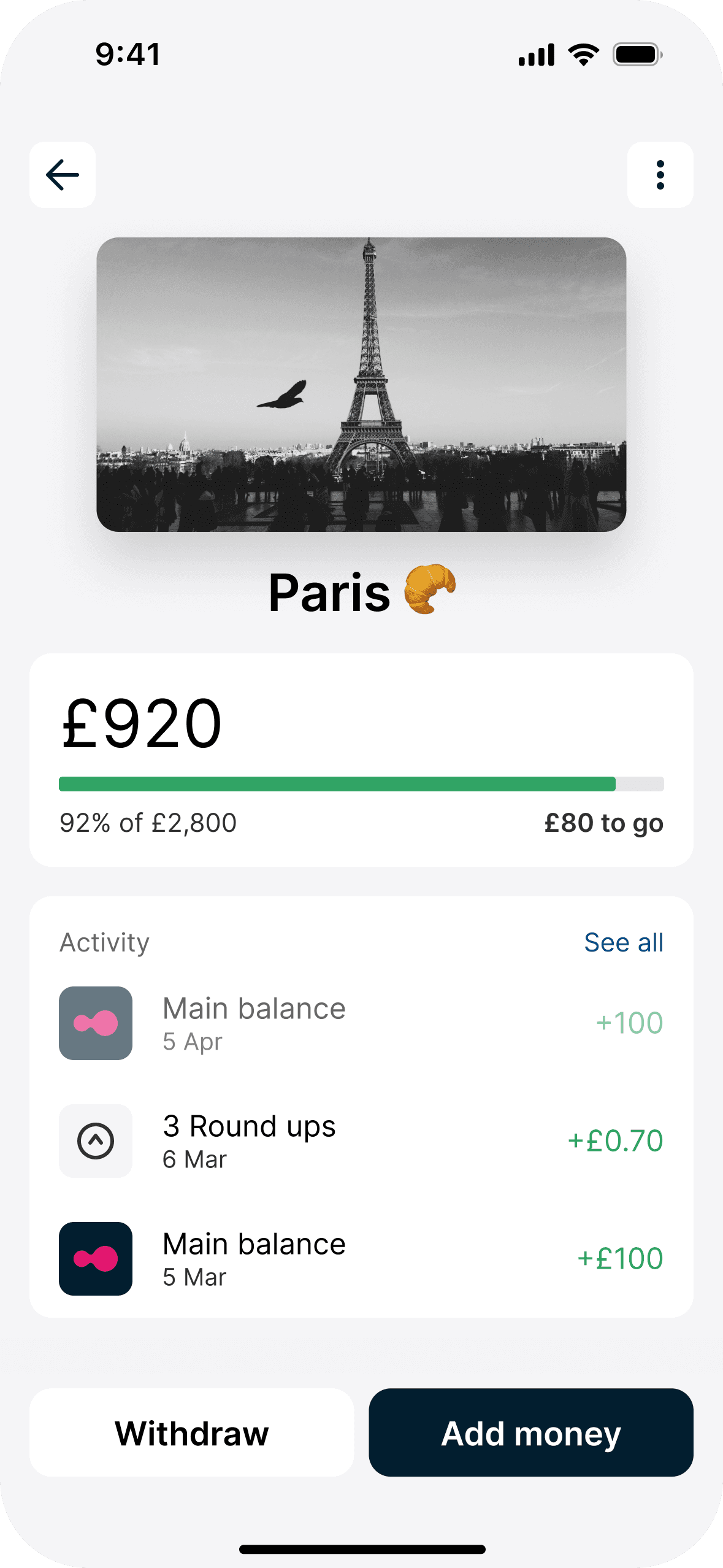

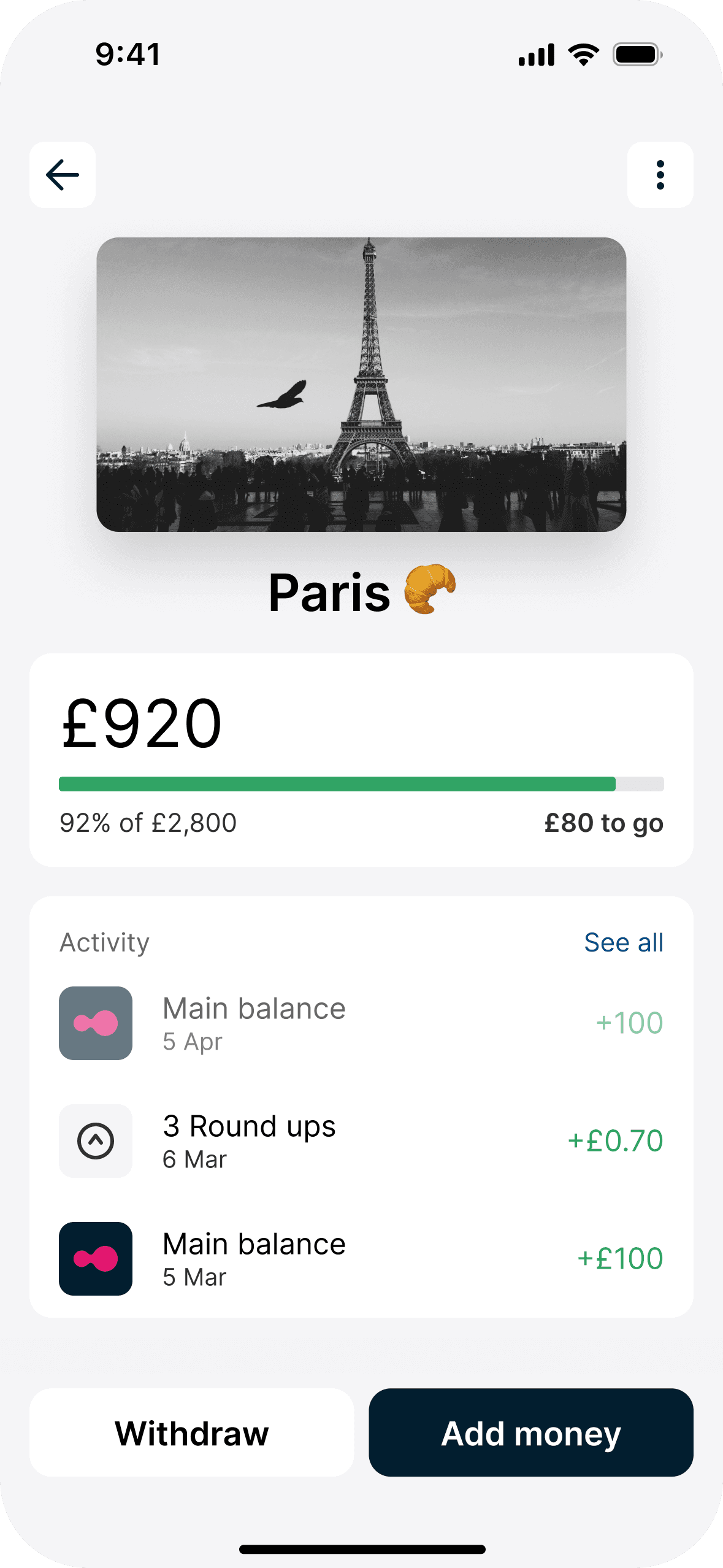

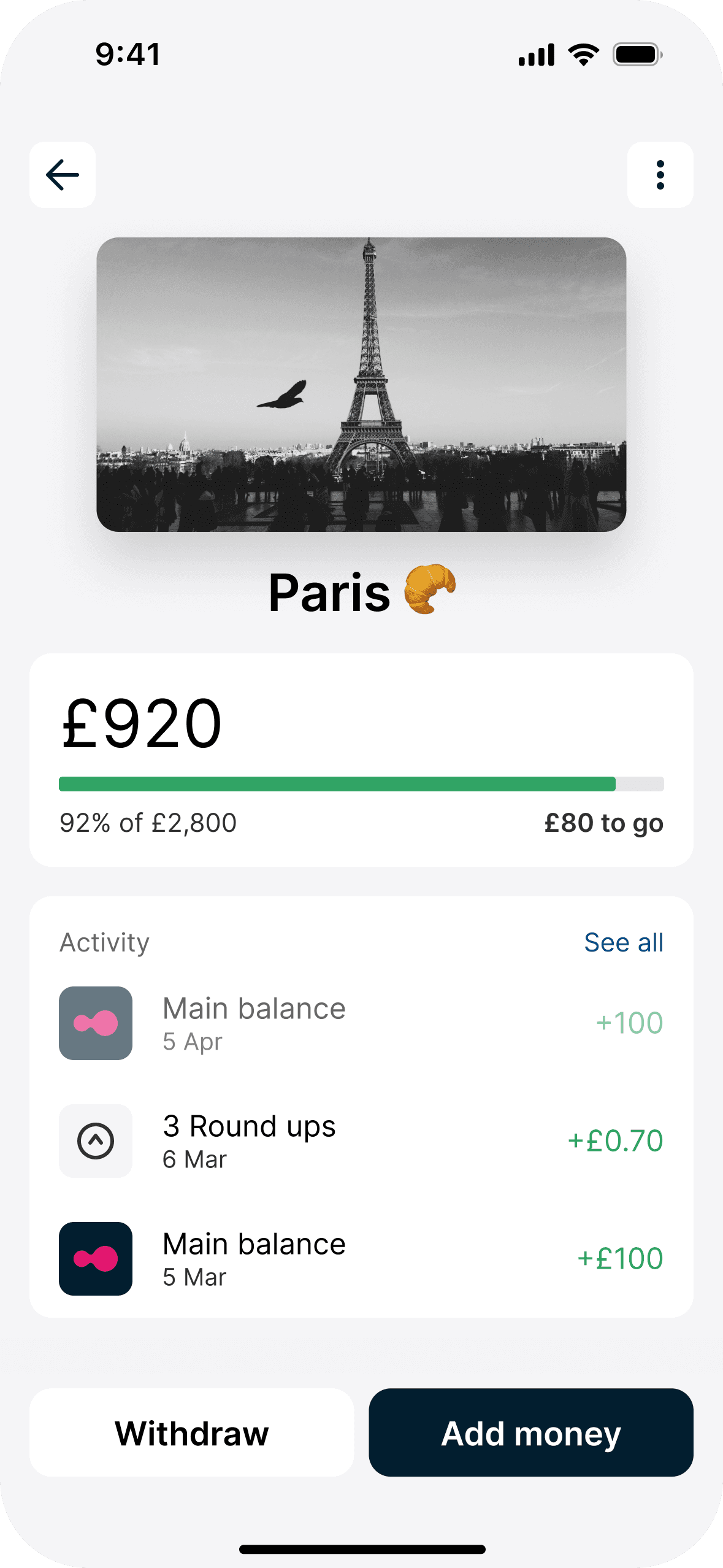

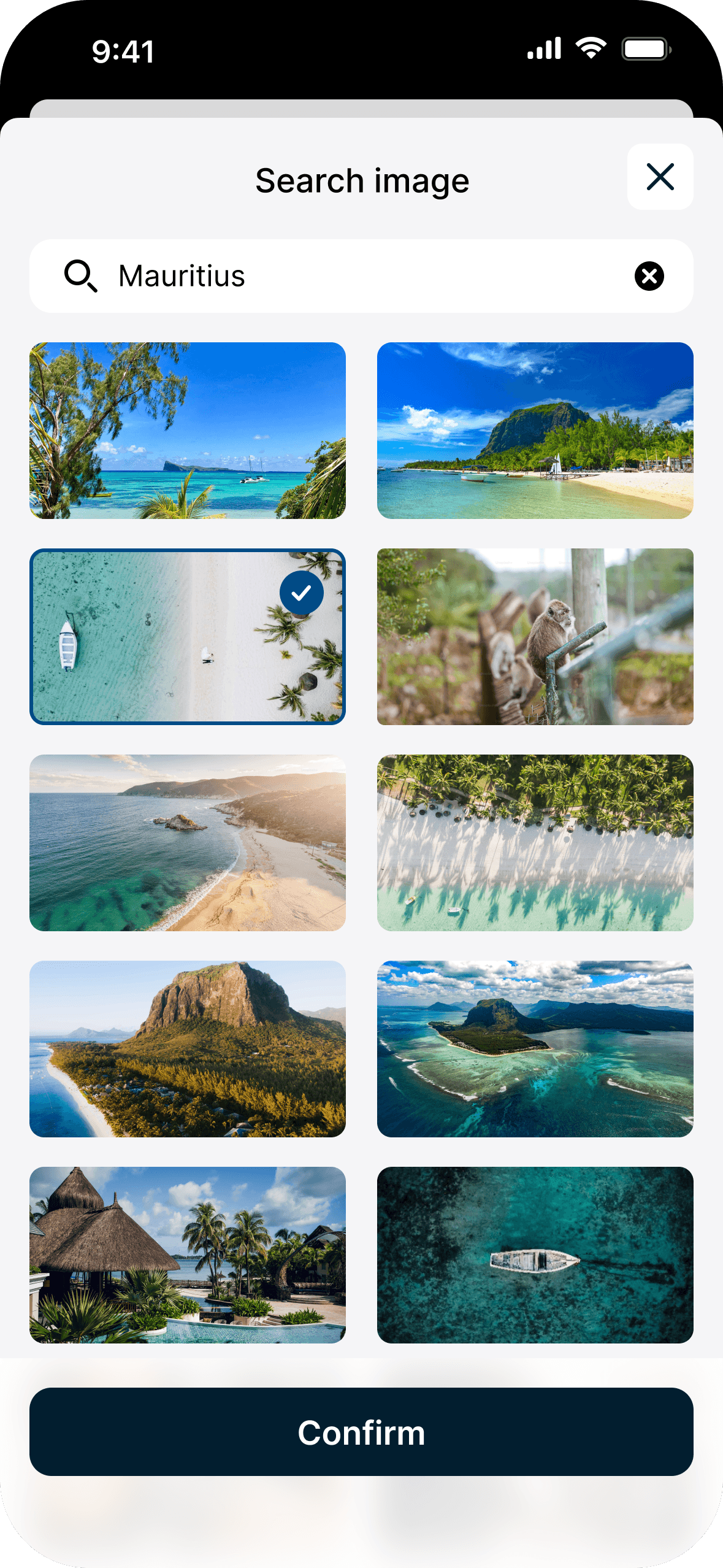

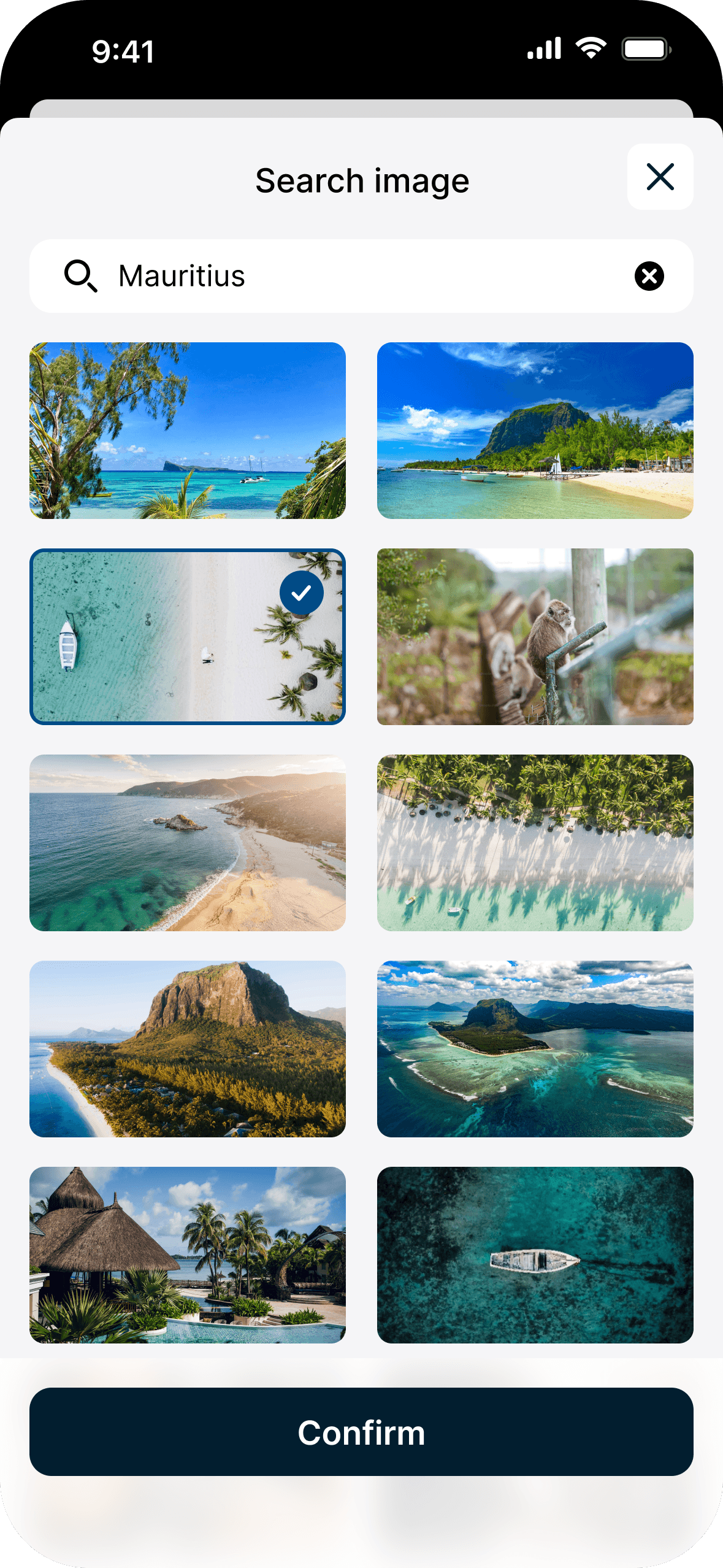

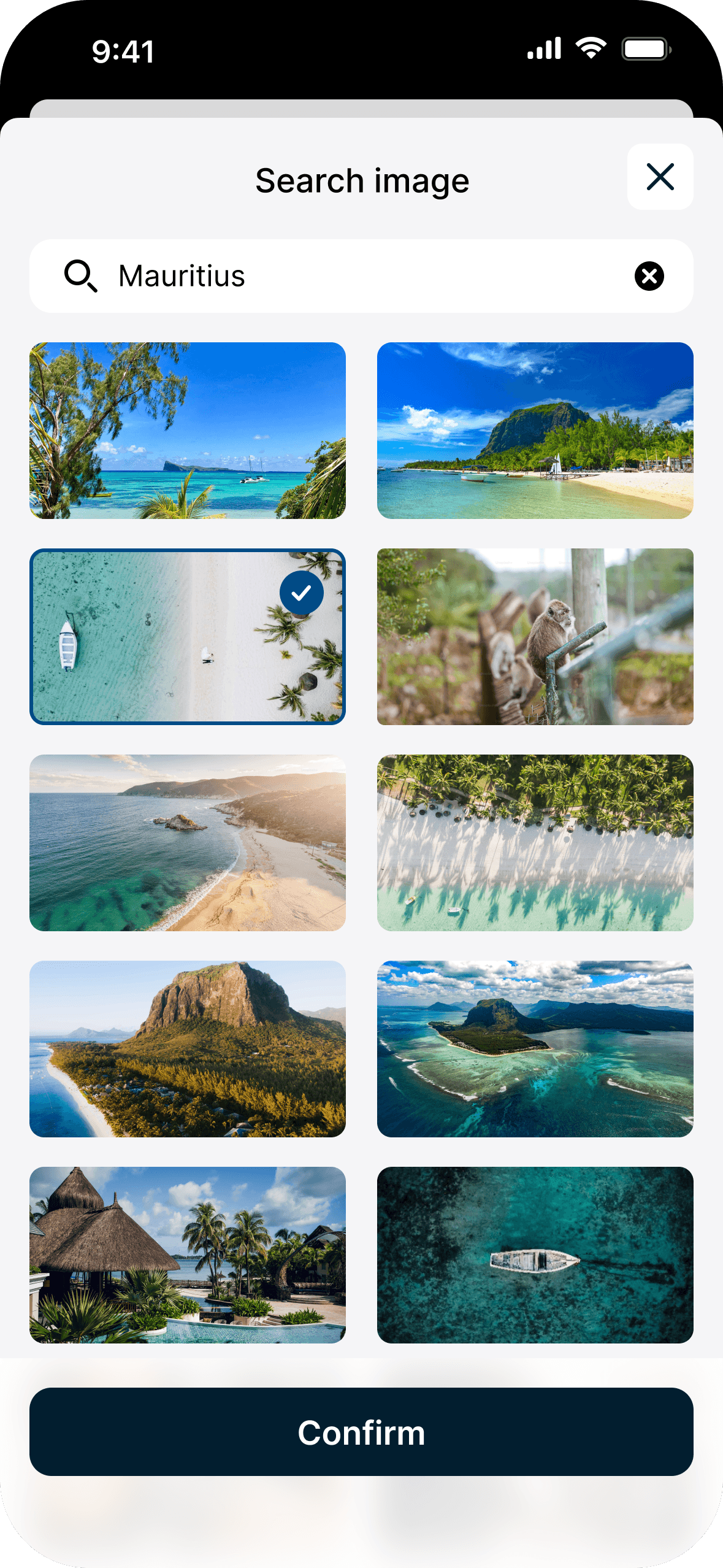

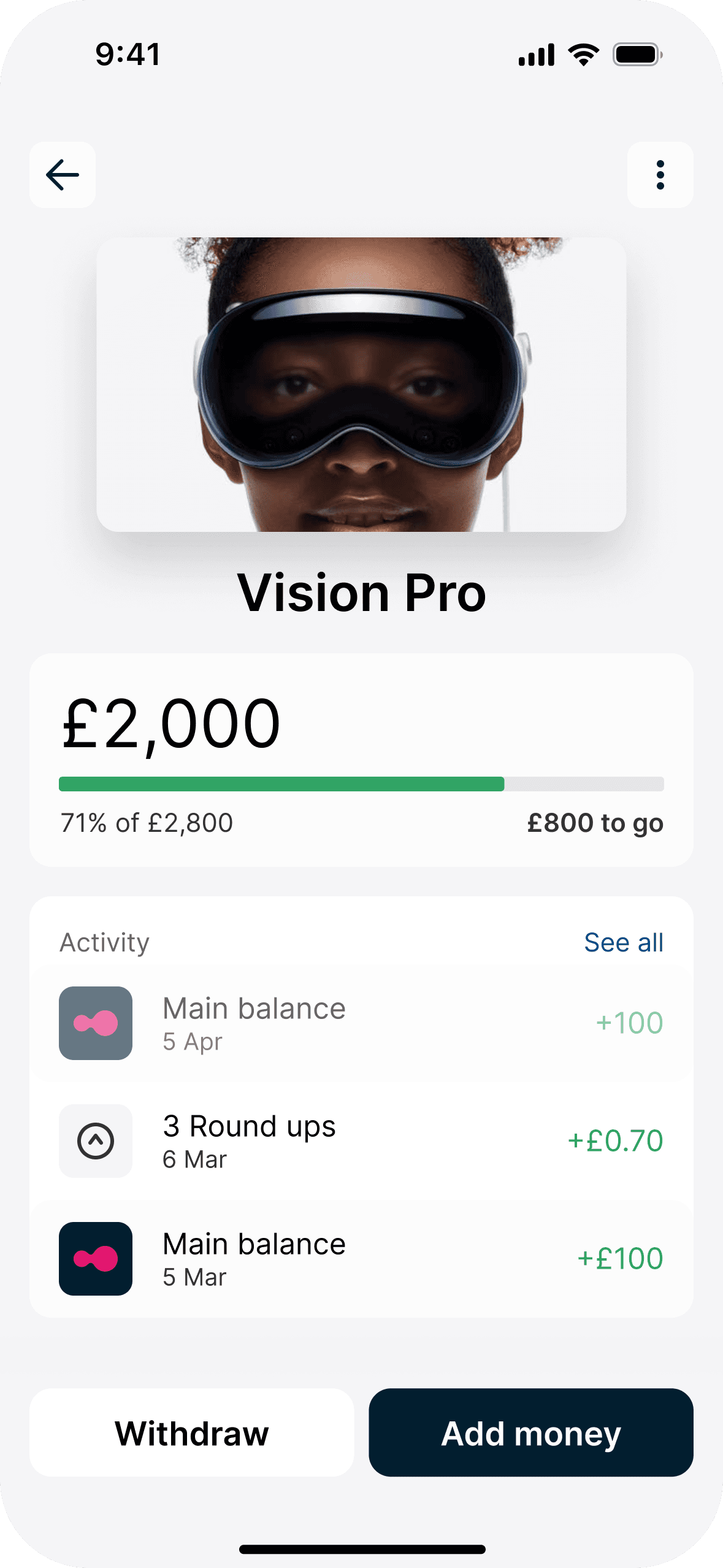

Add image

Adding an image makes your personally connected to your goals, increasing likelihood of saving success.

Add image

Adding an image makes your personally connected to your goals, increasing likelihood of saving success.

Add image

Adding an image makes your personally connected to your goals, increasing likelihood of saving success.

Upload any image

If you have something specific in mind, upload the perfect image.

Upload any image

If you have something specific in mind, upload the perfect image.

Upload any image

If you have something specific in mind, upload the perfect image.

Search in-app

With the Unsplash API, you have access to 6 million+ high quality photos. Find an image in-app that aligns with your goal.

Search in-app

With the Unsplash API, you have access to 6 million+ high quality photos. Find an image in-app that aligns with your goal.

Search in-app

With the Unsplash API, you have access to 6 million+ high quality photos. Find an image in-app that aligns with your goal.

Cohesively styled

Uploaded content maintains visual and brand consistency with Kroo’s blue and text styles overlayed.

Cohesively styled

Uploaded content maintains visual and brand consistency with Kroo’s blue and text styles overlayed.

Cohesively styled

Uploaded content maintains visual and brand consistency with Kroo’s blue and text styles overlayed.

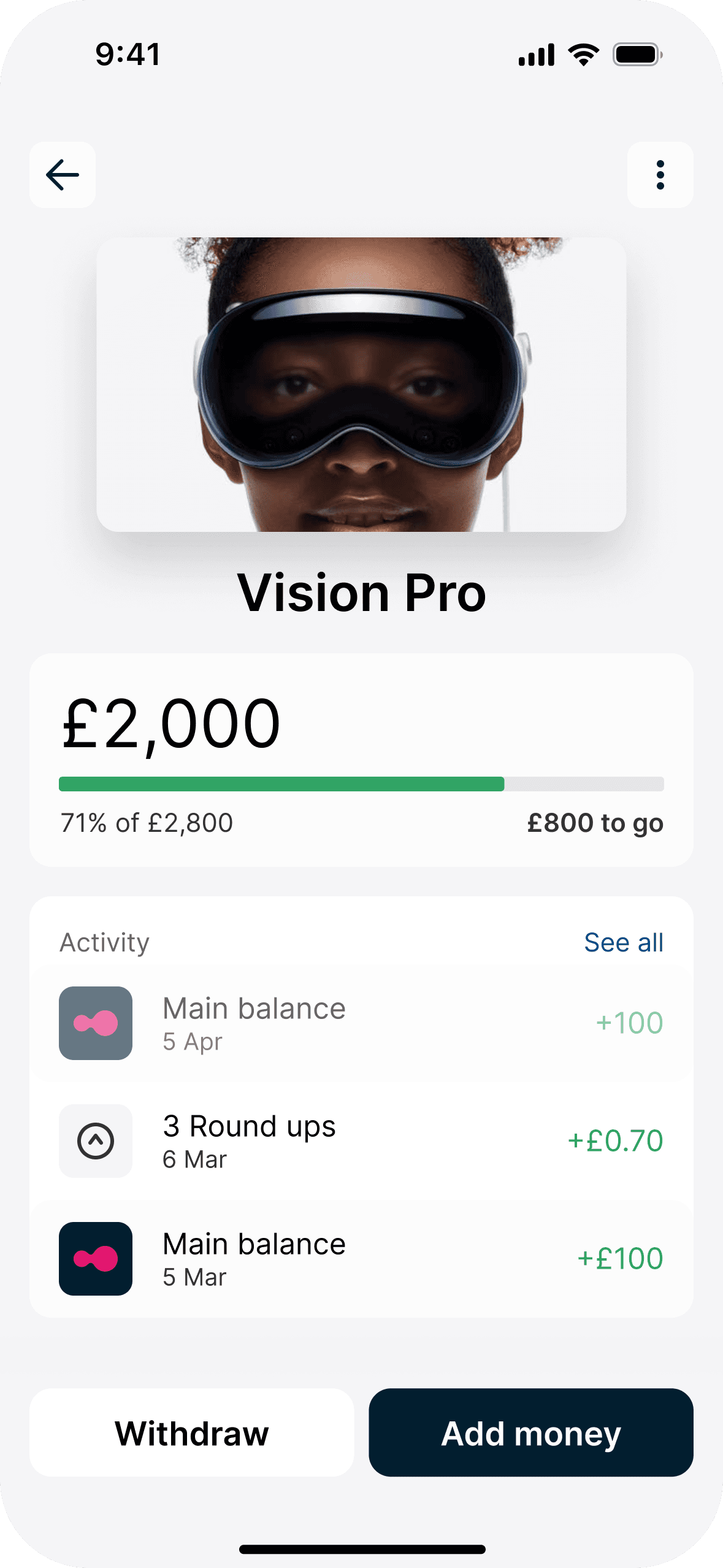

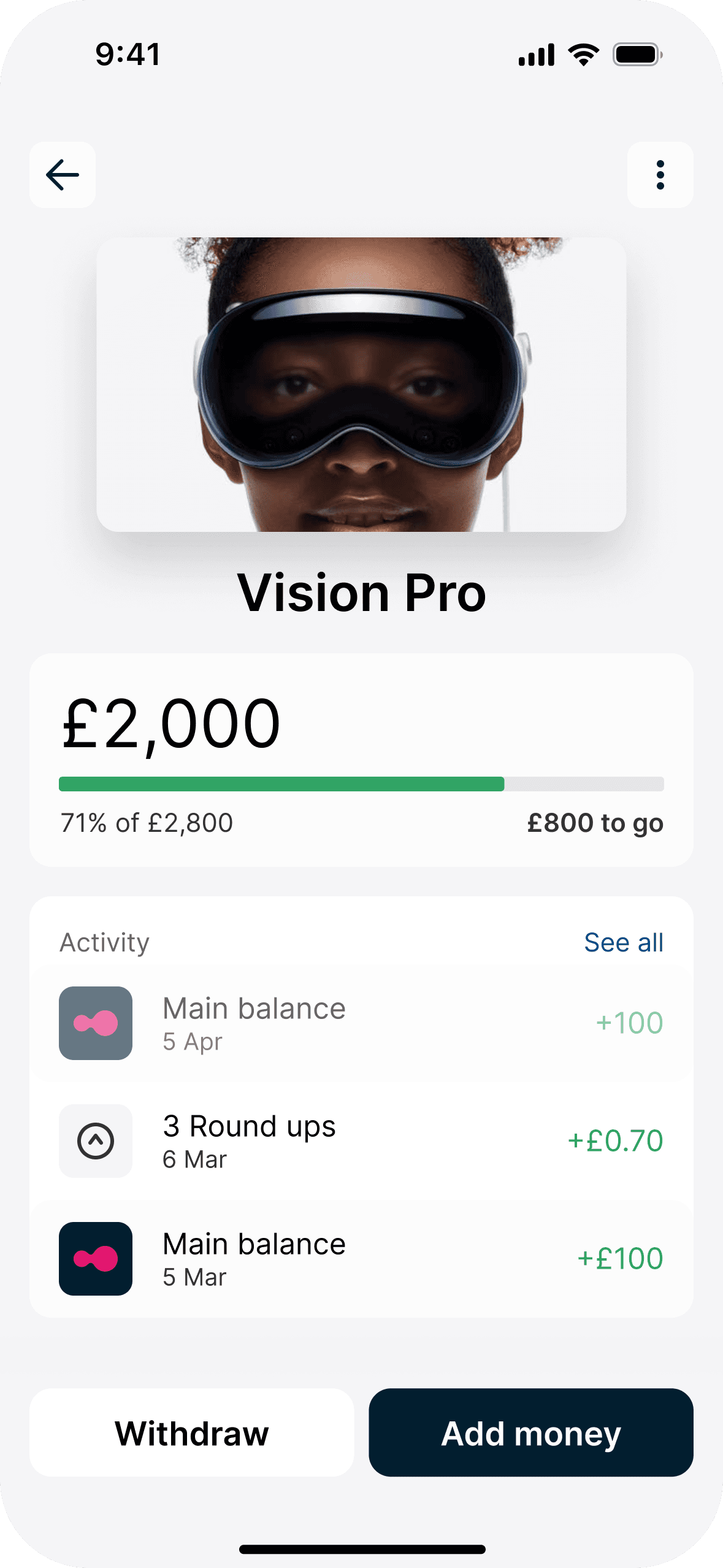

Goals

Ultimately, you save to hit goals, whether it's for a holiday or a down payment on a house. So, it’s important to track progress to stay motivated. When you see how much is left to go, you'll work faster to reach it.

Goals

Ultimately, you save to hit goals, whether it's for a holiday or a down payment on a house. So, it’s important to track progress to stay motivated. When you see how much is left to go, you'll work faster to reach it.

Goals

Ultimately, you save to hit goals, whether it's for a holiday or a down payment on a house. So, it’s important to track progress to stay motivated. When you see how much is left to go, you'll work faster to reach it.

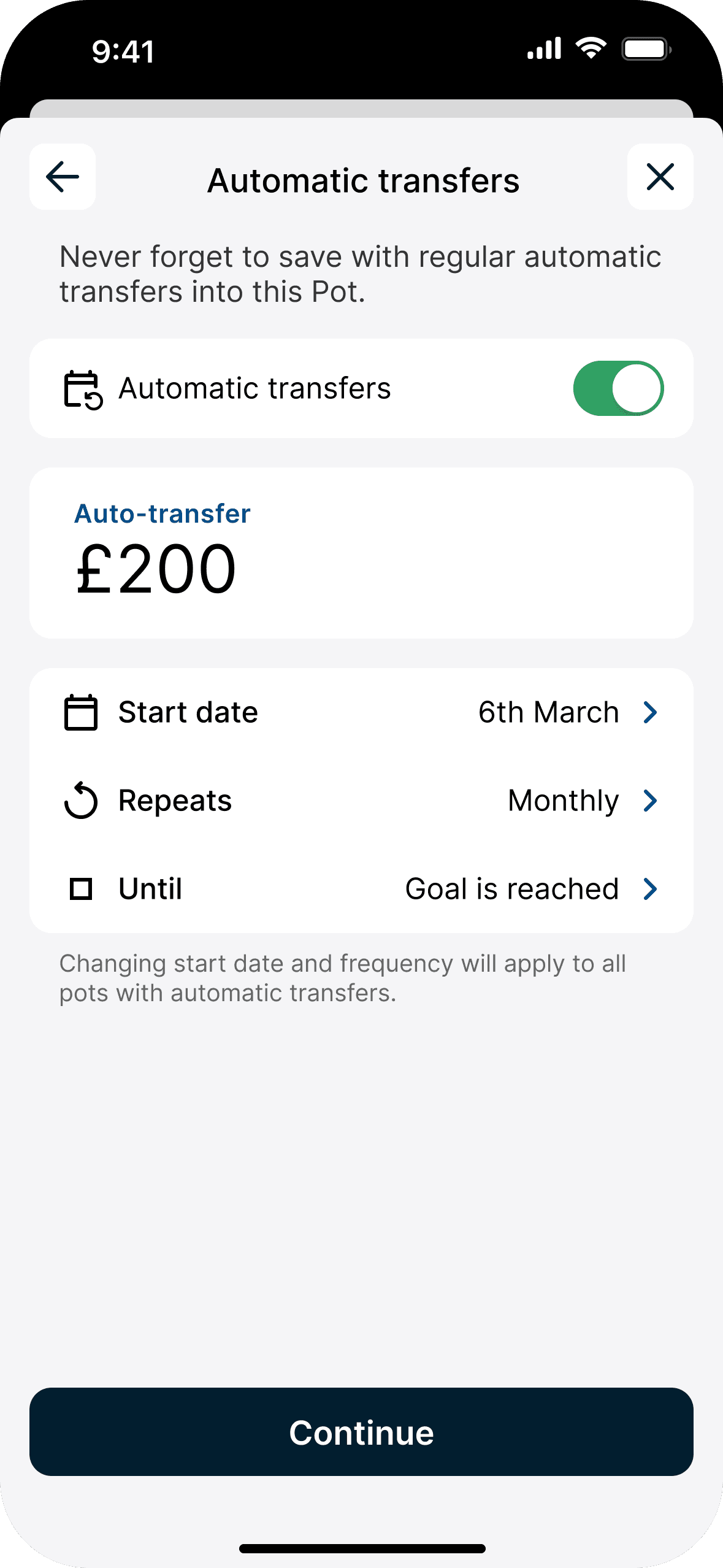

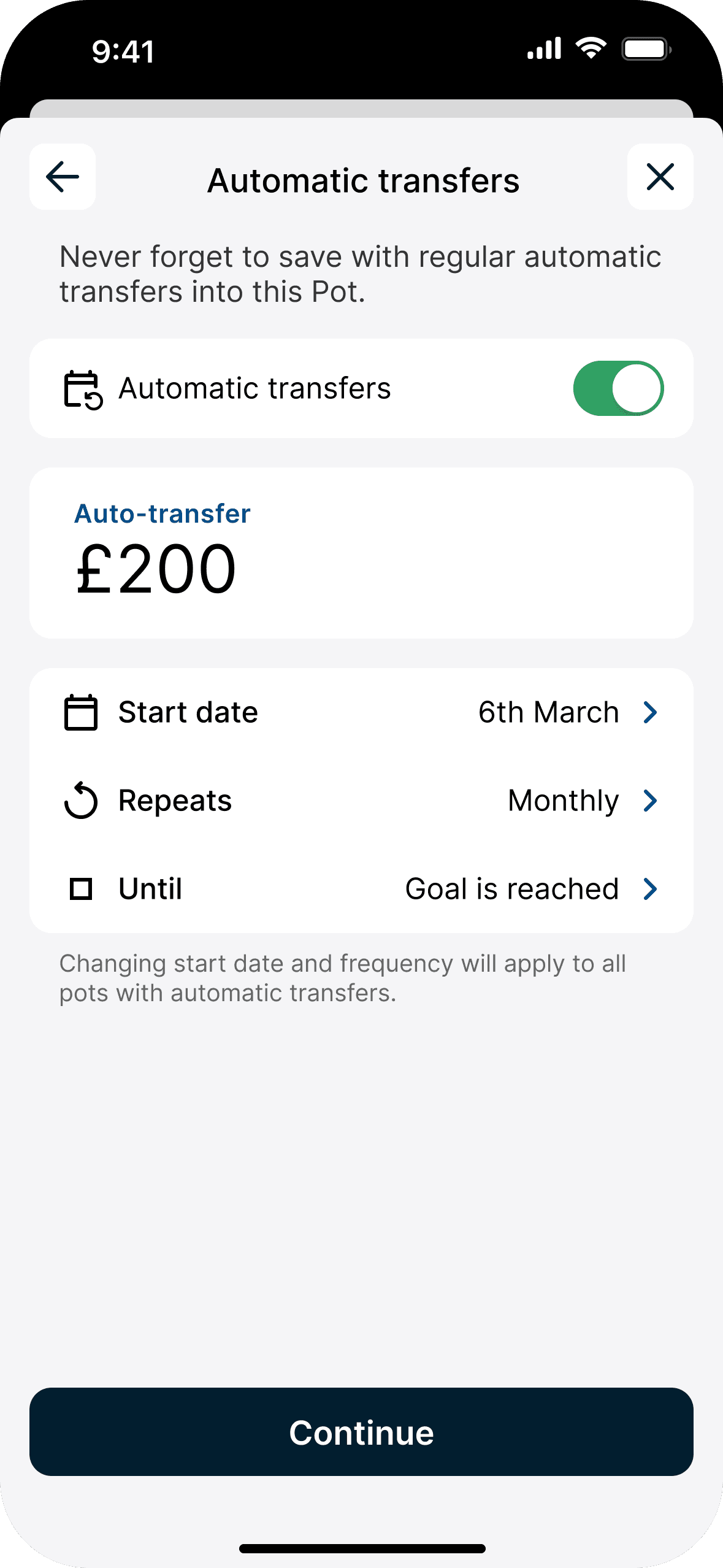

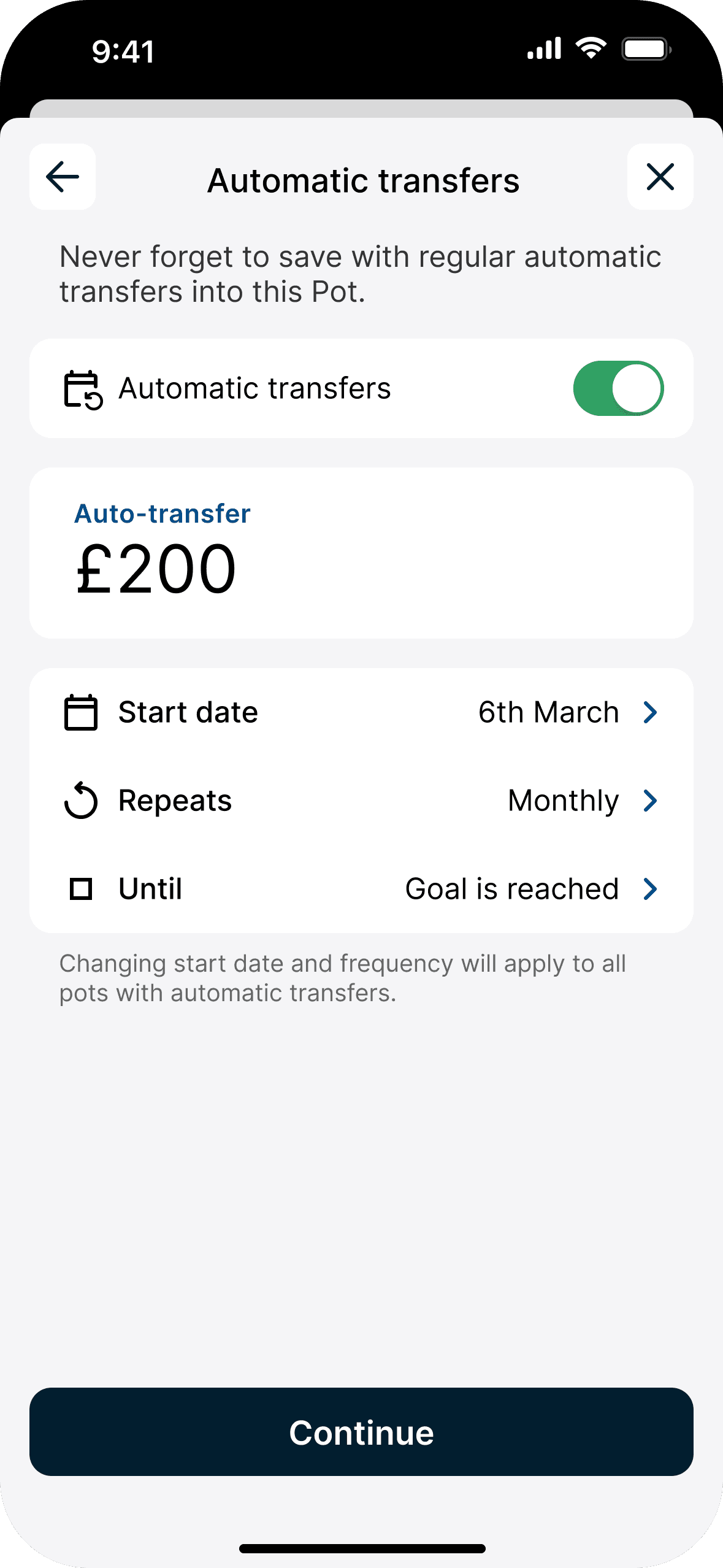

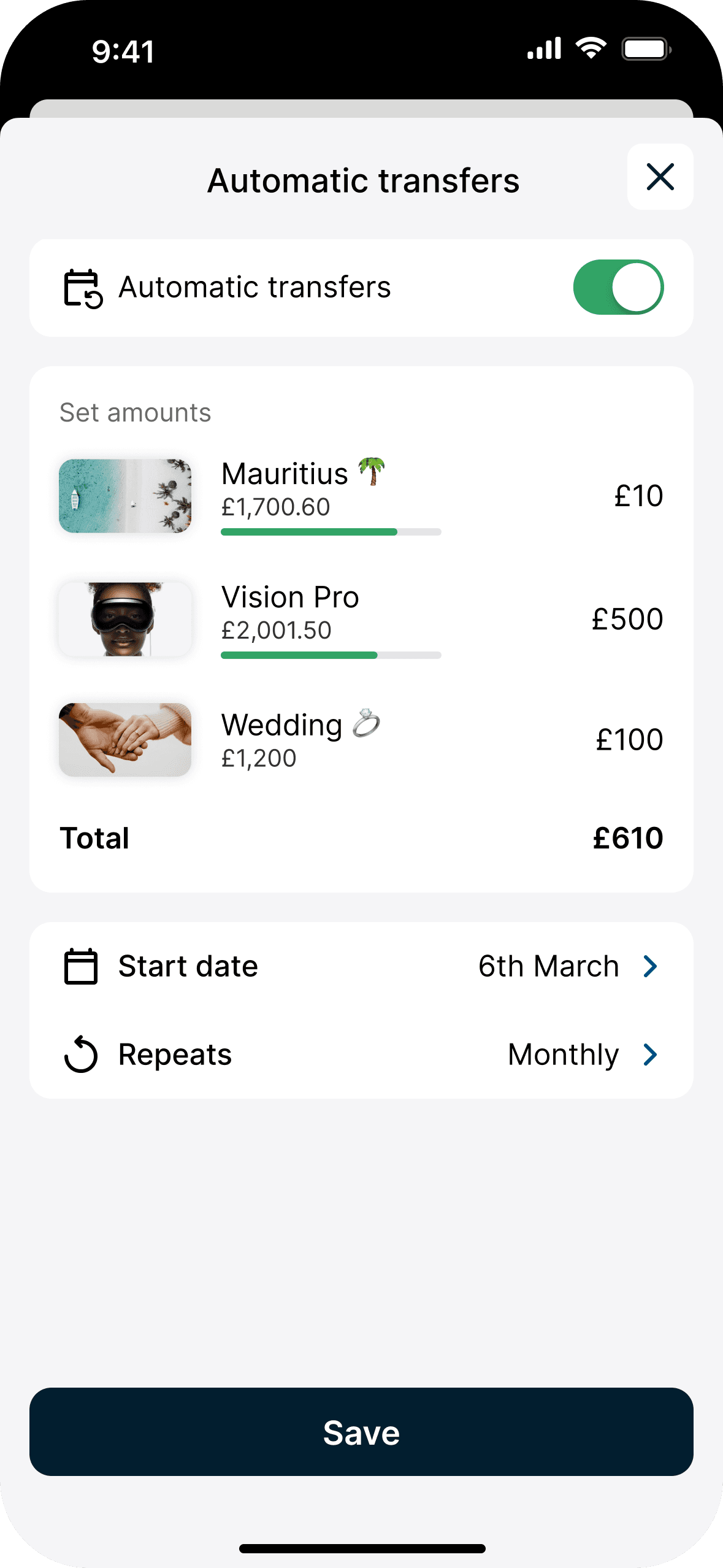

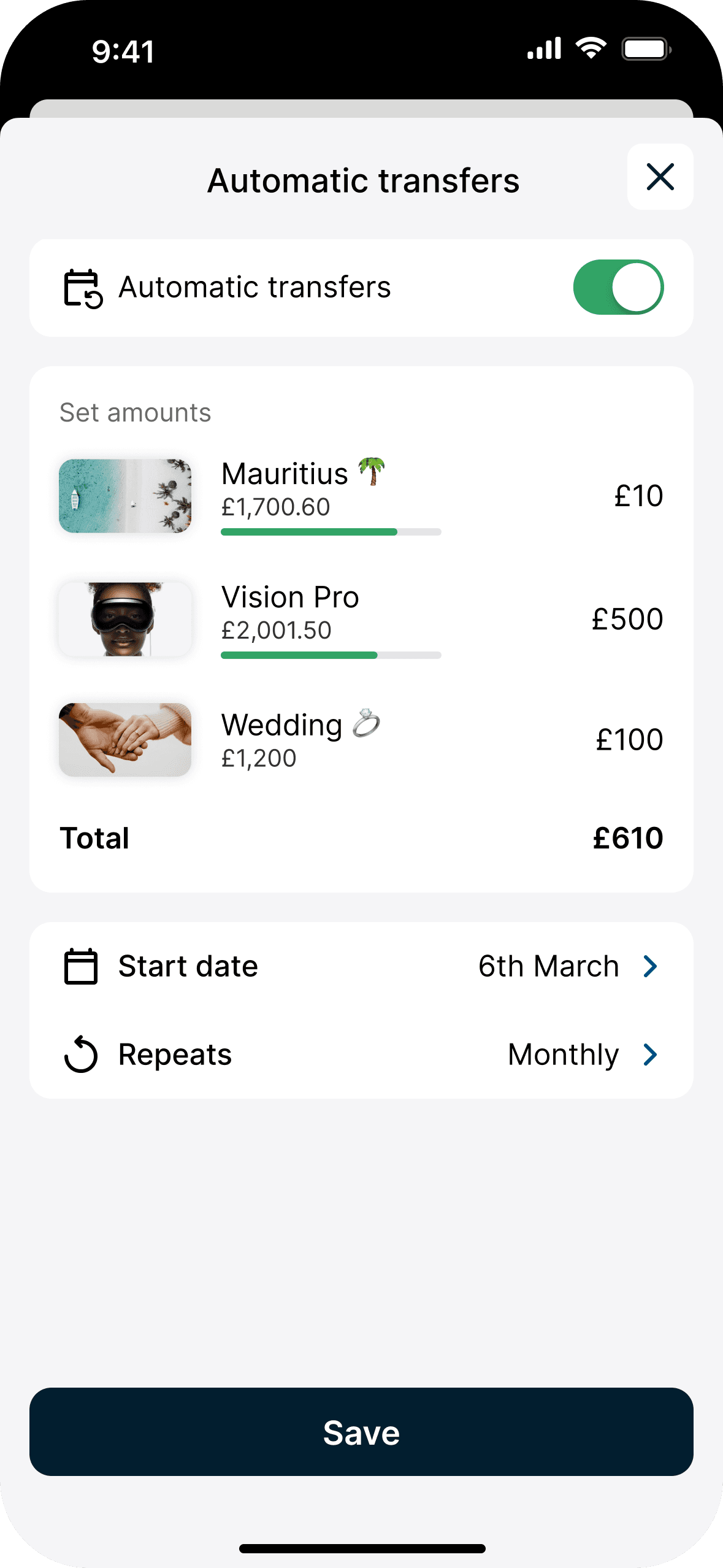

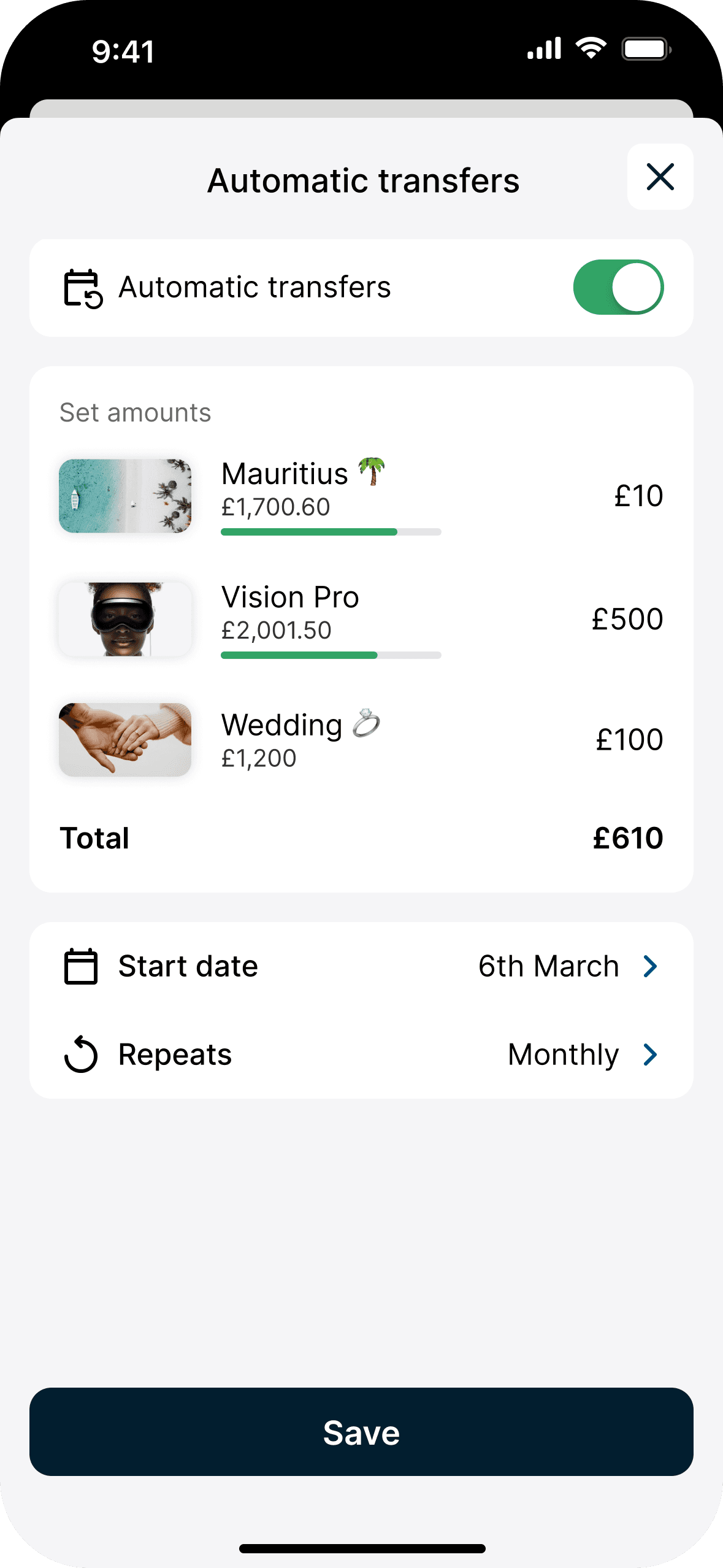

Automatic transfers

Never forget to save, when you move money aside automatically.

Automatic transfers

Never forget to save, when you move money aside automatically.

Automatic transfers

Never forget to save, when you move money aside automatically.

Effortless saving

Treat your savings like a regular utility bill, and become accustomed to a budget that already accounts for saving.

Effortless saving

Treat your savings like a regular utility bill, and become accustomed to a budget that already accounts for saving.

Effortless saving

Treat your savings like a regular utility bill, and become accustomed to a budget that already accounts for saving.

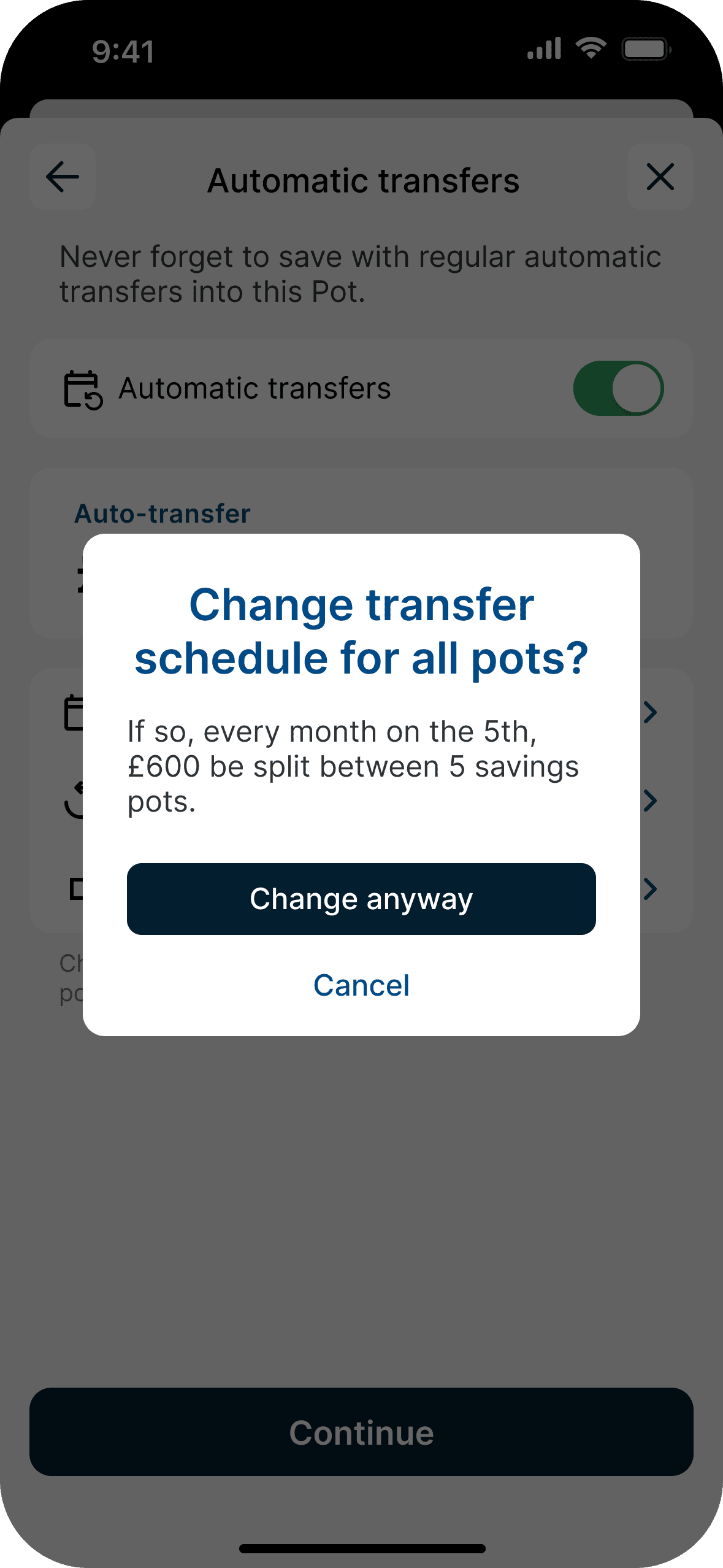

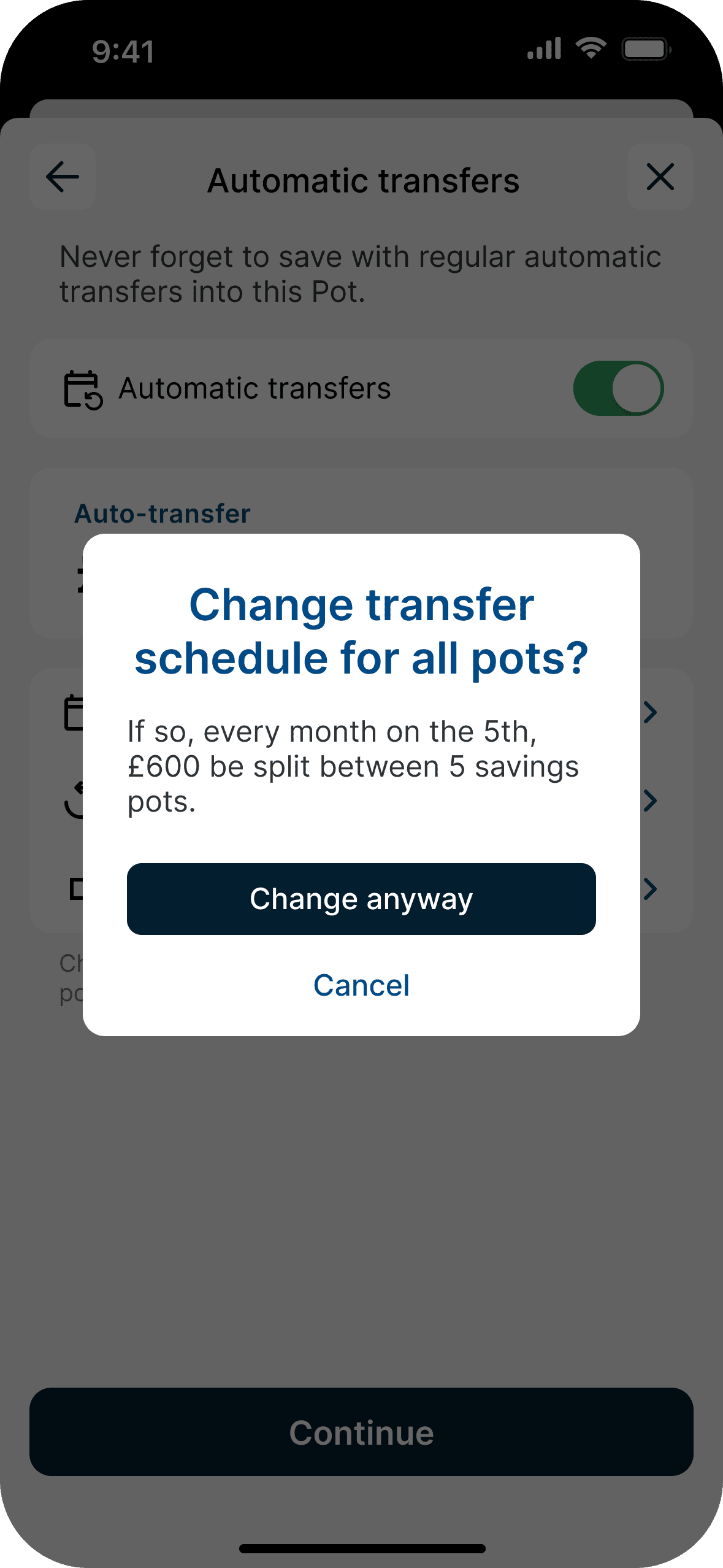

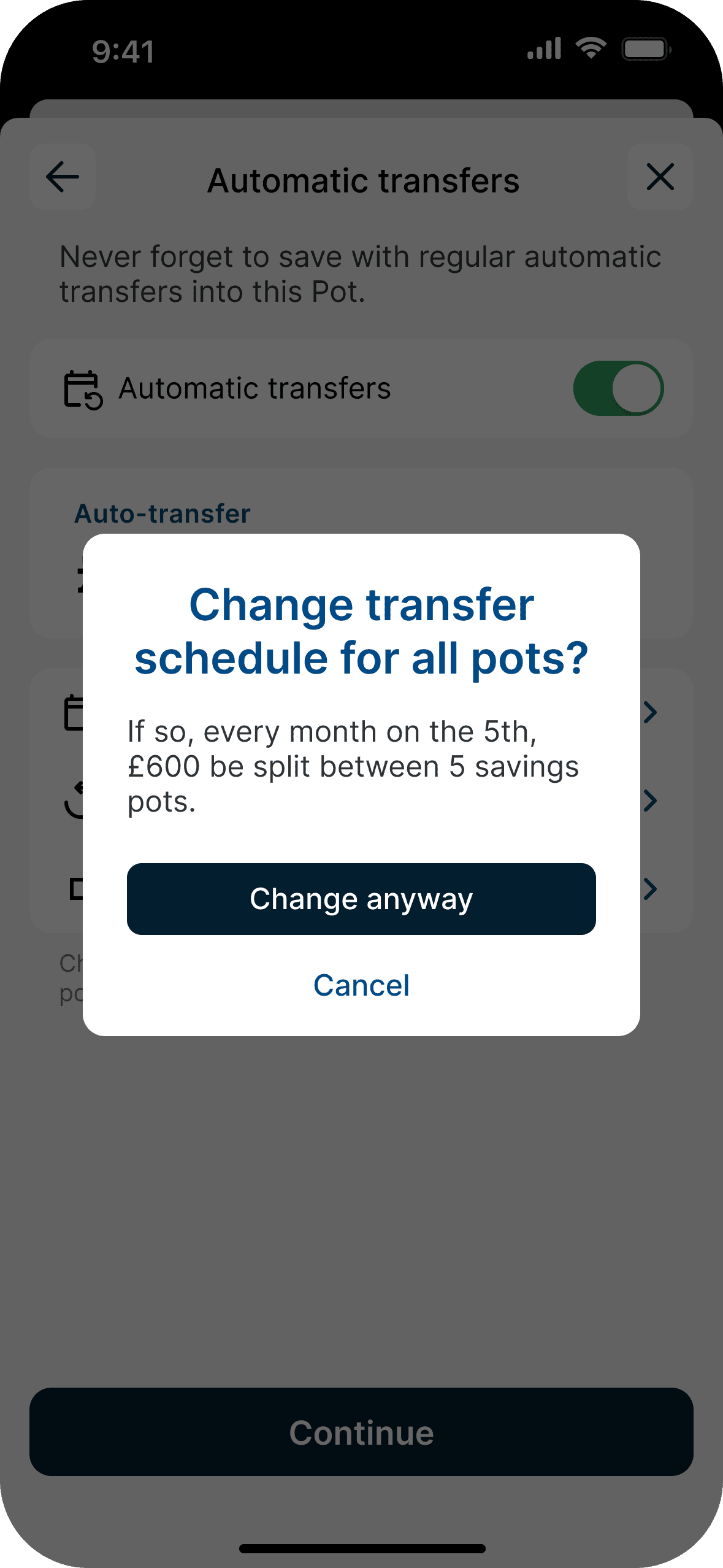

A single schedule

Schedules with varying dates and frequencies complicate tracking and management. Having just one creates a predictable savings routine.

A single schedule

Schedules with varying dates and frequencies complicate tracking and management. Having just one creates a predictable savings routine.

A single schedule

Schedules with varying dates and frequencies complicate tracking and management. Having just one creates a predictable savings routine.

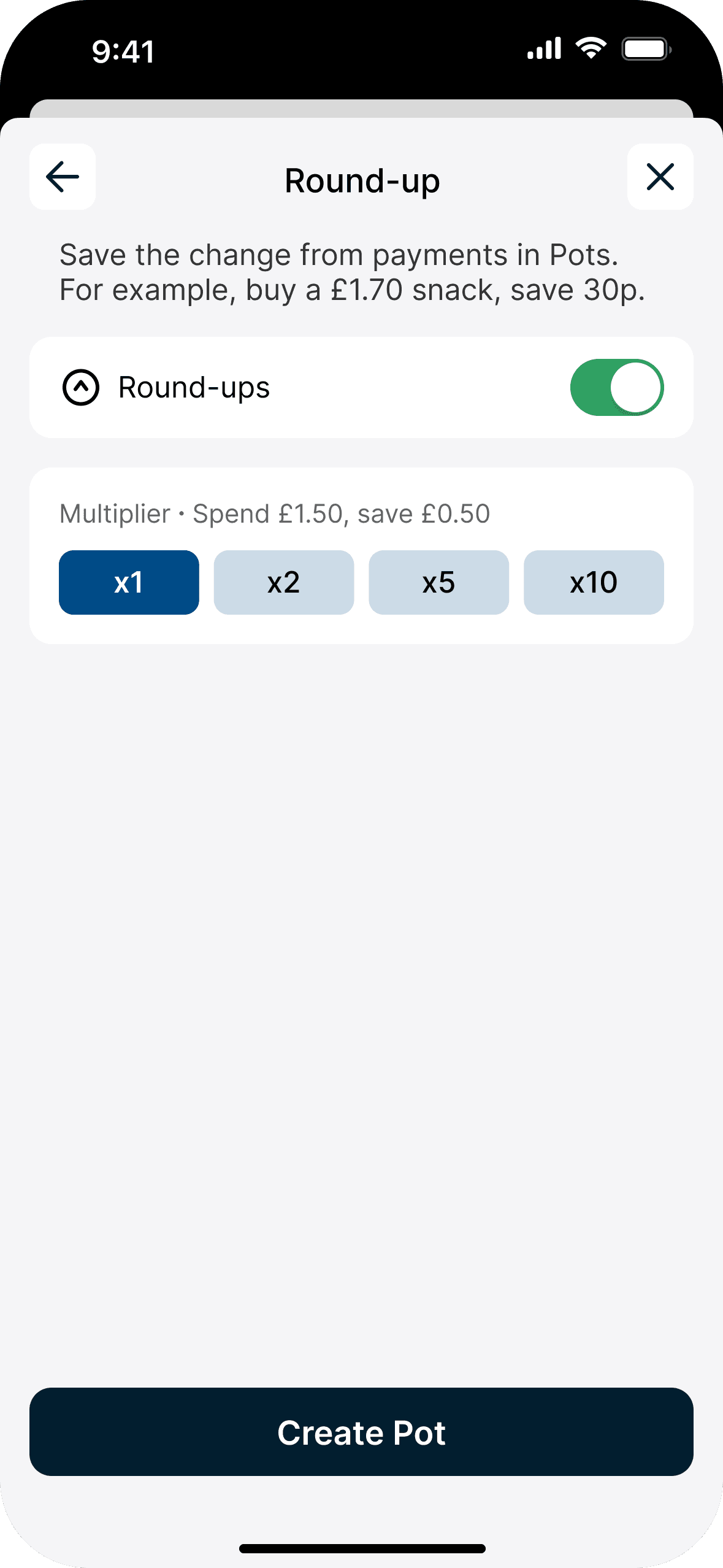

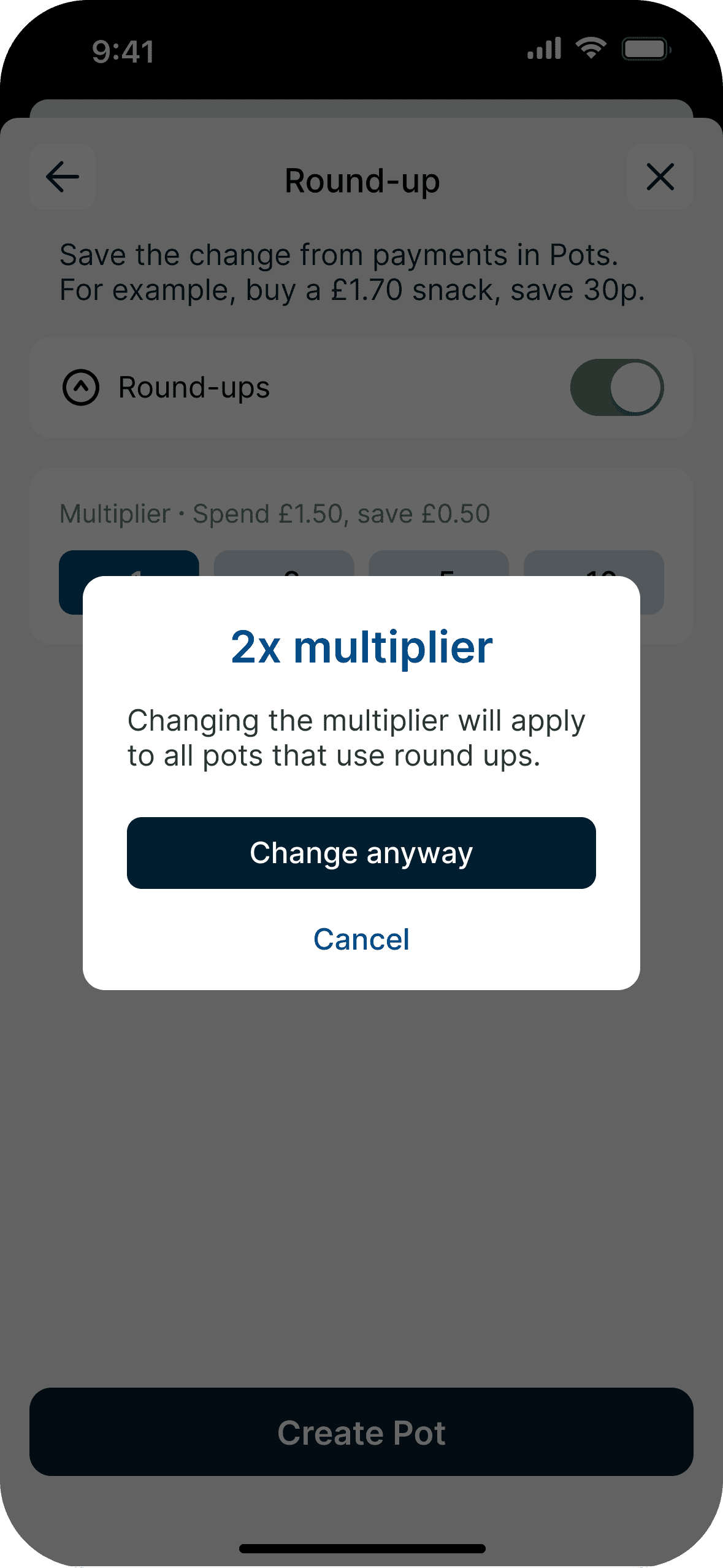

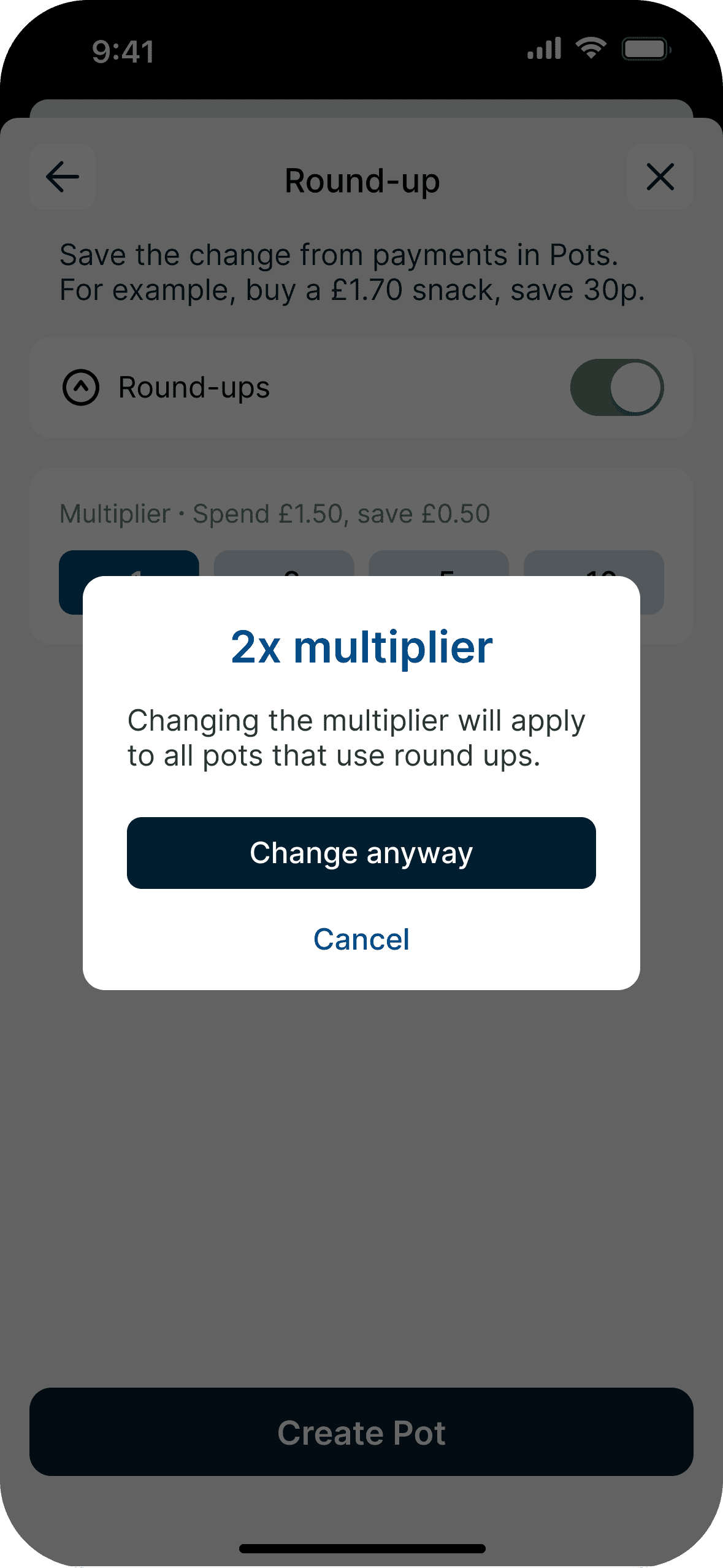

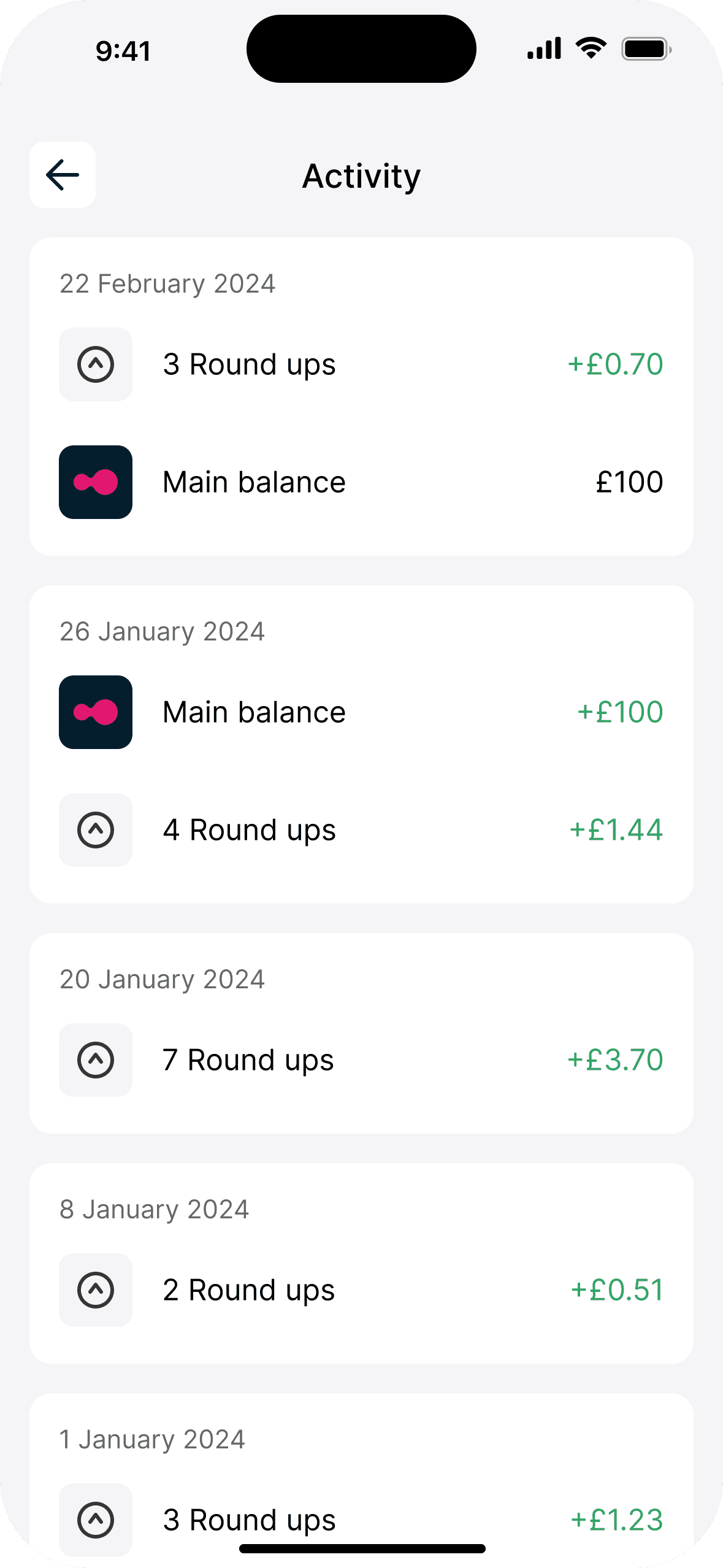

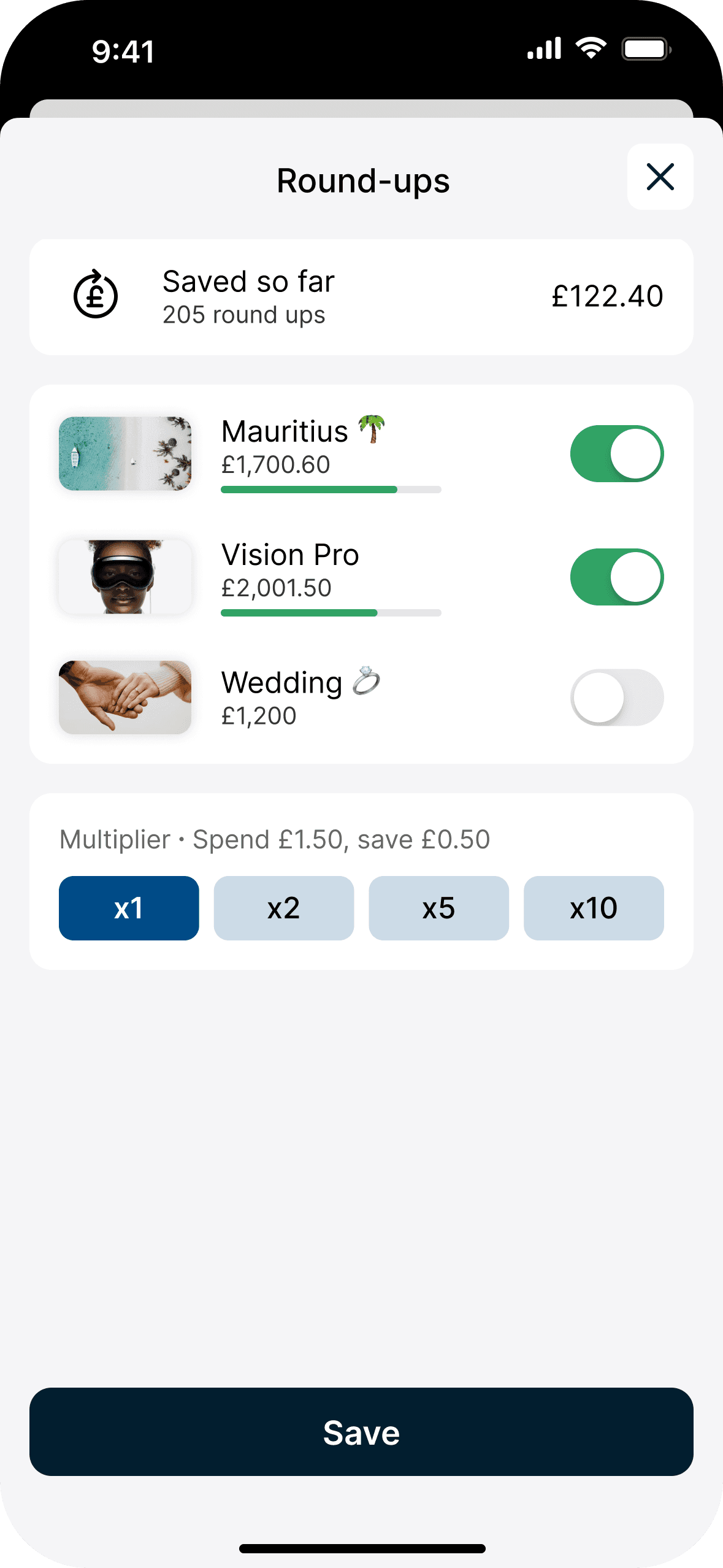

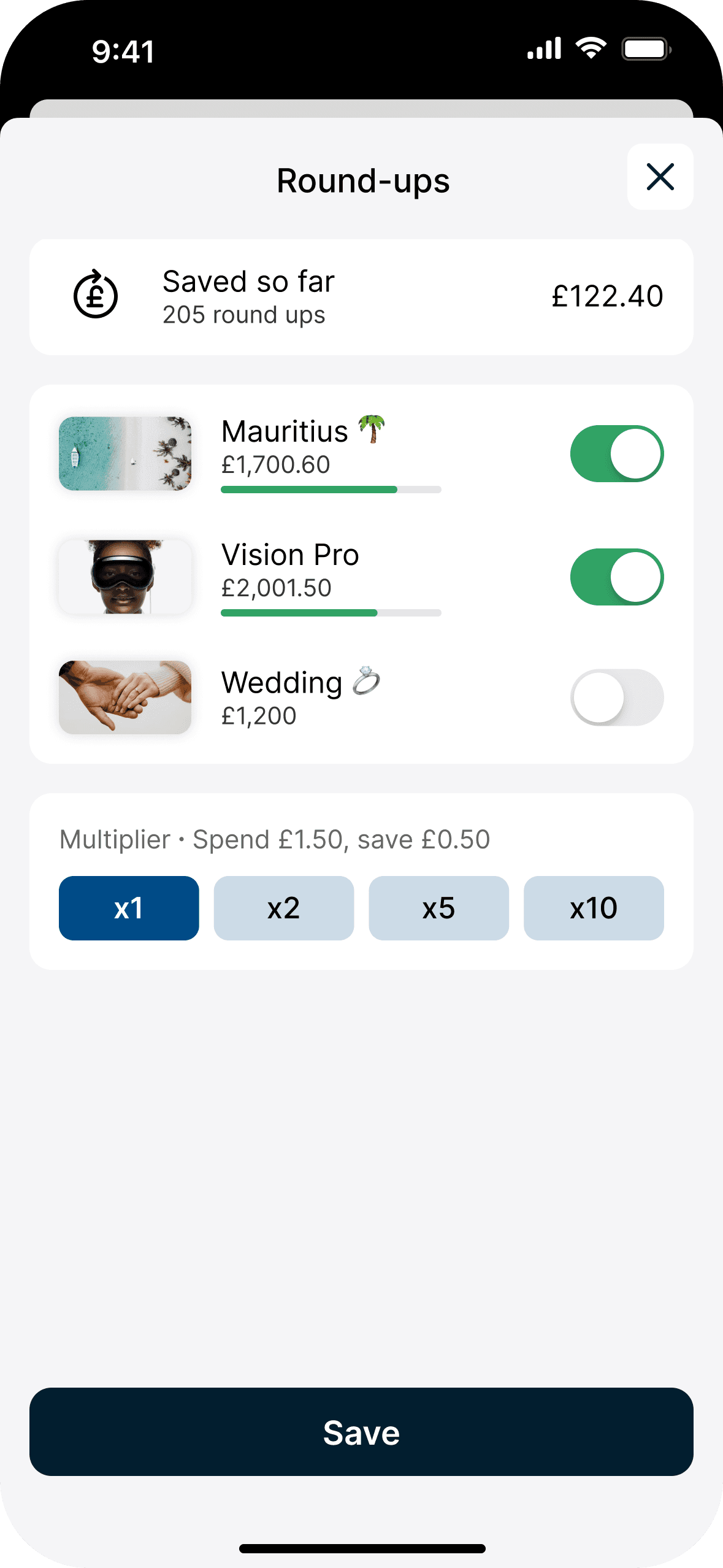

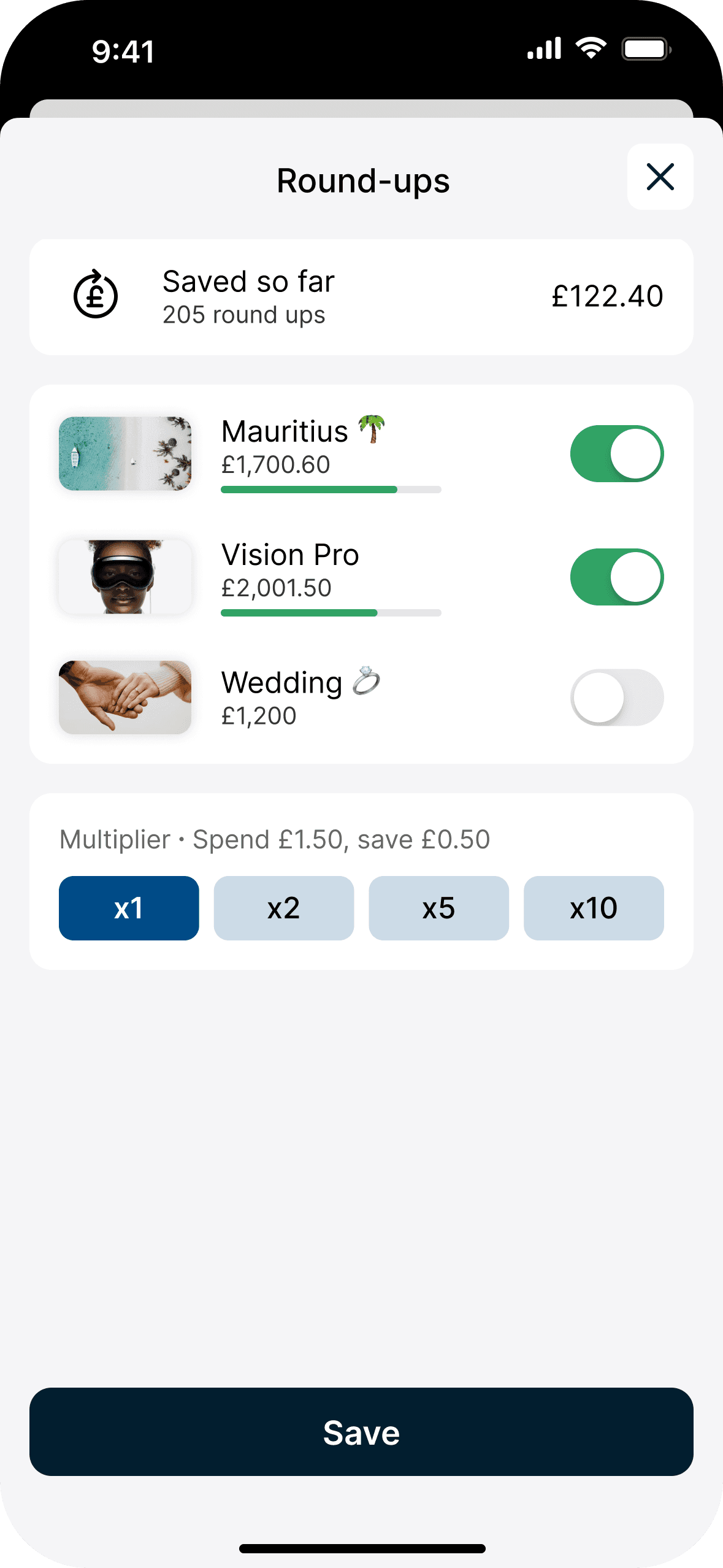

Round ups

Save without changing your spending habits by rounding-up payments to the nearest pound, and transfer the spare change into your chosen Pots.

Round ups

Save without changing your spending habits by rounding-up payments to the nearest pound, and transfer the spare change into your chosen Pots.

Round ups

Save without changing your spending habits by rounding-up payments to the nearest pound, and transfer the spare change into your chosen Pots.

Joe & The Juice

£5.20

£0.80

Joe & The Juice

£5.20

£0.80

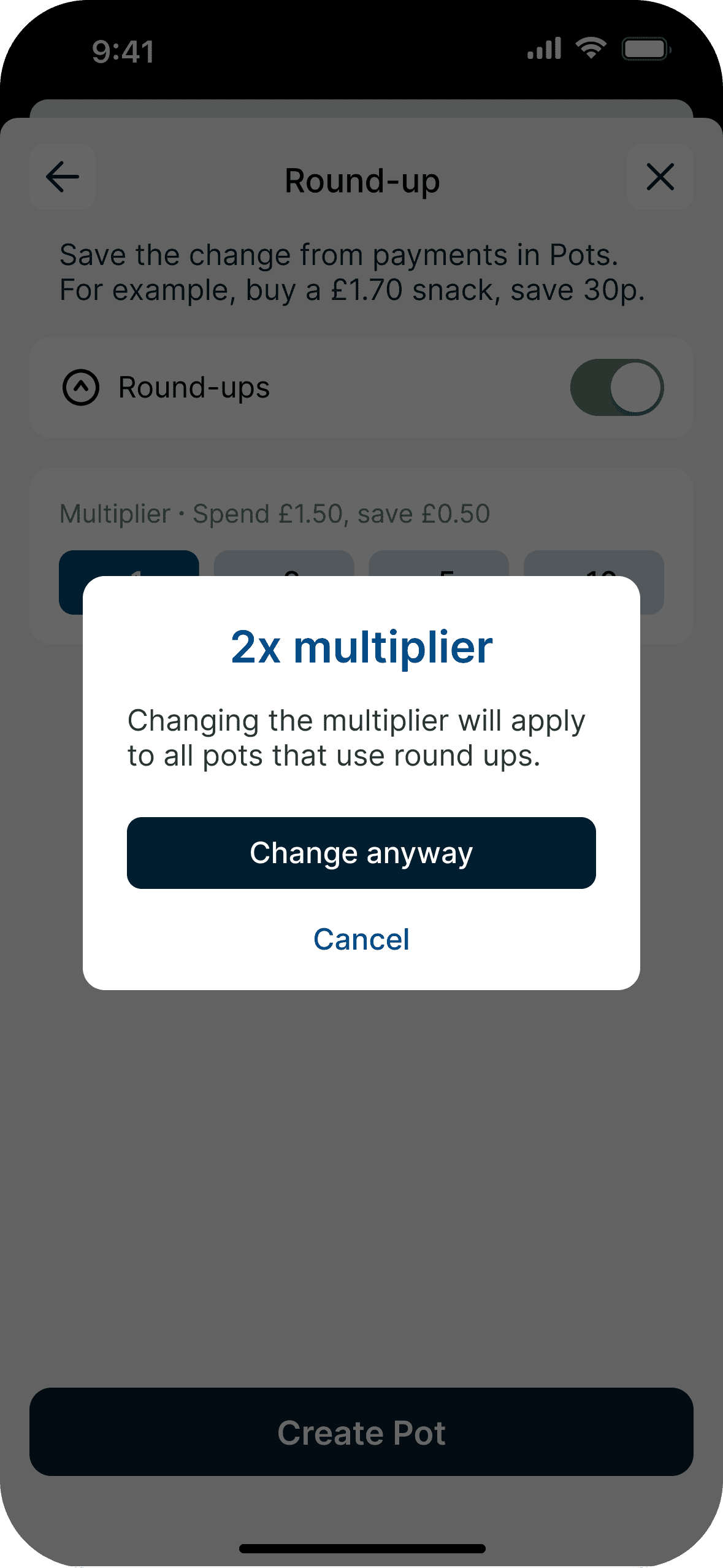

Multiply the change

If saving from round ups feels too slow, choose a higher multiplier to reach your goals faster.

Multiply the change

If saving from round ups feels too slow, choose a higher multiplier to reach your goals faster.

Multiply the change

If saving from round ups feels too slow, choose a higher multiplier to reach your goals faster.

Enable on all pots

Round-ups aren’t limited to one pot at a time, so you can prioritise different goals equally.

Enable on all pots

Round-ups aren’t limited to one pot at a time, so you can prioritise different goals equally.

Enable on all pots

Round-ups aren’t limited to one pot at a time, so you can prioritise different goals equally.

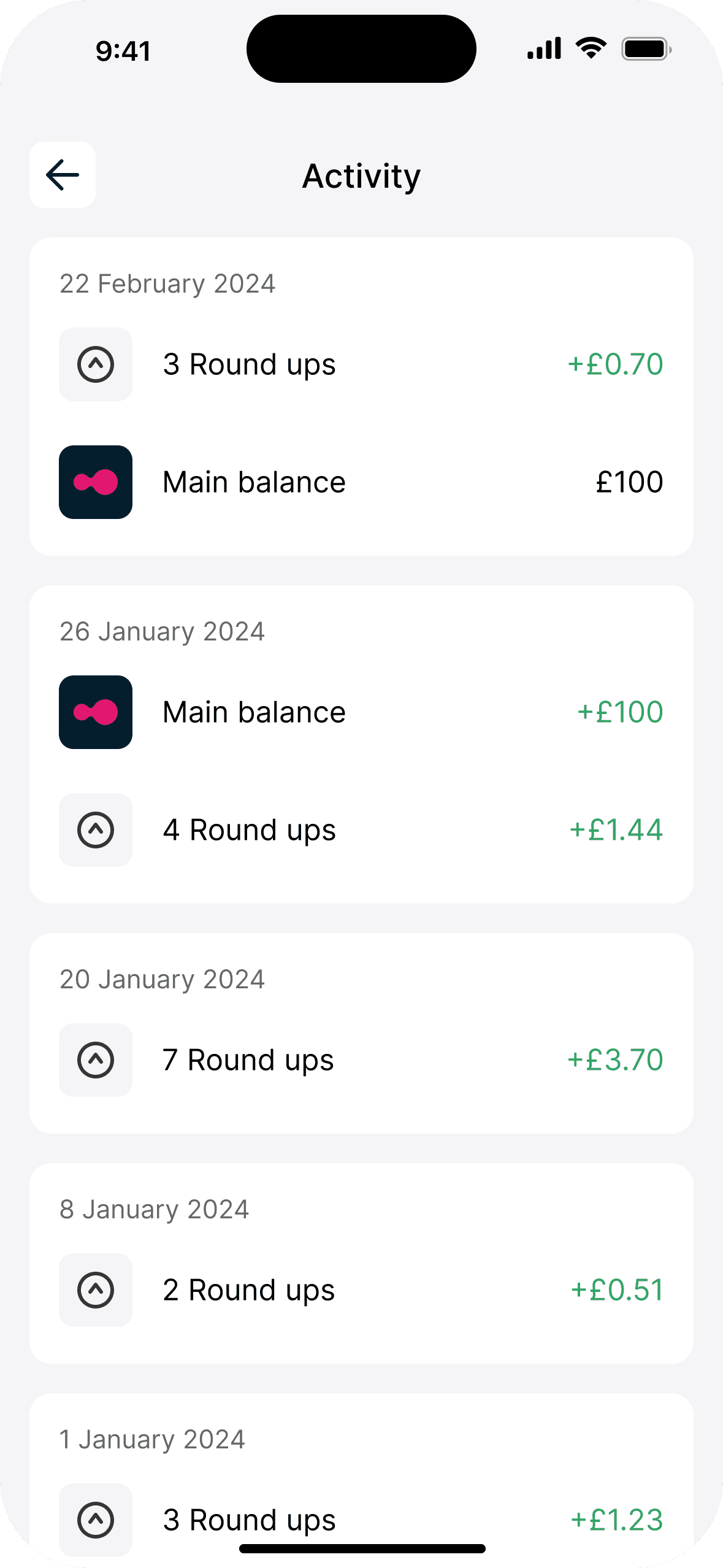

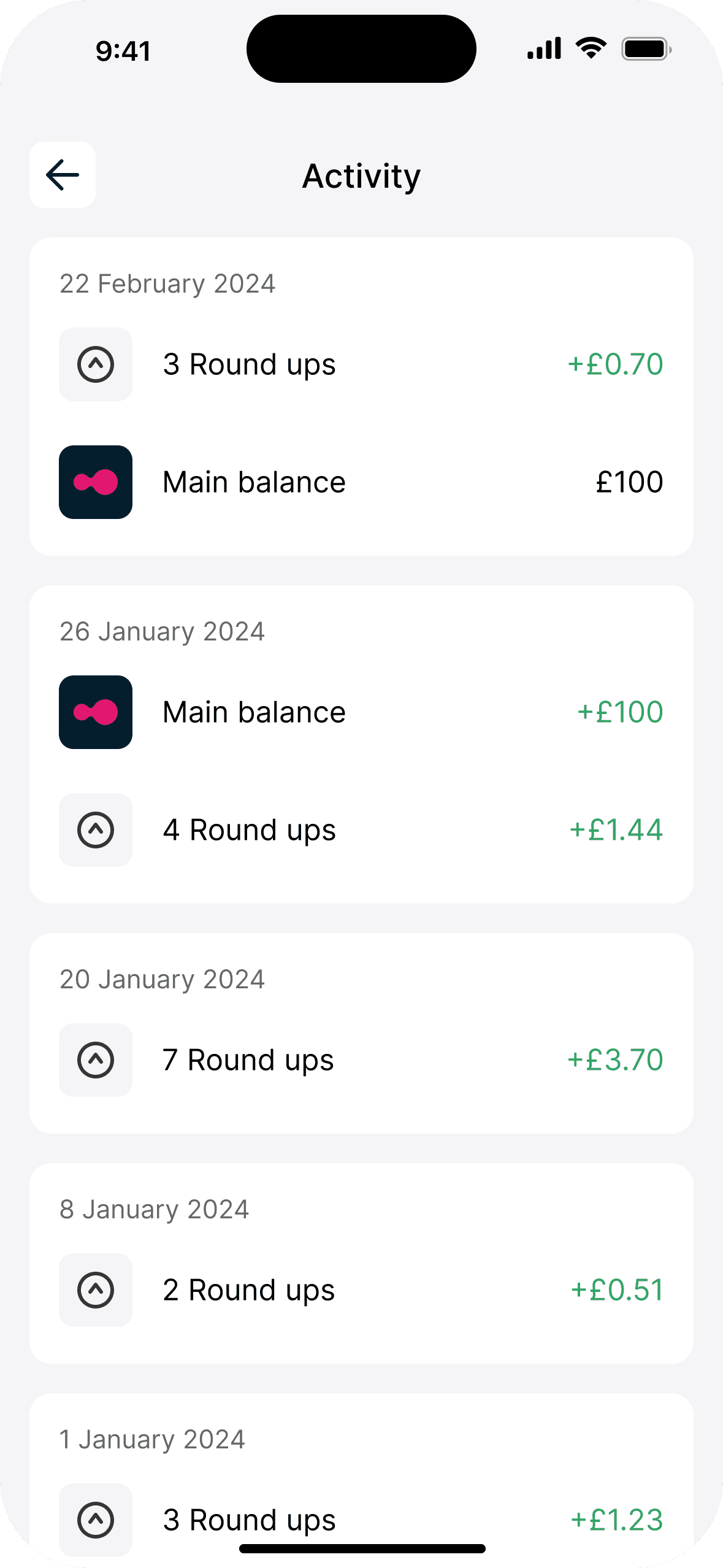

Aggregated activity

Transactions are combined to declutter your activity feed.

Aggregated activity

Transactions are combined to declutter your activity feed.

Aggregated activity

Transactions are combined to declutter your activity feed.

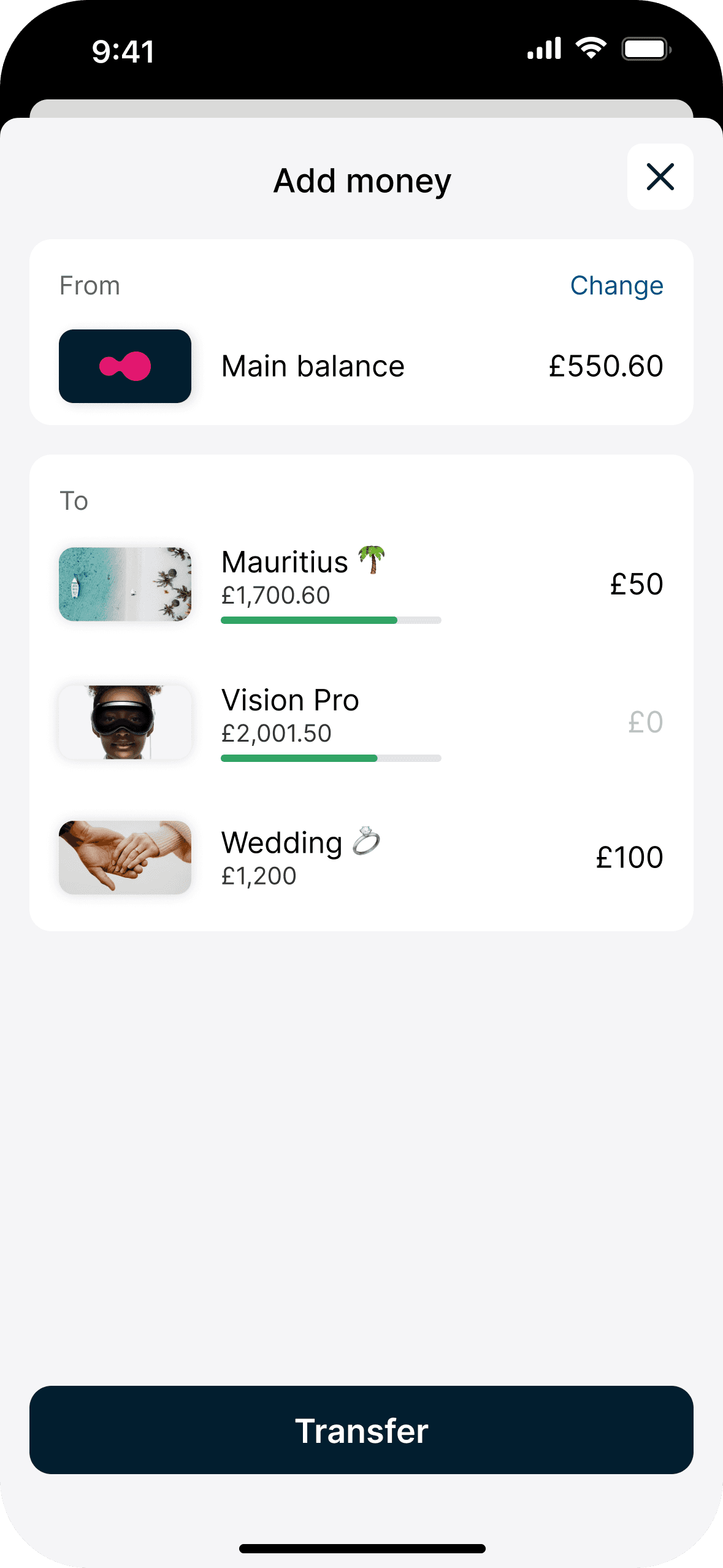

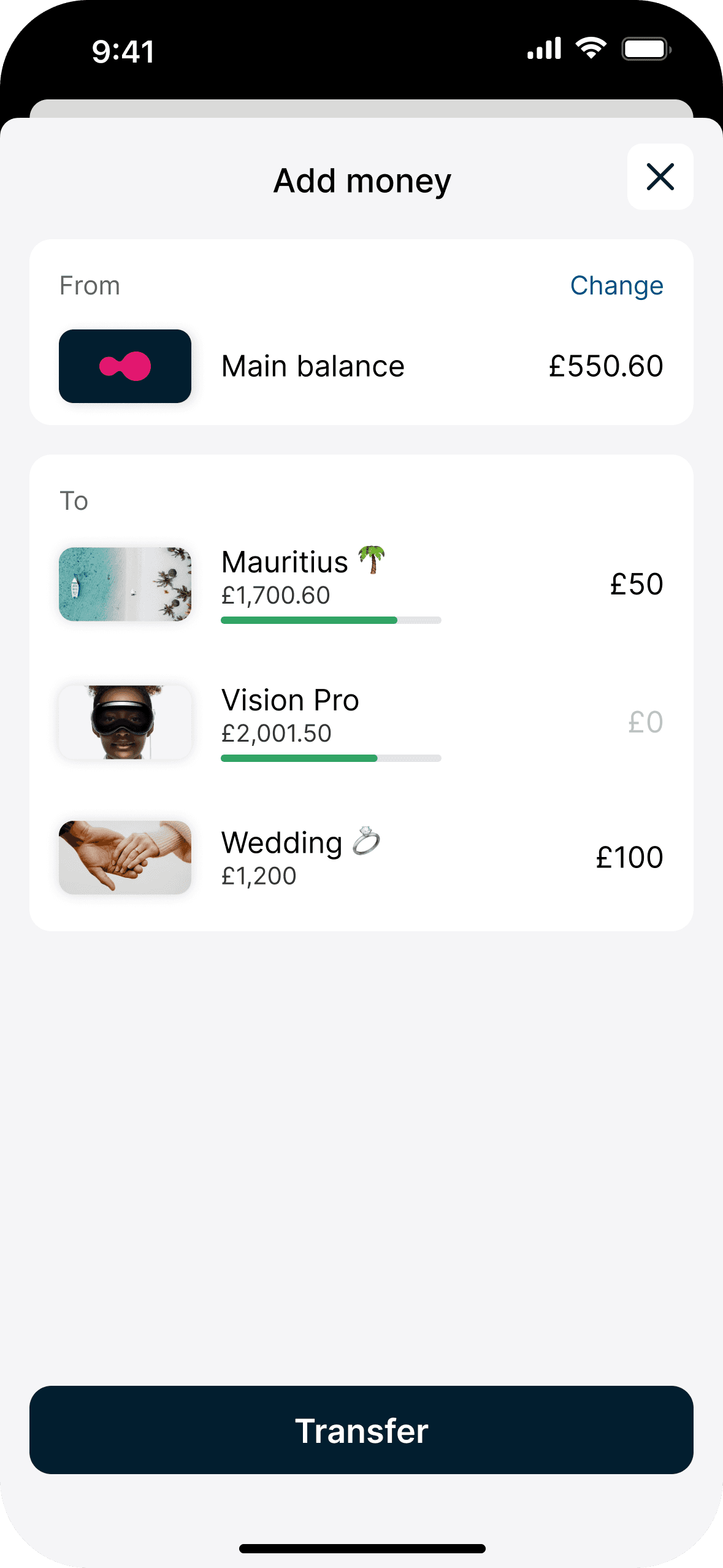

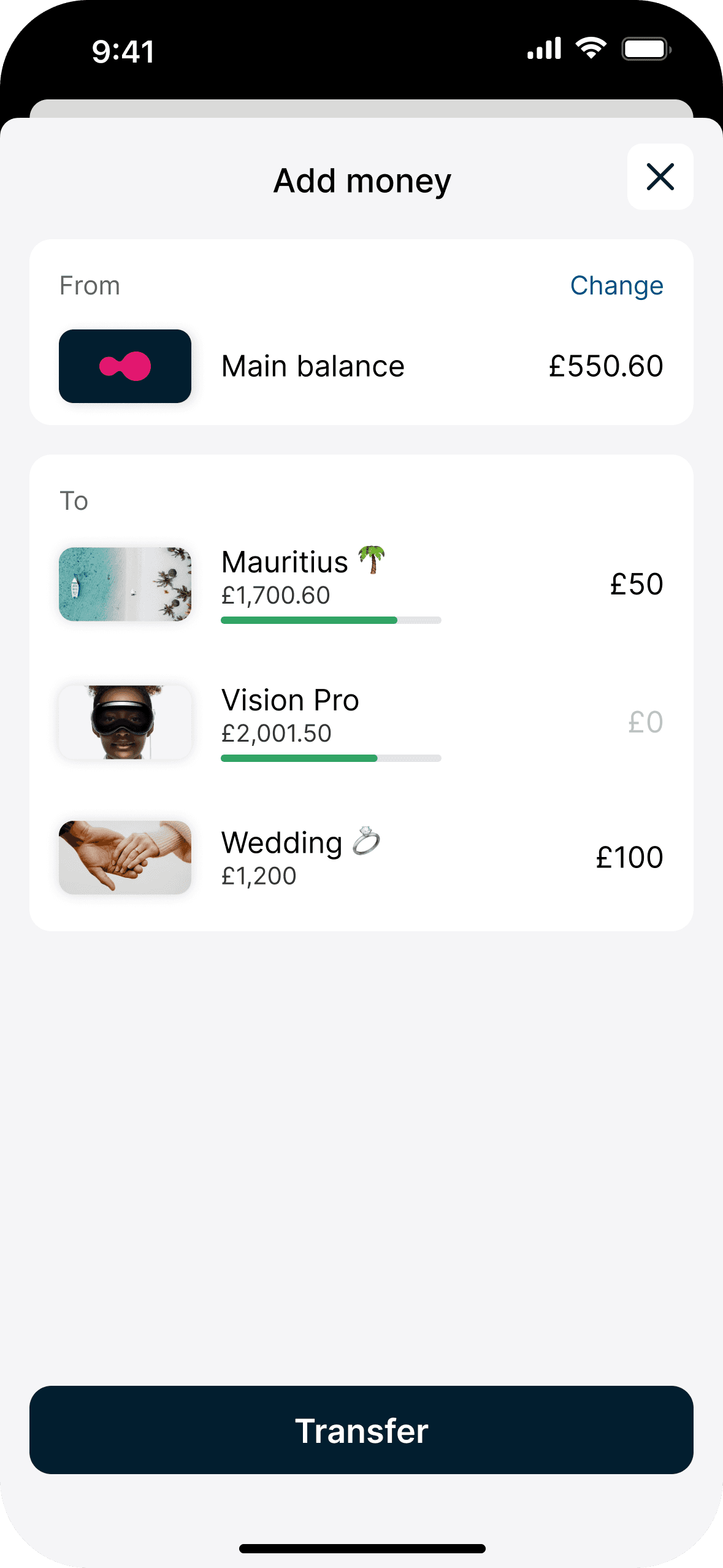

Sort income

Whenever you receive income, allocate how much you would like to contribute to each pot in one go.

See the figures adjust dynamically, giving you clarity on your progress towards your goals.

Sort income

Whenever you receive income, allocate how much you would like to contribute to each pot in one go.

See the figures adjust dynamically, giving you clarity on your progress towards your goals.

Sort income

Whenever you receive income, allocate how much you would like to contribute to each pot in one go.

See the figures adjust dynamically, giving you clarity on your progress towards your goals.

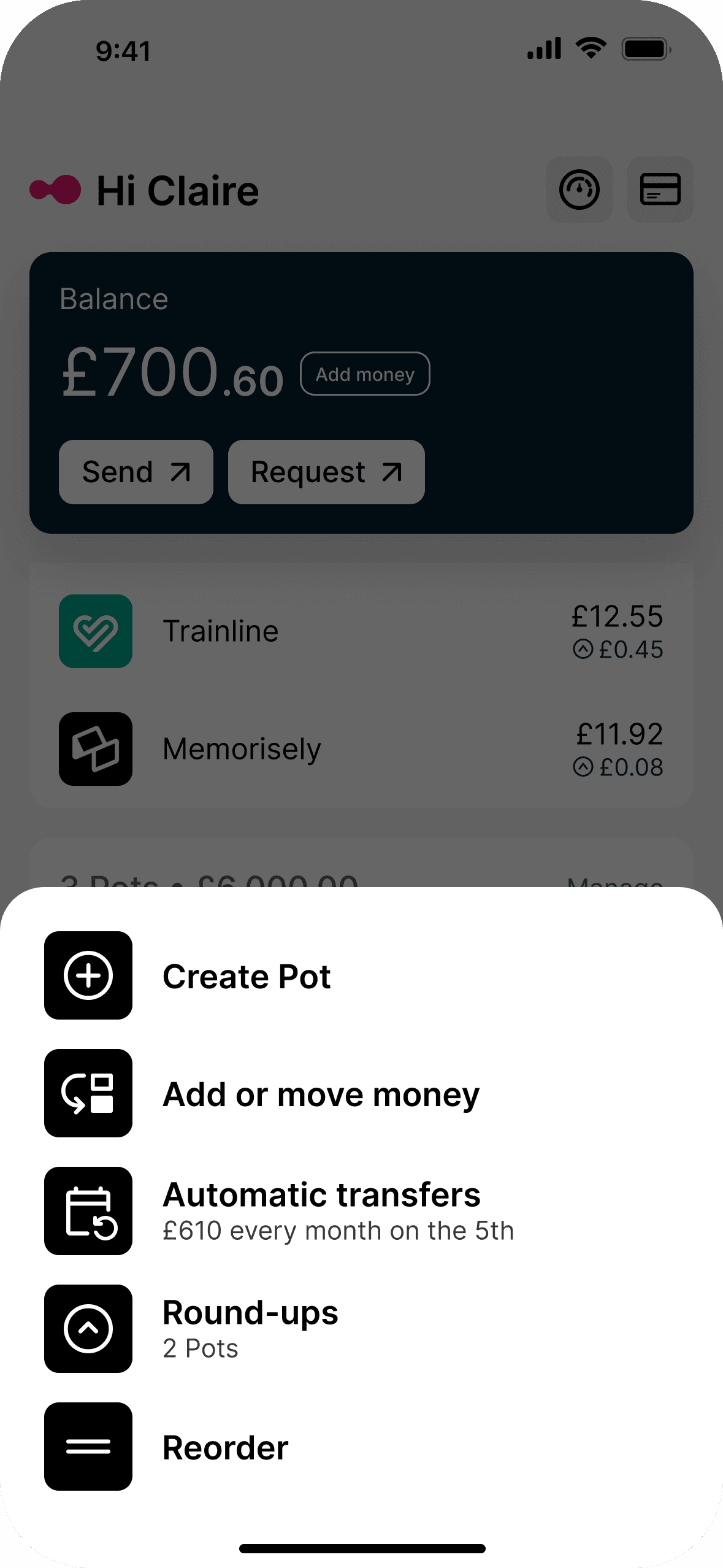

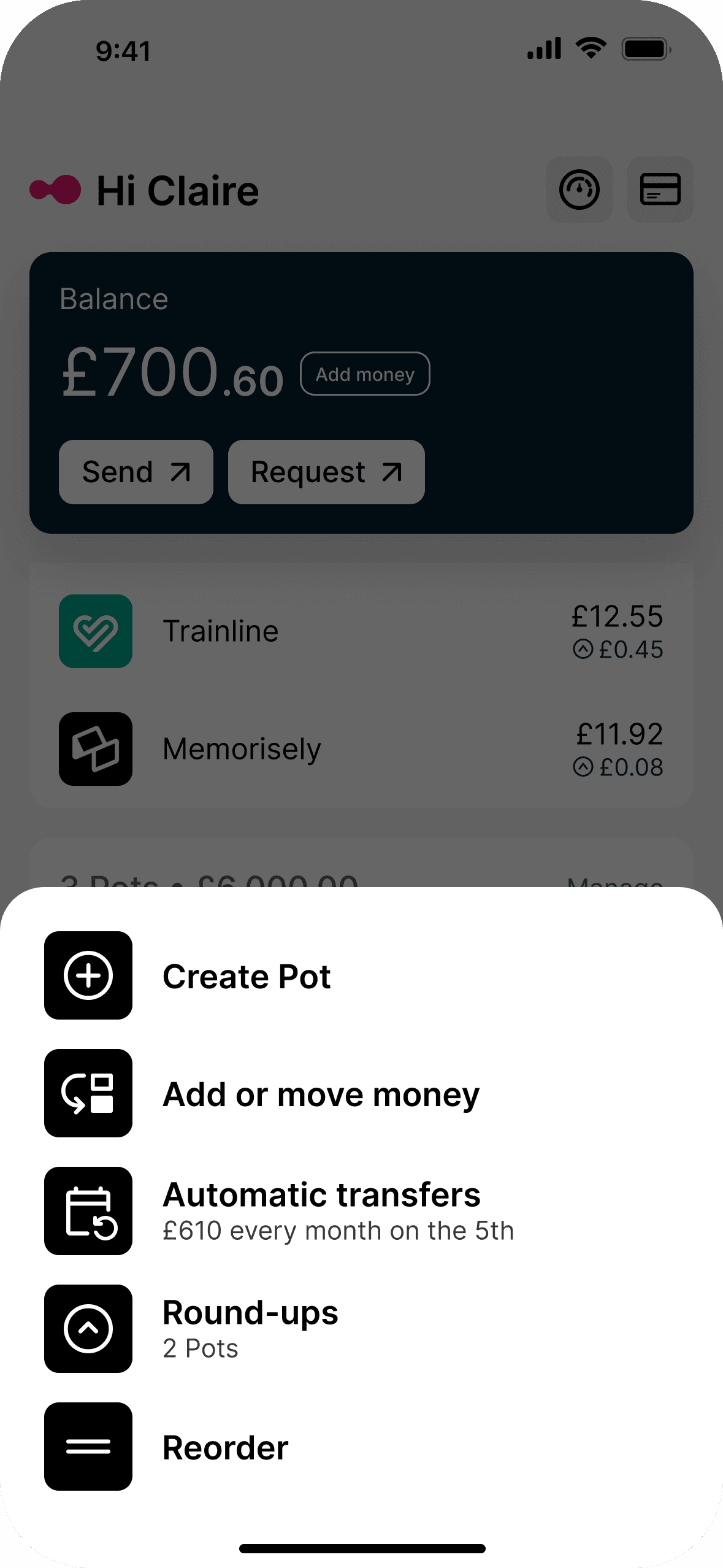

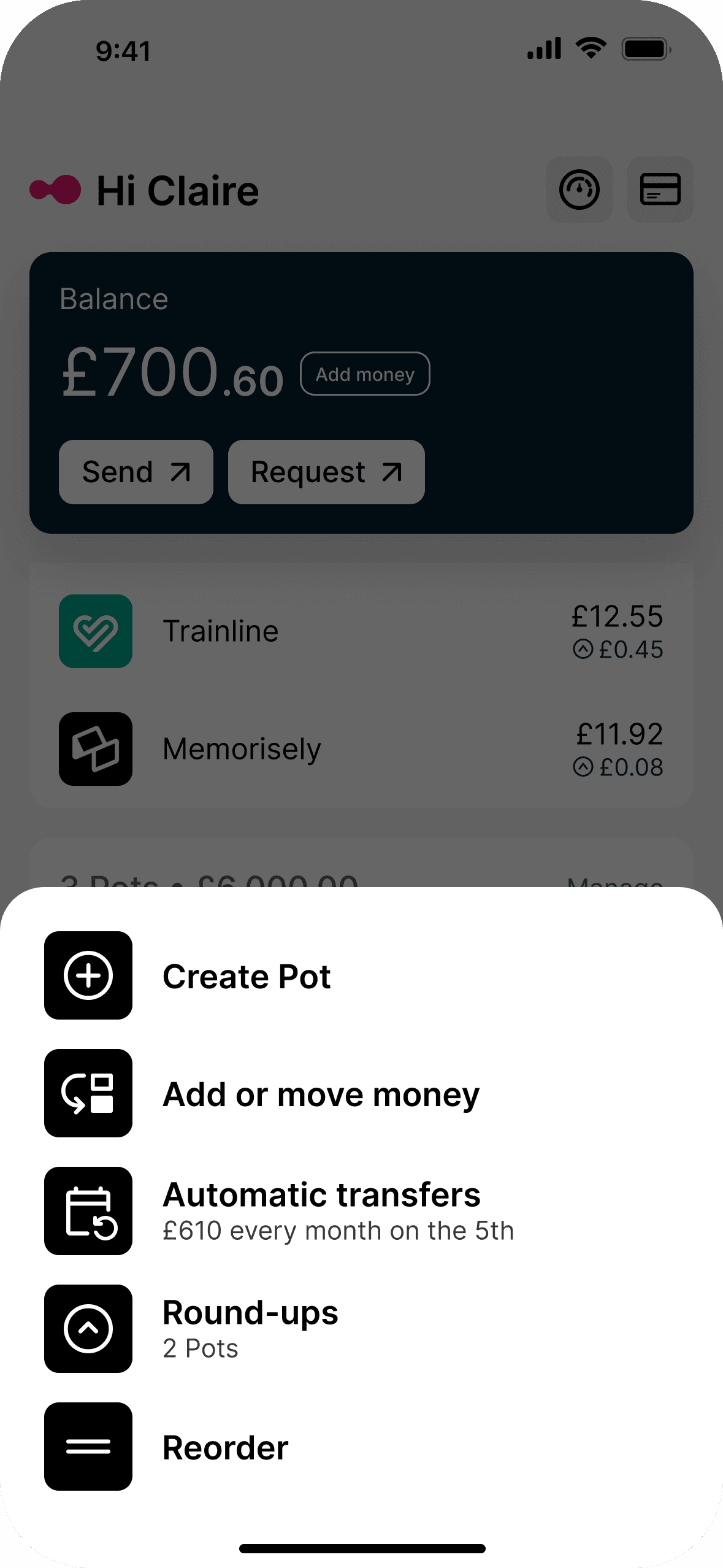

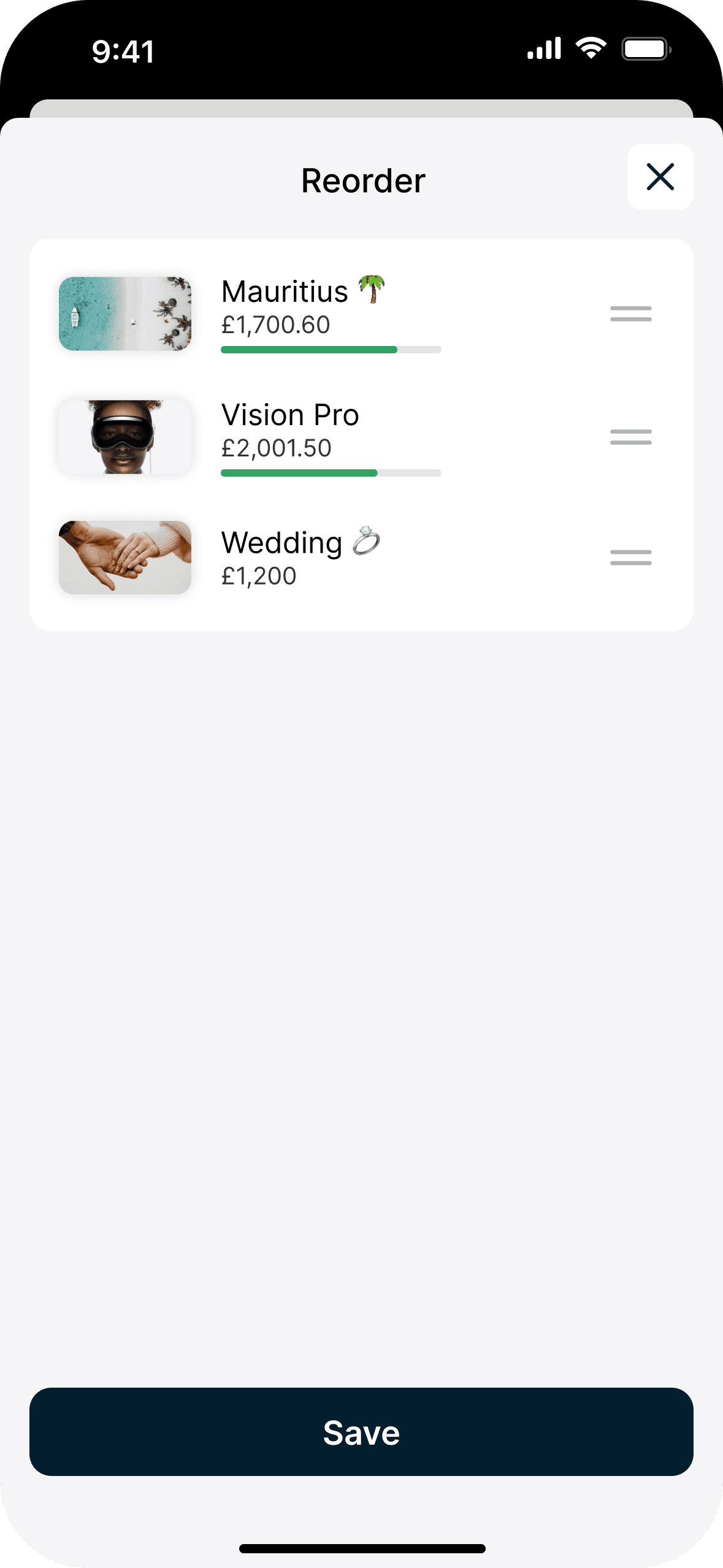

Pots management

There's no need to perform an action on each pot individually when you can do it on multiple pots all in one place.

Pots management

There's no need to perform an action on each pot individually when you can do it on multiple pots all in one place.

Pots management

There's no need to perform an action on each pot individually when you can do it on multiple pots all in one place.

Bulk transfers

Move money between pots quickly and easily.

Bulk transfers

Move money between pots quickly and easily.

Bulk transfers

Move money between pots quickly and easily.

Streamlined scheduling

Adjust automatic transfers across all pots in a centralised place.

Streamlined scheduling

Adjust automatic transfers across all pots in a centralised place.

Streamlined scheduling

Adjust automatic transfers across all pots in a centralised place.

Round-ups rounded up

See how much you've earned from round-ups and easily turn them on or off for each pot.

Round-ups rounded up

See how much you've earned from round-ups and easily turn them on or off for each pot.

Round-ups rounded up

See how much you've earned from round-ups and easily turn them on or off for each pot.

Re-order

Organise pots visually to focus on your most important goals.

Re-order

Organise pots visually to focus on your most important goals.

Re-order

Organise pots visually to focus on your most important goals.